Question: can you do #3 Bright Landscapes Practice Set Hunter s. Instructions 1 account a. Income Statement Use the information shown below and the Bright Landscapes

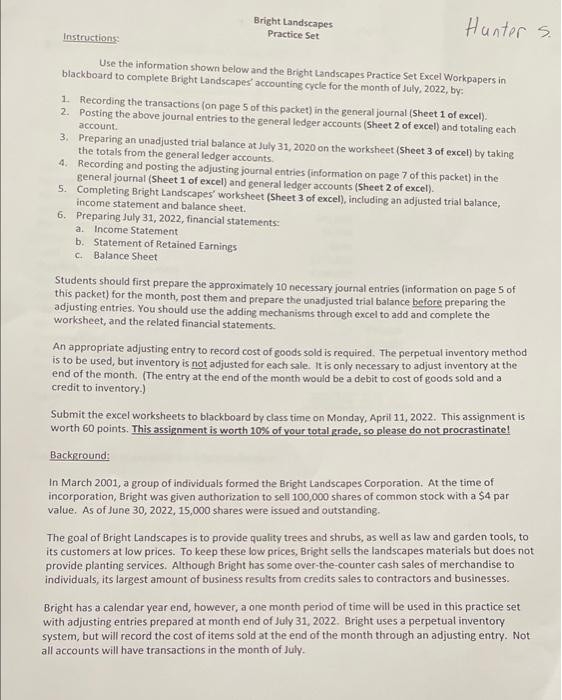

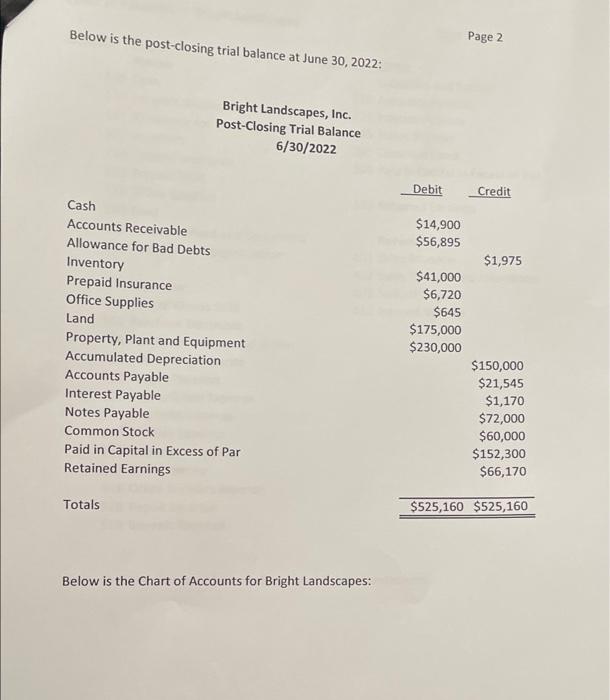

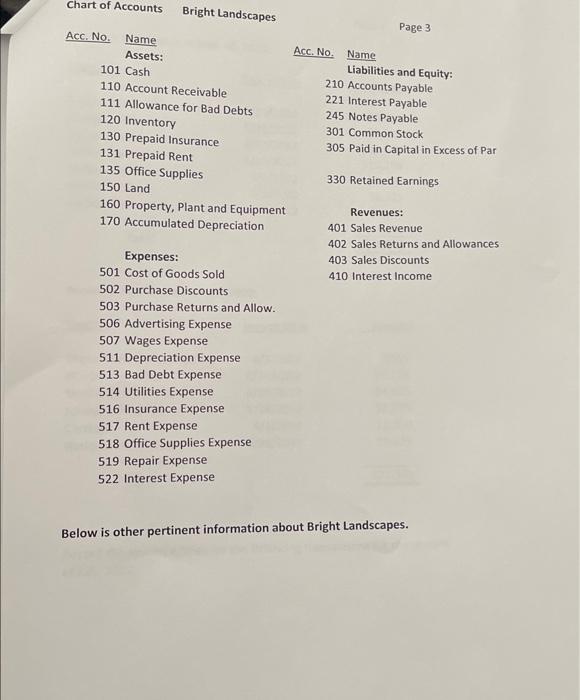

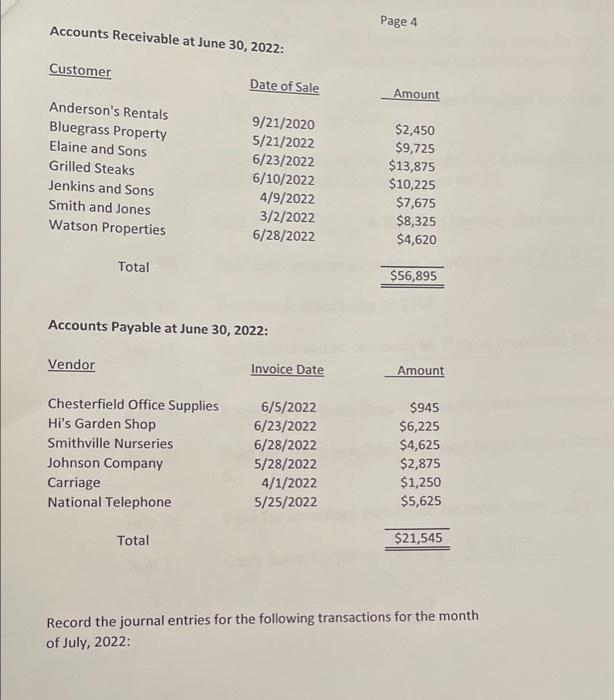

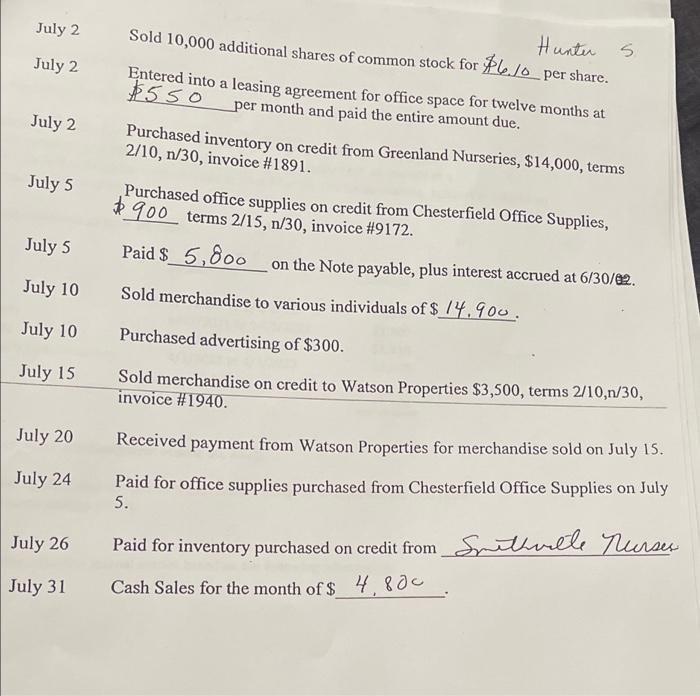

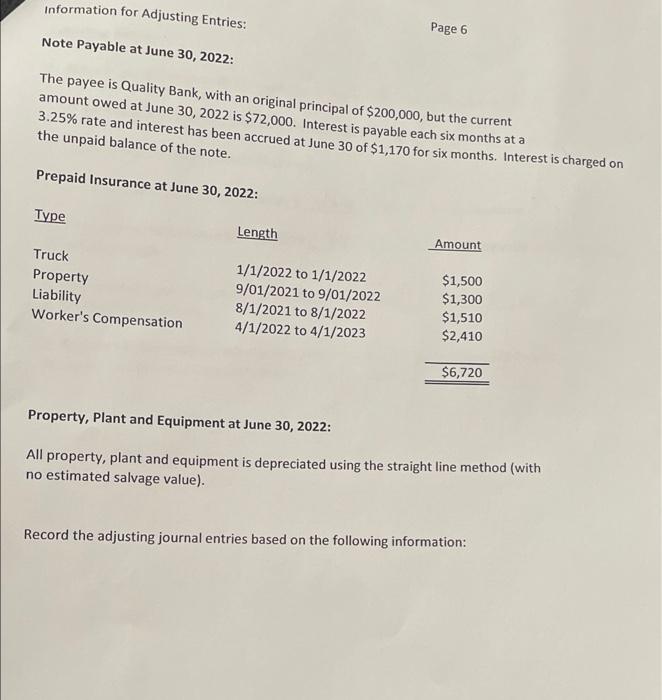

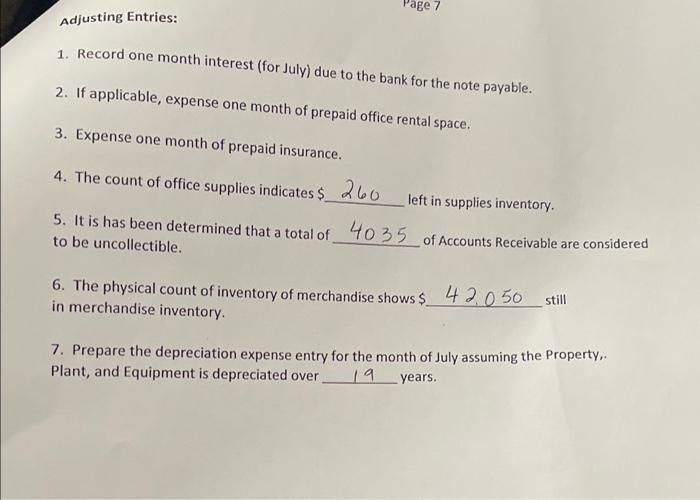

Bright Landscapes Practice Set Hunter s. Instructions 1 account a. Income Statement Use the information shown below and the Bright Landscapes Practice Set Excel Workpapers in blackboard to complete Bright Landscapes accounting cycle for the month of July, 2022, by: 1. Recording the transactions (on page 5 of this packet) in the general journal (Sheet 1 of excel). 2. Posting the above journal entries to the general ledger accounts (Sheet 2 of excel) and totaling each 3. Preparing an unadjusted trial balance at July 31, 2020 on the worksheet (Sheet 3 of excel) by taking the totals from the general ledger accounts. 4. Recording and posting the adjusting journal entries (information on page 7 of this packet) in the general journal (Sheet 1 of excel) and general ledger accounts (Sheet 2 of excel). 5. Completing Bright Landscapes' worksheet (Sheet 3 of excell), including an adjusted trial balance, income statement and balance sheet. 6. Preparing July 31, 2022, financial statements b. Statement of Retained Earnings C. Balance Sheet Students should first prepare the approximately 10 necessary journal entries (information on page 5 of this packet) for the month, post them and prepare the unadjusted trial balance before preparing the adjusting entries. You should use the adding mechanisms through excel to add and complete the worksheet, and the related financial statements. An appropriate adjusting entry to record cost of goods sold is required. The perpetual inventory method is to be used, but inventory is not adjusted for each sale. It is only necessary to adjust inventory at the end of the month. (The entry at the end of the month would be a debit to cost of goods sold and a credit to inventory.) Submit the excel worksheets to blackboard by class time on Monday, April 11, 2022. This assignment is worth 60 points. This assignment is worth 10% of your total grade, so please do not procrastinate! Background In March 2001, a group of individuais formed the Bright Landscapes Corporation. At the time of incorporation, Bright was given authorization to sell 100,000 shares of common stock with a $4 par value. As of June 30, 2022, 15,000 shares were issued and outstanding. The goal of Bright Landscapes is to provide quality trees and shrubs, as well as law and garden tools, to its customers at low prices. To keep these low prices, Bright sells the landscapes materials but does not provide planting services. Although Bright has some over-the-counter cash sales of merchandise to individuals, its largest amount of business results from credits sales to contractors and businesses. Bright has a calendar year end, however, a one month period of time will be used in this practice set with adjusting entries prepared at month end of July 31, 2022. Bright uses a perpetual inventory system, but will record the cost of items sold at the end of the month through an adjusting entry. Not all accounts will have transactions in the month of July. Below is the post-closing trial balance at June 30, 2022: Page 2 Bright Landscapes, Inc. Post-Closing Trial Balance 6/30/2022 Debit Credit $14,900 $56,895 $1,975 Cash Accounts Receivable Allowance for Bad Debts Inventory Prepaid Insurance Office Supplies Land Property, Plant and Equipment Accumulated Depreciation Accounts Payable Interest Payable Notes Payable Common Stock Paid in Capital in Excess of Par Retained Earnings $41,000 $6,720 $645 $175,000 $230,000 $150,000 $21,545 $1,170 $72,000 $60,000 $152,300 $66,170 Totals $525,160 $525,160 Below is the Chart of Accounts for Bright Landscapes: Chart of Accounts Bright Landscapes Page 3 Acc No. Name Acc. No. Name Assets: Liabilities and Equity: 101 Cash 210 Accounts Payable 110 Account Receivable 221 Interest Payable 111 Allowance for Bad Debts 245 Notes Payable 120 Inventory 301 Common Stock 130 Prepaid Insurance 305 Paid in Capital in Excess of Par 131 Prepaid Rent 135 Office Supplies 330 Retained Earnings 150 Land 160 Property, Plant and Equipment Revenues: 170 Accumulated Depreciation 401 Sales Revenue 402 Sales Returns and Allowances Expenses: 403 Sales Discounts 501 Cost of Goods Sold 410 Interest Income 502 Purchase Discounts 503 Purchase Returns and Allow. 506 Advertising Expense 507 Wages Expense 511 Depreciation Expense 513 Bad Debt Expense 514 Utilities Expense 516 Insurance Expense 517 Rent Expense 518 Office Supplies Expense 519 Repair Expense 522 Interest Expense Below is other pertinent information about Bright Landscapes. Page 4 Accounts Receivable at June 30, 2022: Customer Date of Sale Amount Anderson's Rentals Bluegrass Property Elaine and Sons Grilled Steaks Jenkins and Sons Smith and Jones Watson Properties 9/21/2020 5/21/2022 6/23/2022 6/10/2022 4/9/2022 3/2/2022 6/28/2022 $2,450 $9,725 $13,875 $10,225 $7,675 $8,325 $4,620 Total $56,895 Accounts Payable at June 30, 2022: Vendor Invoice Date Amount Chesterfield Office Supplies Hi's Garden Shop Smithville Nurseries Johnson Company Carriage National Telephone 6/5/2022 6/23/2022 6/28/2022 5/28/2022 4/1/2022 5/25/2022 $945 $6,225 $4,625 $2,875 $1,250 $5,625 Total $21,545 Record the journal entries for the following transactions for the month of July, 2022: July 2 July 2 Hunter s Sold 10,000 additional shares of common stock for Pleje per share. Entered into a leasing agreement for office space for twelve months at $550 per month and paid the entire amount due. Purchased inventory on credit from Greenland Nurseries, $14,000, terms 2/10, 1/30, invoice #1891. July 2 July 5 July 5 July 10 Purchased office supplies on credit from Chesterfield Office Supplies, # 900 terms 2/15, n/30, invoice #9172. Paid $ 5,800 on the Note payable, plus interest accrued at 6/30/e2. Sold merchandise to various individuals of $ 14.900. Purchased advertising of $300. Sold merchandise on credit to Watson Properties $3,500, terms 2/10,n/30, invoice #1940. July 10 July 15 July 20 July 24 Received payment from Watson Properties for merchandise sold on July 15. Paid for office supplies purchased from Chesterfield Office Supplies on July 5. July 26 Paid for inventory purchased on credit from Smithvelle Murser Cash Sales for the month of $ 4,800 July 31 Information for Adjusting Entries: Page 6 Note Payable at June 30, 2022: The payee is Quality Bank, with an original principal of $200,000, but the current amount owed at June 30, 2022 is $72,000. Interest is payable each six months at a 3.25% rate and interest has been accrued at June 30 of $1,170 for six months. Interest is charged on the unpaid balance of the note. Prepaid Insurance at June 30, 2022: Type Length Amount Truck Property Liability Worker's Compensation 1/1/2022 to 1/1/2022 9/01/2021 to 9/01/2022 8/1/2021 to 8/1/2022 4/1/2022 to 4/1/2023 $1,500 $1,300 $1,510 $2,410 $6,720 Property, Plant and Equipment at June 30, 2022: All property, plant and equipment is depreciated using the straight line method (with no estimated salvage value). Record the adjusting journal entries based on the following information: Page 7 Adjusting Entries: 1. Record one month interest (for July) due to the bank for the note payable. 2. If applicable, expense one month of prepaid office rental space. 3. Expense one month of prepaid insurance. 4. The count of office supplies indicates $ 260 left in supplies inventory. 5. It is has been determined that a total of 4035 of Accounts Receivable are considered to be uncollectible. 6. The physical count of inventory of merchandise shows $ 42.050_still in merchandise inventory. 7. Prepare the depreciation expense entry for the month of July assuming the Property.. Plant, and Equipment is depreciated over 19 years. Bright Landscapes Practice Set Hunter s. Instructions 1 account a. Income Statement Use the information shown below and the Bright Landscapes Practice Set Excel Workpapers in blackboard to complete Bright Landscapes accounting cycle for the month of July, 2022, by: 1. Recording the transactions (on page 5 of this packet) in the general journal (Sheet 1 of excel). 2. Posting the above journal entries to the general ledger accounts (Sheet 2 of excel) and totaling each 3. Preparing an unadjusted trial balance at July 31, 2020 on the worksheet (Sheet 3 of excel) by taking the totals from the general ledger accounts. 4. Recording and posting the adjusting journal entries (information on page 7 of this packet) in the general journal (Sheet 1 of excel) and general ledger accounts (Sheet 2 of excel). 5. Completing Bright Landscapes' worksheet (Sheet 3 of excell), including an adjusted trial balance, income statement and balance sheet. 6. Preparing July 31, 2022, financial statements b. Statement of Retained Earnings C. Balance Sheet Students should first prepare the approximately 10 necessary journal entries (information on page 5 of this packet) for the month, post them and prepare the unadjusted trial balance before preparing the adjusting entries. You should use the adding mechanisms through excel to add and complete the worksheet, and the related financial statements. An appropriate adjusting entry to record cost of goods sold is required. The perpetual inventory method is to be used, but inventory is not adjusted for each sale. It is only necessary to adjust inventory at the end of the month. (The entry at the end of the month would be a debit to cost of goods sold and a credit to inventory.) Submit the excel worksheets to blackboard by class time on Monday, April 11, 2022. This assignment is worth 60 points. This assignment is worth 10% of your total grade, so please do not procrastinate! Background In March 2001, a group of individuais formed the Bright Landscapes Corporation. At the time of incorporation, Bright was given authorization to sell 100,000 shares of common stock with a $4 par value. As of June 30, 2022, 15,000 shares were issued and outstanding. The goal of Bright Landscapes is to provide quality trees and shrubs, as well as law and garden tools, to its customers at low prices. To keep these low prices, Bright sells the landscapes materials but does not provide planting services. Although Bright has some over-the-counter cash sales of merchandise to individuals, its largest amount of business results from credits sales to contractors and businesses. Bright has a calendar year end, however, a one month period of time will be used in this practice set with adjusting entries prepared at month end of July 31, 2022. Bright uses a perpetual inventory system, but will record the cost of items sold at the end of the month through an adjusting entry. Not all accounts will have transactions in the month of July. Below is the post-closing trial balance at June 30, 2022: Page 2 Bright Landscapes, Inc. Post-Closing Trial Balance 6/30/2022 Debit Credit $14,900 $56,895 $1,975 Cash Accounts Receivable Allowance for Bad Debts Inventory Prepaid Insurance Office Supplies Land Property, Plant and Equipment Accumulated Depreciation Accounts Payable Interest Payable Notes Payable Common Stock Paid in Capital in Excess of Par Retained Earnings $41,000 $6,720 $645 $175,000 $230,000 $150,000 $21,545 $1,170 $72,000 $60,000 $152,300 $66,170 Totals $525,160 $525,160 Below is the Chart of Accounts for Bright Landscapes: Chart of Accounts Bright Landscapes Page 3 Acc No. Name Acc. No. Name Assets: Liabilities and Equity: 101 Cash 210 Accounts Payable 110 Account Receivable 221 Interest Payable 111 Allowance for Bad Debts 245 Notes Payable 120 Inventory 301 Common Stock 130 Prepaid Insurance 305 Paid in Capital in Excess of Par 131 Prepaid Rent 135 Office Supplies 330 Retained Earnings 150 Land 160 Property, Plant and Equipment Revenues: 170 Accumulated Depreciation 401 Sales Revenue 402 Sales Returns and Allowances Expenses: 403 Sales Discounts 501 Cost of Goods Sold 410 Interest Income 502 Purchase Discounts 503 Purchase Returns and Allow. 506 Advertising Expense 507 Wages Expense 511 Depreciation Expense 513 Bad Debt Expense 514 Utilities Expense 516 Insurance Expense 517 Rent Expense 518 Office Supplies Expense 519 Repair Expense 522 Interest Expense Below is other pertinent information about Bright Landscapes. Page 4 Accounts Receivable at June 30, 2022: Customer Date of Sale Amount Anderson's Rentals Bluegrass Property Elaine and Sons Grilled Steaks Jenkins and Sons Smith and Jones Watson Properties 9/21/2020 5/21/2022 6/23/2022 6/10/2022 4/9/2022 3/2/2022 6/28/2022 $2,450 $9,725 $13,875 $10,225 $7,675 $8,325 $4,620 Total $56,895 Accounts Payable at June 30, 2022: Vendor Invoice Date Amount Chesterfield Office Supplies Hi's Garden Shop Smithville Nurseries Johnson Company Carriage National Telephone 6/5/2022 6/23/2022 6/28/2022 5/28/2022 4/1/2022 5/25/2022 $945 $6,225 $4,625 $2,875 $1,250 $5,625 Total $21,545 Record the journal entries for the following transactions for the month of July, 2022: July 2 July 2 Hunter s Sold 10,000 additional shares of common stock for Pleje per share. Entered into a leasing agreement for office space for twelve months at $550 per month and paid the entire amount due. Purchased inventory on credit from Greenland Nurseries, $14,000, terms 2/10, 1/30, invoice #1891. July 2 July 5 July 5 July 10 Purchased office supplies on credit from Chesterfield Office Supplies, # 900 terms 2/15, n/30, invoice #9172. Paid $ 5,800 on the Note payable, plus interest accrued at 6/30/e2. Sold merchandise to various individuals of $ 14.900. Purchased advertising of $300. Sold merchandise on credit to Watson Properties $3,500, terms 2/10,n/30, invoice #1940. July 10 July 15 July 20 July 24 Received payment from Watson Properties for merchandise sold on July 15. Paid for office supplies purchased from Chesterfield Office Supplies on July 5. July 26 Paid for inventory purchased on credit from Smithvelle Murser Cash Sales for the month of $ 4,800 July 31 Information for Adjusting Entries: Page 6 Note Payable at June 30, 2022: The payee is Quality Bank, with an original principal of $200,000, but the current amount owed at June 30, 2022 is $72,000. Interest is payable each six months at a 3.25% rate and interest has been accrued at June 30 of $1,170 for six months. Interest is charged on the unpaid balance of the note. Prepaid Insurance at June 30, 2022: Type Length Amount Truck Property Liability Worker's Compensation 1/1/2022 to 1/1/2022 9/01/2021 to 9/01/2022 8/1/2021 to 8/1/2022 4/1/2022 to 4/1/2023 $1,500 $1,300 $1,510 $2,410 $6,720 Property, Plant and Equipment at June 30, 2022: All property, plant and equipment is depreciated using the straight line method (with no estimated salvage value). Record the adjusting journal entries based on the following information: Page 7 Adjusting Entries: 1. Record one month interest (for July) due to the bank for the note payable. 2. If applicable, expense one month of prepaid office rental space. 3. Expense one month of prepaid insurance. 4. The count of office supplies indicates $ 260 left in supplies inventory. 5. It is has been determined that a total of 4035 of Accounts Receivable are considered to be uncollectible. 6. The physical count of inventory of merchandise shows $ 42.050_still in merchandise inventory. 7. Prepare the depreciation expense entry for the month of July assuming the Property.. Plant, and Equipment is depreciated over 19 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts