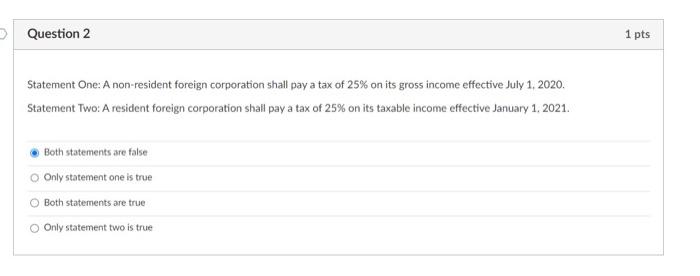

Question: can you answer this Statement One: A non-resident foreign corporation shall pay a tax of 25% on its gross income effective July 1, 2020. Statement

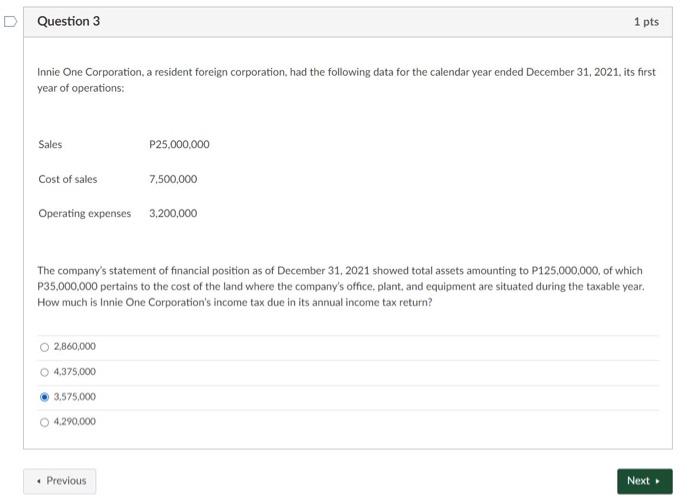

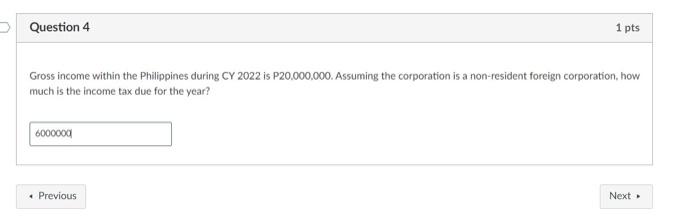

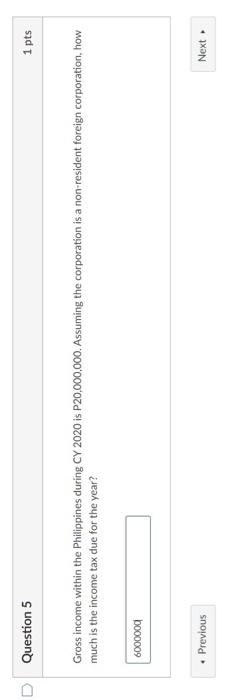

Statement One: A non-resident foreign corporation shall pay a tax of 25% on its gross income effective July 1, 2020. Statement Two: A resident foreign corporation shall pay a tax of 25% on its taxable income effective January 1, 2021. Both statements are false Only statement one is true Both statements are true Only statement two is true Innie One Corporation, a resident foreign corporation, had the following data for the calendar year ended December 31, 2021, its first year of operations: The company's statement of financial position as of December 31, 2021 showed total assets amounting to P125,000,000, of which P35,000,000 pertains to the cost of the land where the company's office, plant, and equipment are situated during the taxable year. How much is Innie One Corporation's income tax due in its annual income tax return? 2,860,0004,375,0003.575,0004,290,000 Gross income within the Philippines during CY 2022 is P20.000,000. Assuming the corporation is a non-resident foreign corporation, how much is the income tax due for the year? Gross income within the Philippines during CY 2020 is P20,000,000. Assuming the corporation is a non-resident foreign corporation, how much is the income tax due for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts