Question: CAN YOU DO STEP BY STEP ON HOW TO GET TO THE ANSWER ONCE I DID MY CALCULATION MY VALUE OF EQUITY WAS 1 6

CAN YOU DO STEP BY STEP ON HOW TO GET TO THE ANSWER ONCE I DID MY CALCULATION MY VALUE OF EQUITY WAS AND VALUE PER SHARE BECAME BOOK VALUE EQUITY OR WAS I HOING TO DO OUSTANDING SHARES IS IT RIGHT OR WRONG AND CAN YOU SHOW HOW TO SOLVE THIS STEP BY STPE IN A EASY WAY TO FOLLOW AND IF YOU USE EXCEL CAN YOU POST THE SPREED SHEET TOO QUESTION

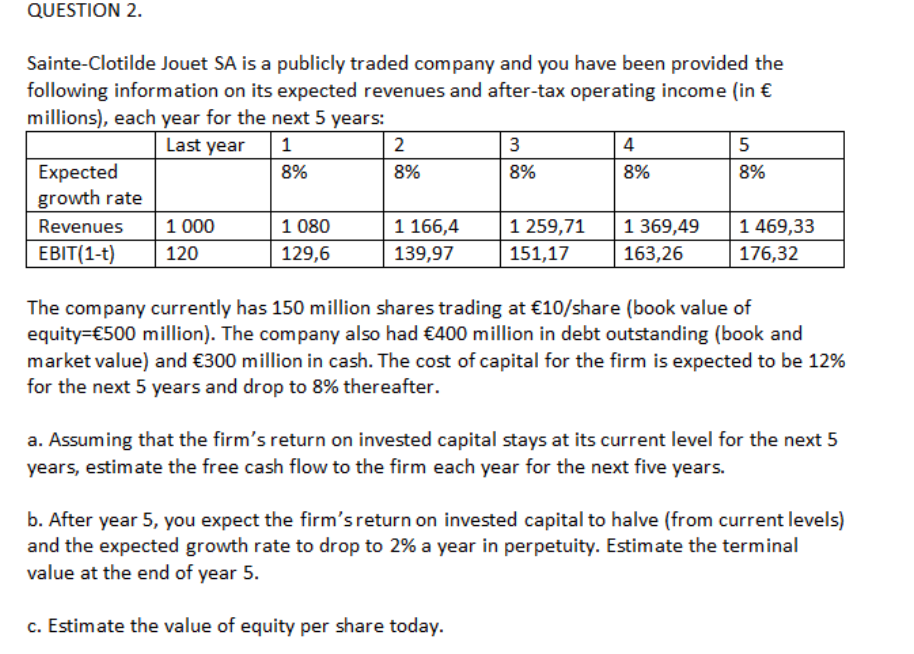

SainteClotilde Jouet SA is a publicly traded company and you have been provided the

following information on its expected revenues and aftertax operating income in

millions each year for the next years:

The company currently has million shares trading at share book value of

equity million The company also had million in debt outstanding book and

market value and million in cash. The cost of capital for the firm is expected to be

for the next years and drop to thereafter.

a Assuming that the firm's return on invested capital stays at its current level for the next

years, estimate the free cash flow to the firm each year for the next five years.

b After year you expect the firm's return on invested capital to halve from current levels

and the expected growth rate to drop to a year in perpetuity. Estimate the terminal

value at the end of year

c Estimate the value of equity per share today.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock