Question: Can you explain how the answer for q47 is A and for question 42 its D coz i do not understand D E F The

Can you explain how the answer for q47 is A and for question 42 its D coz i do not understand

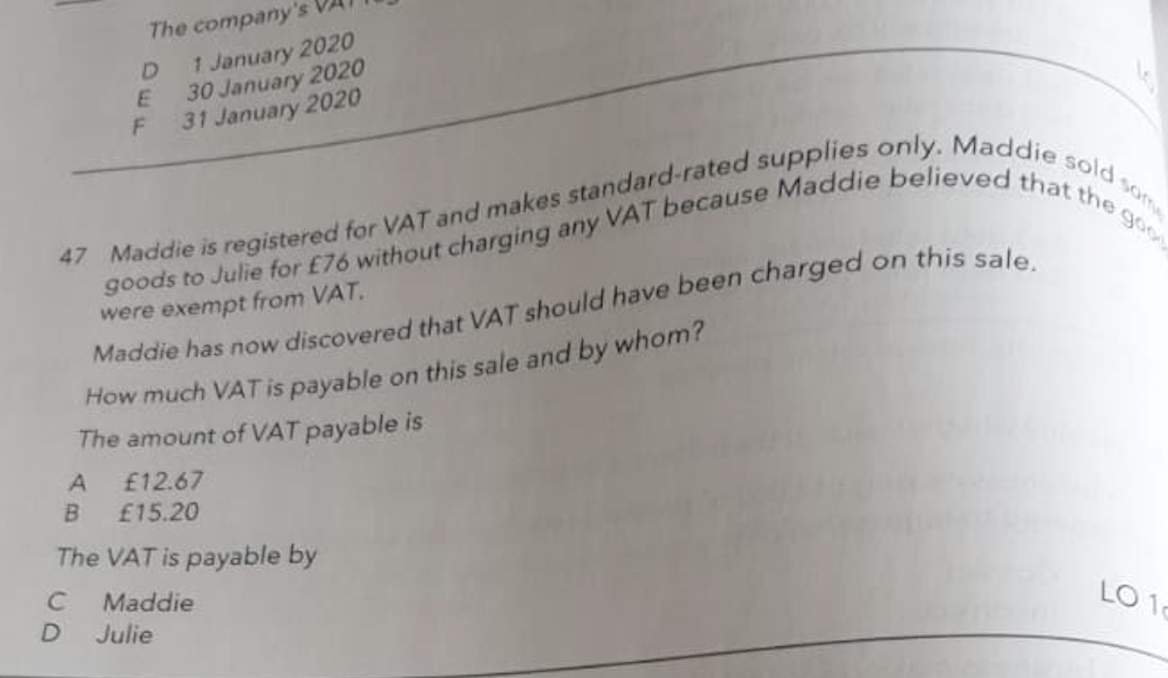

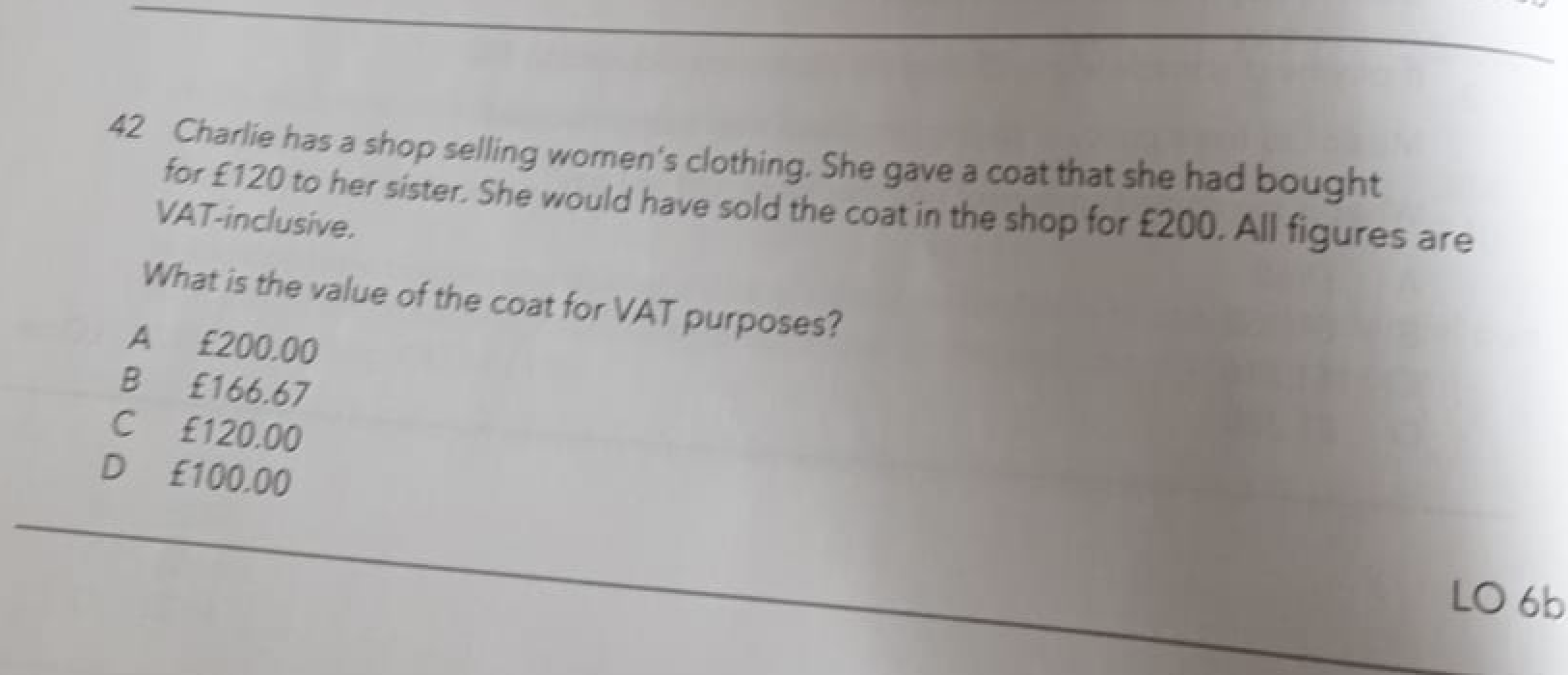

D E F The company's 1 January 2020 30 January 2020 31 January 2020 47 Maddie is registered for VAT and makes standard-rated supplies only. Maddie sold goods to Julie for 76 without charging any VAT because Maddie believed that the were exempt from VAT. Maddie has now discovered that VAT should have been charged on this sale. How much VAT is payable on this sale and by whom? The amount of VAT payable is A B 12.67 15.20 The VAT is payable by Maddie D Julie LO 10 42 Charlie has a shop selling women's clothing. She gave a coat that she had bought for 120 to her sister. She would have sold the coat in the shop for 200. All figures are VAT-inclusive What is the value of the coat for VAT purposes? A 200.00 B 166.67 C 120.00 D E100.00 LO 6b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts