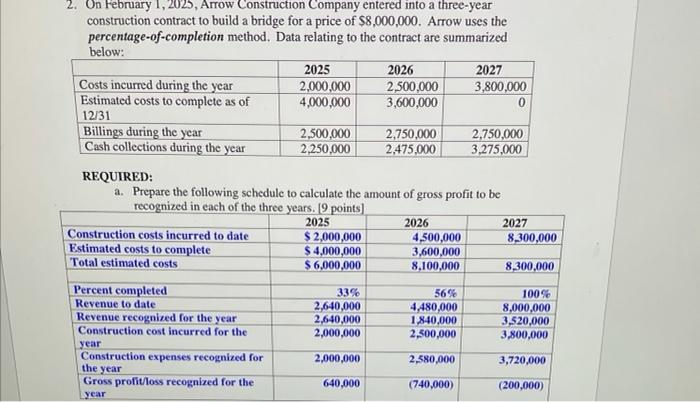

Question: can you explain how the construction expenses recognized for the year 2026 is 2,580,000 and how 2027 is 3,720,000? i would like the formula on

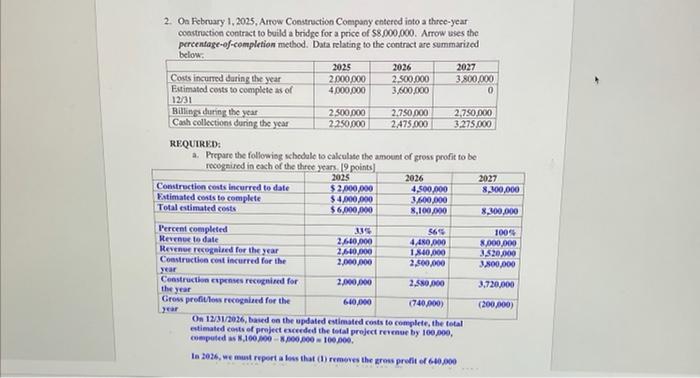

2. Oa February 1, 2025, Arrow Construction Coempany cntered ioto a threc-year coastraction contract to build a bridge for a price of $8,000.000. Arrow uses the percentage-of-cempletion method. Data relating to the contrict are summarized helime REQUIRED: a. Prepare the followisg schodale to calculate the amoent of gross profit to be recoesined in each of the three vears. 10 mintel Un 123yra26, based on the updated cstimated costs to complete, the total etimated cots of project raceeded the tetal project revenue by 100,800 , In 2026, ne mast report a less that (d) remeves the zrost preatit of 640,000 2. On February 1,2025 , Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,000,000. Arrow uses the percentage-of-completion method. Data relating to the contract are summarized below: REQUIRED: a. Prepare the following schedule to calculate the amount of gross profit to be recognized in each of the three vears. 19 points1 2. Oa February 1, 2025, Arrow Construction Coempany cntered ioto a threc-year coastraction contract to build a bridge for a price of $8,000.000. Arrow uses the percentage-of-cempletion method. Data relating to the contrict are summarized helime REQUIRED: a. Prepare the followisg schodale to calculate the amoent of gross profit to be recoesined in each of the three vears. 10 mintel Un 123yra26, based on the updated cstimated costs to complete, the total etimated cots of project raceeded the tetal project revenue by 100,800 , In 2026, ne mast report a less that (d) remeves the zrost preatit of 640,000 2. On February 1,2025 , Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,000,000. Arrow uses the percentage-of-completion method. Data relating to the contract are summarized below: REQUIRED: a. Prepare the following schedule to calculate the amount of gross profit to be recognized in each of the three vears. 19 points1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts