Question: Can you do calculations for Question 2 and Question 3 showing step by step work and equations please and thank you! QUESTION 2 50 points

Can you do calculations for Question 2 and Question 3 showing step by step work and equations please and thank you!

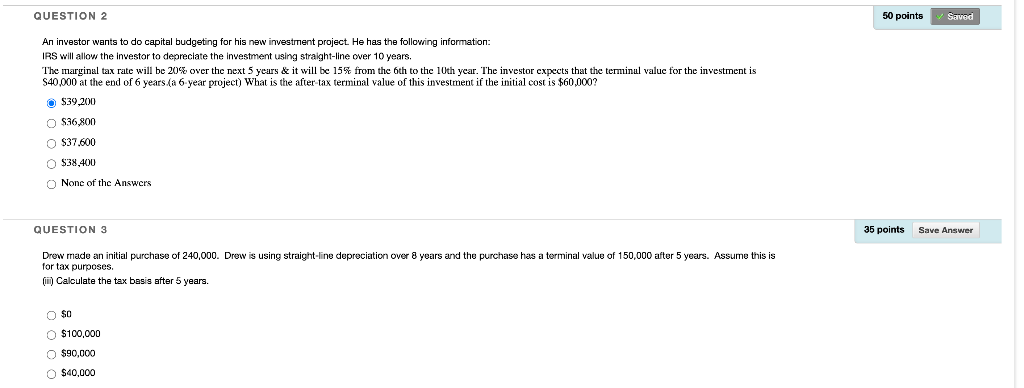

QUESTION 2 50 points Saved An investor wants to do capital budgeting for his new investment project. He has the following information: IRS will allow the investor to depreciate the investment using straight-line over 10 years. The marginal tax rate will be 20% over the next 5 years & it will be 15% from the 6th to the 10th year. The investor expects that the terminul value for the investment is $40.000 at the end of 6 years fa 6 year project) What is the after tax terminal value of this investment if the initial cost is $60,000? $39,200 O $36,800 $37.600 $38,400 None of the Answers QUESTION 3 35 points Save Answer Drew made an initial purchase of 240,000. Drew is using straight-line depreciation over 8 years and the purchase has a terminal value of 150,000 after 5 years. Assume this is for tax purposes. 1) Calculate the tax basis after 5 years. $0 O $100,000 $90,000 0 $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts