Question: can you break down how to do it Horizontal Analysis of Income Statements Consolidated income statements for Cooper Manufacturing follow. Cooper Manufacturing Consolidated Income Statements

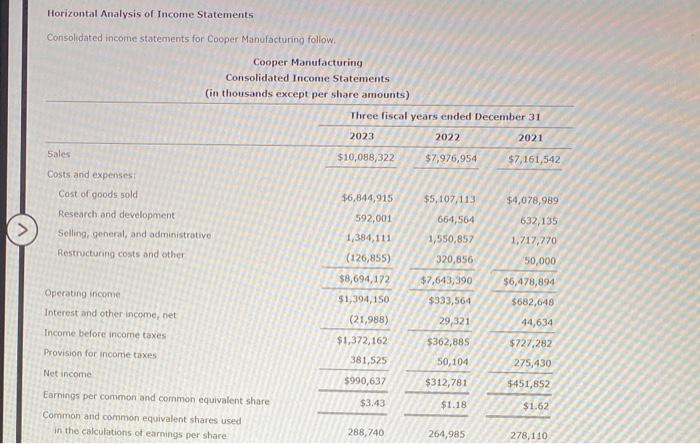

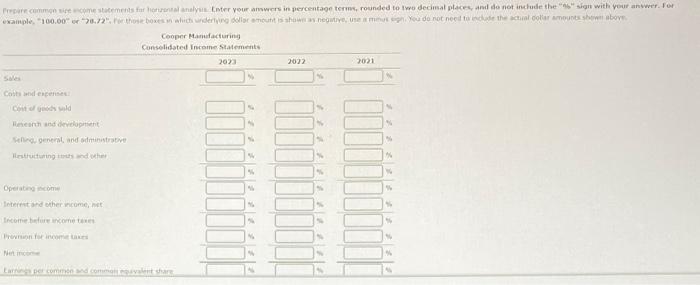

Horizontal Analysis of Income Statements Consolidated income statements for Cooper Manufacturing follow. Cooper Manufacturing Consolidated Income Statements (in thousands except per share amounts) Three fiscal years ended December 31 2023 2022 2021 Sales $10,088,322 $7,976,954 $7,161,542 $6,844,915 $5,107,113 $4,078,989 Costs and expenses Cost of goods sold Research and development Selling general, and administrative Restructuring costs and other 664,564 632,135 592,001 1,384,111 (126,855) 1,550,857 1,717770 320,856 50,000 $7,643,390 Operating income Interest and other income, net $8,694,172 $1,394,150 $333,564 $6,478,894 $682,648 44,634 (21,988) 29,321 Income before income taxes $1,372,162 $727.282 Provision for income taxes 381,525 $362,885 50,104 $312,781 275,430 Net income 5990,637 $451,852 $3.43 $1.18 Earnings per common and common equivalent share Common and common equivalent shares used in the calculations of earnings per share $1.62 288,740 264,985 278,110 pare common come statements for any loter your answers in percentage terms, rounded to two decimal place and do not include the sign with your anwwer. For example 100.000 78.72" those boxes which were ramettishownegutsema you do not need to the actual color amounts above Cooper Manufacturing Consolidated Income Statements 2023 2022 2021 Chocold Reconhand von Sen general and strate Operating.com Interest and other come Income becomes Port per como

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts