Question: can you do c,d, and question 5? 4. A firm issues 15 -year, zero coupon bonds with a face value of $1,000 each. The effective

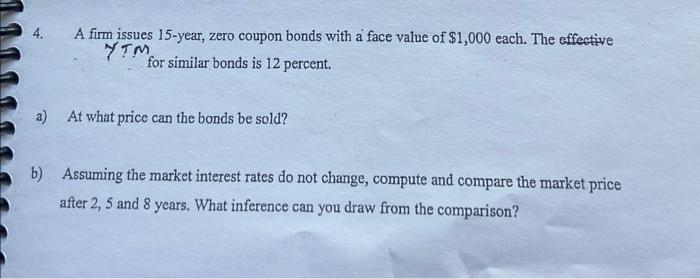

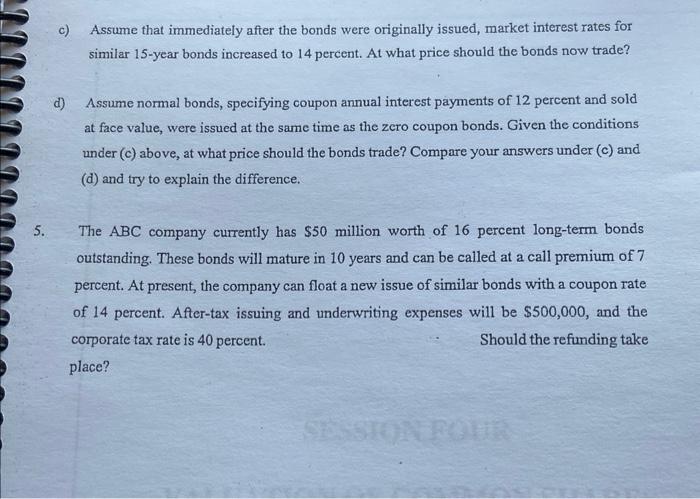

4. A firm issues 15 -year, zero coupon bonds with a face value of $1,000 each. The effective for similar bonds is 12 percent. a) At what price can the bonds be sold? b) Assuming the market interest rates do not change, compute and compare the market price after 2,5 and 8 years. What inference can you draw from the comparison? c) Assume that immediately after the bonds were originally issued, market interest rates for similar 15 -year bonds increased to 14 percent. At what price should the bonds now trade? d) Assume normal bonds, specifying coupon annual interest payments of 12 percent and sold at face value, were issued at the same time as the zcro coupon bonds. Given the conditions under (c) above, at what price should the bonds trade? Compare your answers under (c) and (d) and try to explain the difference. 5. The ABC company currently has $50 million worth of 16 percent long-term bonds outstanding. These bonds will mature in 10 years and can be called at a call premium of 7 percent. At present, the company can float a new issue of similar bonds with a coupon rate of 14 percent. After-tax issuing and underwriting expenses will be $500,000, and the corporate tax rate is 40 percent. Should the refunding take place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts