Question: Can you estimate a value for Blaine based on a 5-year term of analysis projections a YOY compound growth rate of revenue of 11%, a

Can you estimate a value for Blaine based on a 5-year term of analysis projections a YOY compound growth rate of revenue of 11%, a tax rate of 40%, and your estimate of WACC to come up with a projected value of BKI with and without the stock repurchase after five years, i.e. make some assumptions about FCF, and establish NPV of the firm based on capital structure and your WACC for the respective capital structure.

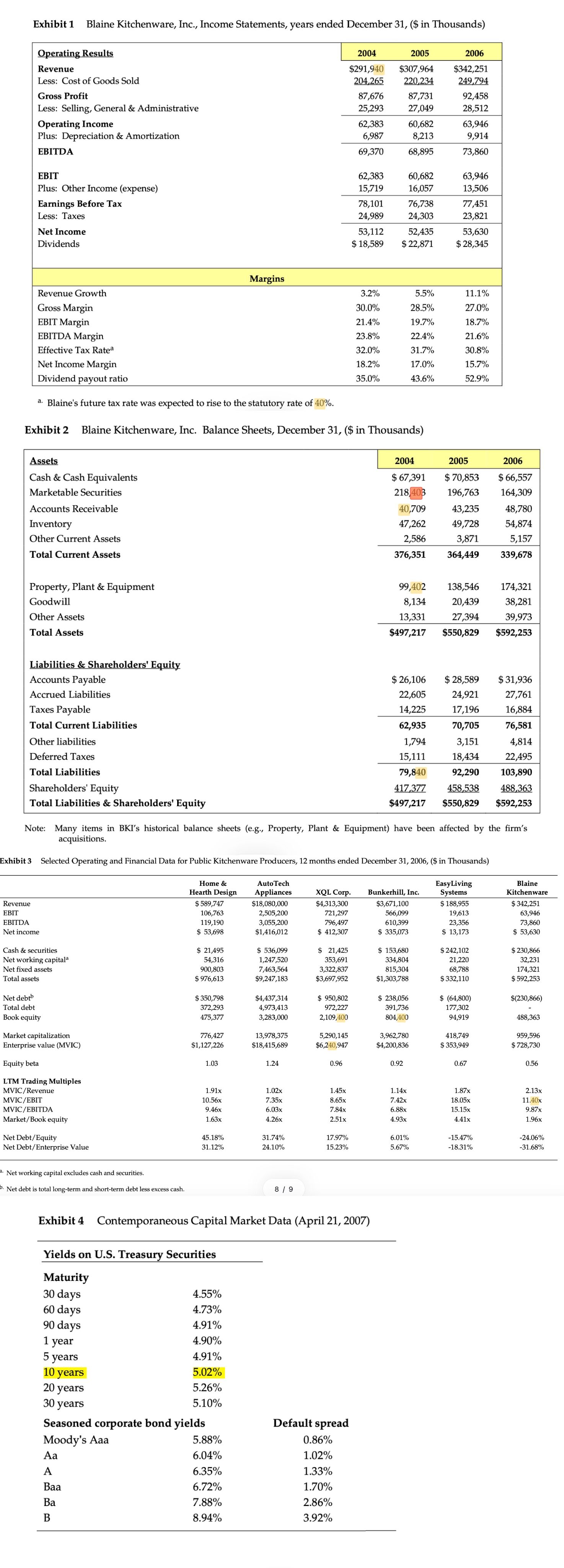

Exhibit 1 Blaine Kitchenware, Inc., Income Statements, years ended December 31, (\$ in Thousands) a. Blaine's future tax rate was expected to rise to the statutory rate of 40%. Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, (\$ in Thousands) Note: Many items in bKI's historical balance sheets (e.g., Property, Plant \& Equipment) have been attected by the fir acquisitions. xhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, (\$ in Thousands) Exhibit 1 Blaine Kitchenware, Inc., Income Statements, years ended December 31, (\$ in Thousands) a. Blaine's future tax rate was expected to rise to the statutory rate of 40%. Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, (\$ in Thousands) Note: Many items in bKI's historical balance sheets (e.g., Property, Plant \& Equipment) have been attected by the fir acquisitions. xhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, (\$ in Thousands)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts