Question: Can you anwser these based off this data Advanced Micro Devices, Inc. Based on this (Advanced Micro Devices (AMD) - Student Version.xlsx ) data: The

Can you anwser these based off this data

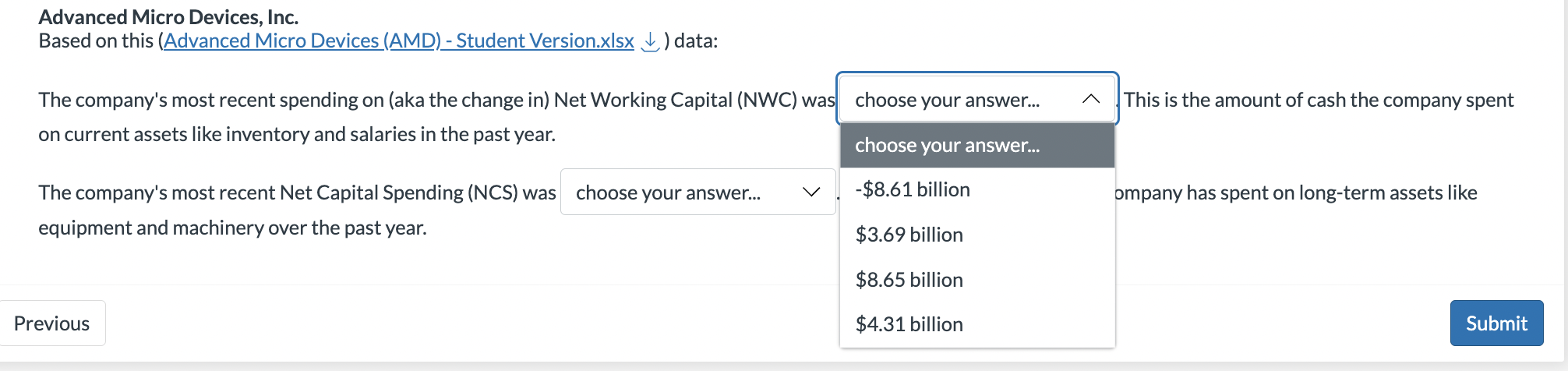

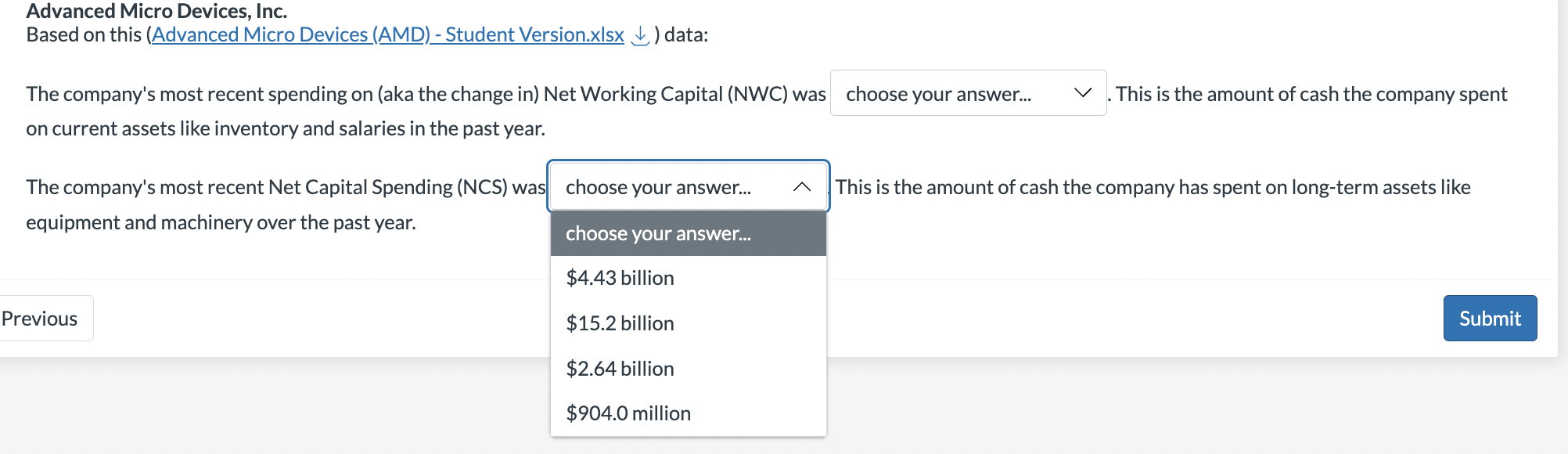

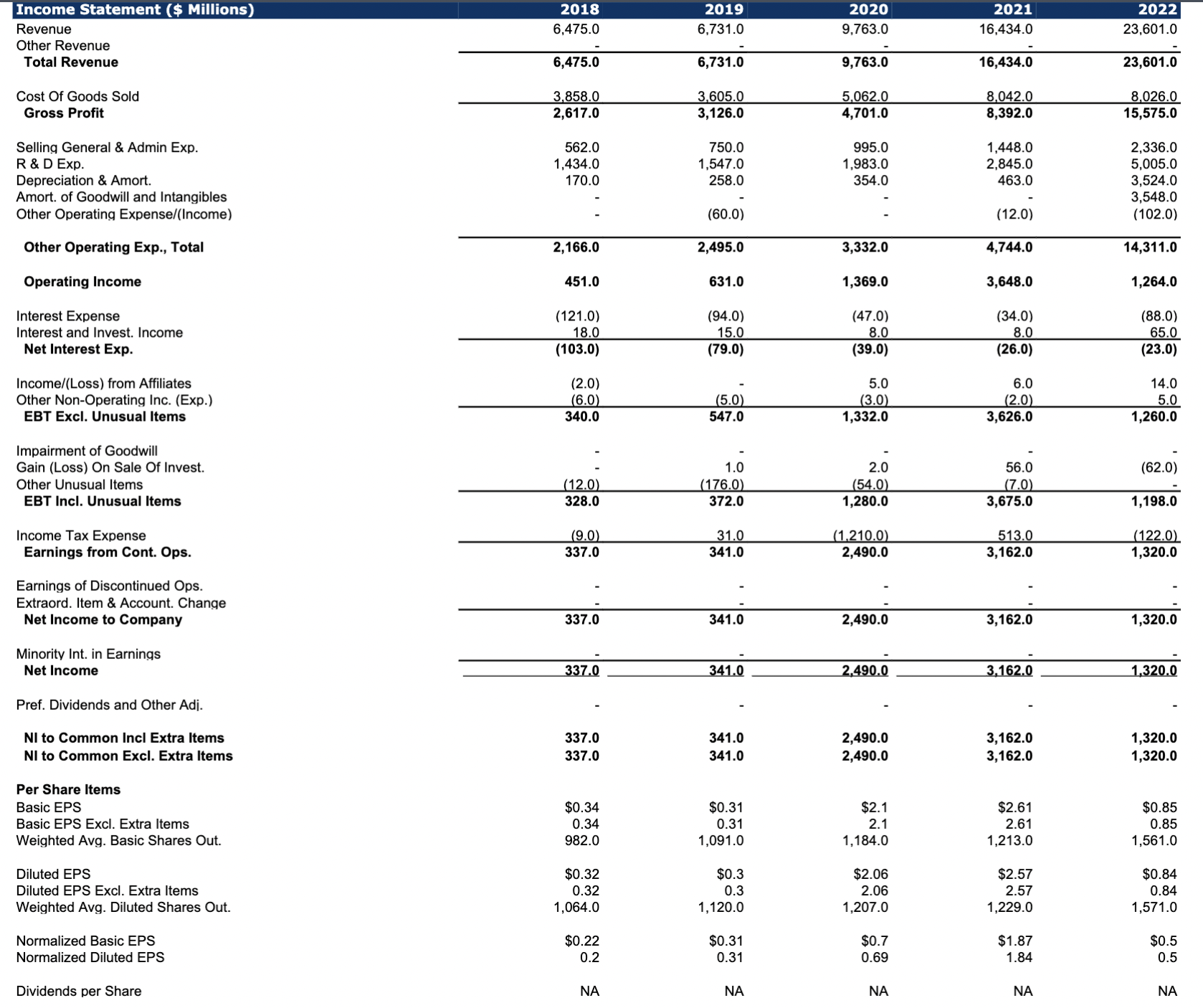

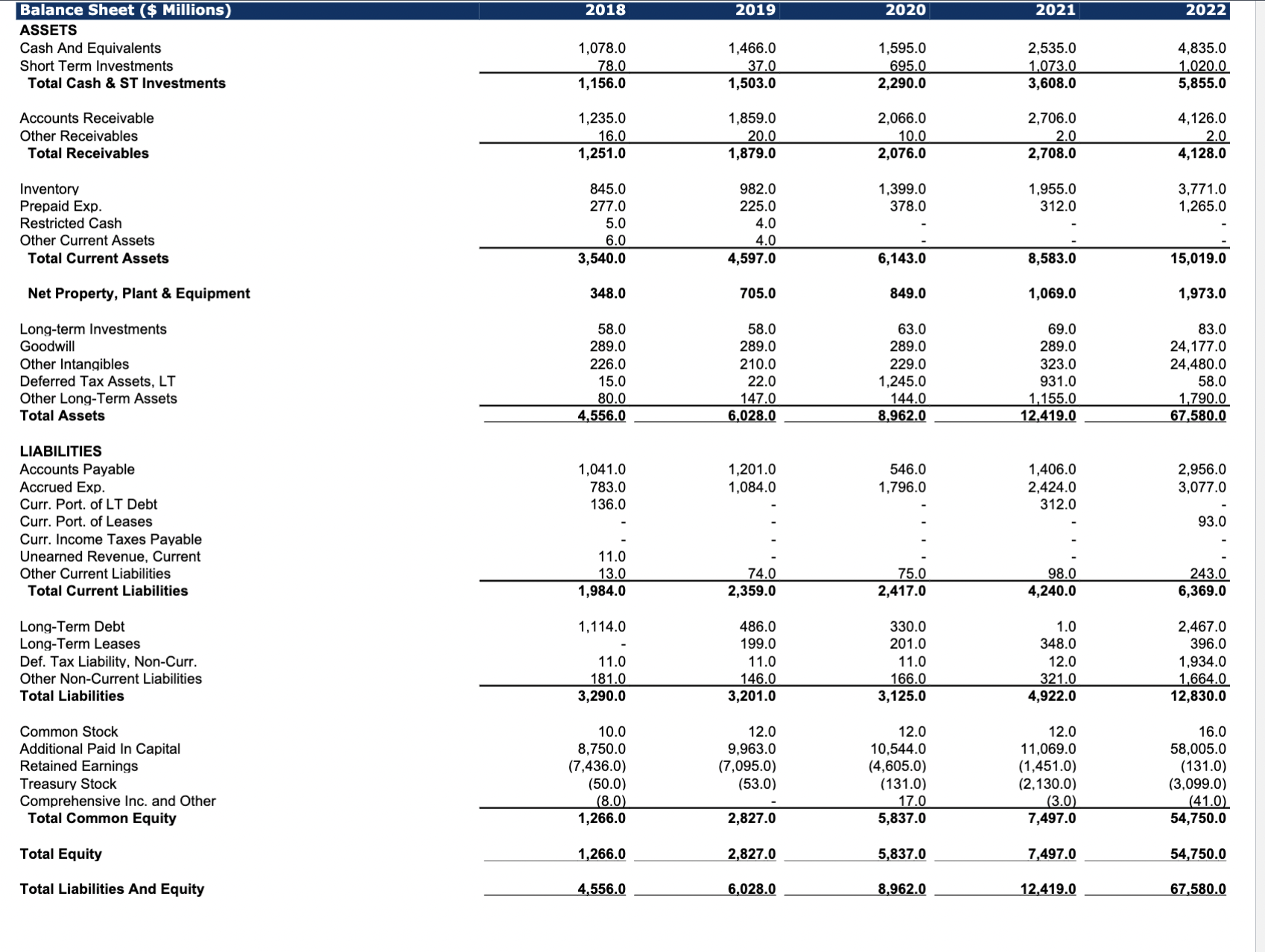

Advanced Micro Devices, Inc. Based on this (Advanced Micro Devices (AMD) - Student Version.xlsx ) data: The company's most recent spending on (aka the change in) Net Working Capital (NWC) was on current assets like inventory and salaries in the past year. The company's most recent Net Capital Spending (NCS) was equipment and machinery over the past year. Previous choose your answer... choose your answer... $8.61 billion $3.69 billion $8.65 billion $4.31 billion This is the amount of cash the company spent ompany has spent on long-term assets like ompany has spent on long-term assets like Submit Based on this (Advanced Micro Devices (AMD) - Student Version.xlsx ) data: The company's most recent spending on (aka the change in) Net Working Capital (NWC) was This is the amount of cash the company spent on current assets like inventory and salaries in the past year. The company's most recent Net Capital Spending (NCS) was equipment and machinery over the past year. This is the amount of cash the company has spent on long-term assets like Previous \begin{tabular}{|c|c|c|c|c|c|} \hline Balance Sheet (\$ MHIIions) & 2018 & 2019 & 2020 & 2021 & 2022 \\ \hline \multicolumn{6}{|l|}{ ASSETS } \\ \hline Cash And Equivalents & 1,078.0 & 1,466.0 & 1,595.0 & 2,535.0 & 4,835.0 \\ \hline Short Term Investments & 78.0 & 37.0 & 695.0 & 1.073 .0 & 1,020.0 \\ \hline Total Cash \& ST Investments & 1,156.0 & 1,503.0 & 2,290.0 & 3,608.0 & 5,855.0 \\ \hline Accounts Receivable & 1,235.0 & 1,859.0 & 2,066.0 & 2,706.0 & 4,126.0 \\ \hline Other Receivables & 16.0 & 20.0 & 10.0 & 2.0 & 2.0 \\ \hline Total Receivables & 1,251.0 & 1,879.0 & 2,076.0 & 2,708.0 & 4,128.0 \\ \hline Inventory & 845.0 & 982.0 & 1,399.0 & 1,955.0 & 3,771.0 \\ \hline Prepaid Exp. & 277.0 & 225.0 & 378.0 & 312.0 & 1,265.0 \\ \hline Restricted Cash & 5.0 & 4.0 & - & - & - \\ \hline Other Current Assets & 6.0 & 4.0 & - & - & \\ \hline Total Current Assets & 3,540.0 & 4,597.0 & 6,143.0 & 8,583.0 & 15,019.0 \\ \hline Net Property, Plant \& Equipment & 348.0 & 705.0 & 849.0 & 1,069.0 & 1,973.0 \\ \hline Long-term Investments & 58.0 & 58.0 & 63.0 & 69.0 & 83.0 \\ \hline Goodwill & 289.0 & 289.0 & 289.0 & 289.0 & 24,177.0 \\ \hline Other Intangibles & 226.0 & 210.0 & 229.0 & 323.0 & 24,480.0 \\ \hline Deferred Tax Assets, LT & 15.0 & 22.0 & 1,245.0 & 931.0 & 58.0 \\ \hline Other Long-Term Assets & 80.0 & 147.0 & 144.0 & 1,155.0 & 1,790.0 \\ \hline \multicolumn{6}{|l|}{ LIABILITIES } \\ \hline Accounts Payable & 1,041.0 & 1,201.0 & 546.0 & 1,406.0 & 2,956.0 \\ \hline Accrued Exp. & 783.0 & 1,084.0 & 1,796.0 & 2,424.0 & 3,077.0 \\ \hline Curr. Port. of LT Debt & 136.0 & - & - & 312.0 & - \\ \hline Curr. Port. of Leases & - & - & - & - & 93.0 \\ \hline Curr. Income Taxes Pavable & - & - & - & - & - \\ \hline Unearned Revenue, Current & 11.0 & - & - & - & - \\ \hline Other Current Liabilities & 13.0 & 74.0 & 75.0 & 98.0 & 243.0 \\ \hline Total Current Liabilities & 1,984.0 & 2,359.0 & 2,417.0 & 4,240.0 & 6,369.0 \\ \hline Long-Term Debt & 1,114.0 & 486.0 & 330.0 & 1.0 & 2,467.0 \\ \hline Long-Term Leases & - & 199.0 & 201.0 & 348.0 & 396.0 \\ \hline Def. Tax Liability, Non-Curr. & 11.0 & 11.0 & 11.0 & 12.0 & 1,934.0 \\ \hline Other Non-Current Liabilities & 181.0 & 146.0 & 166.0 & 321.0 & 1,664.0 \\ \hline Total Liabilities & 3,290.0 & 3,201.0 & 3,125.0 & 4,922.0 & 12,830.0 \\ \hline Common Stock & 10.0 & 12.0 & 12.0 & 12.0 & 16.0 \\ \hline Additional Paid In Capital & 8,750.0 & 9,963.0 & 10,544.0 & 11,069.0 & 58,005.0 \\ \hline Retained Earnings & (7,436.0) & (7,095.0) & (4,605.0) & (1,451.0) & (131.0) \\ \hline Treasury Stock & (50.0) & (53.0) & (131.0) & (2,130.0) & (3,099.0) \\ \hline Comprehensive Inc. and Other & (8.0) & & 17.0 & (3.0) & (41.0) \\ \hline Total Liabilities And Equity & 4,556.0 & 6,028.0 & 8,962.0 & 12,419.0 & 67,580.0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts