Question: Can you do it step by step elaborate and elucidate it . Thanks A.PROBLEMS 1a) We have a payable in tenge in one year (

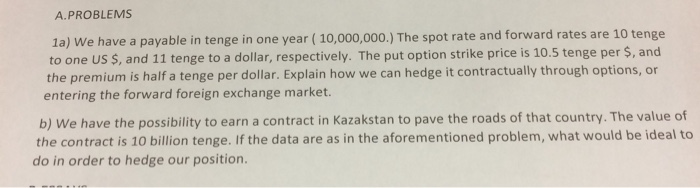

A.PROBLEMS 1a) We have a payable in tenge in one year ( 10,000,000.) The spot rate and forward rates are 10 tenge to one US $, and 11 tenge to a dollar, respectively. The put option strike price is 10.5 tenge per $, and the premium is half a tenge per dollar. Explain how we can hedge it contractually through options, or entering the forward foreign exchange market. b) We have the possibility to earn a contract in Kazakstan to pave the roads of that country. The value of the contract is 10 billion tenge. If the data are as in the aforementioned problem, what would be ideal to do in order to hedge our position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts