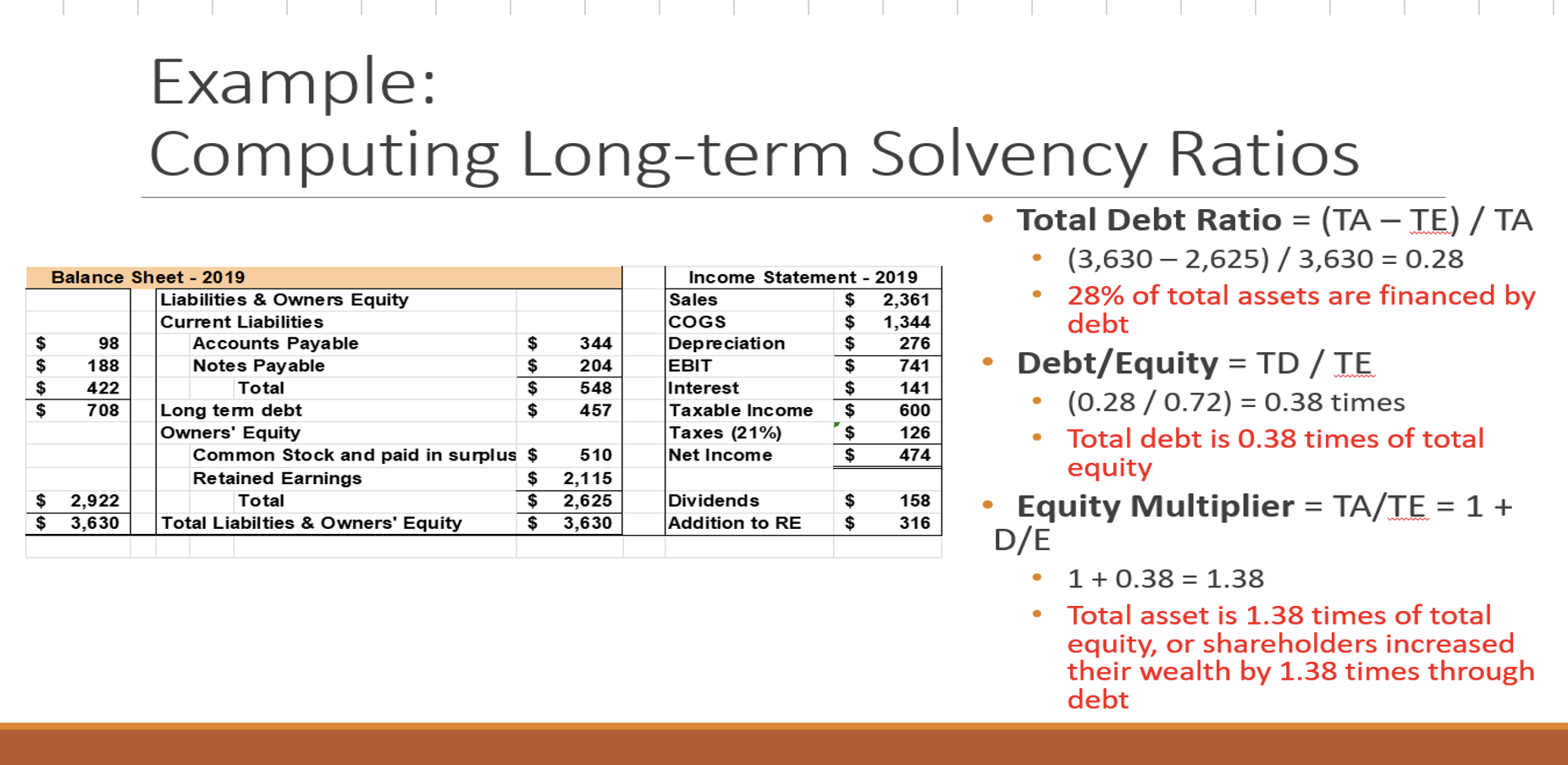

Question: Can you explain how the Debt / Equity was found? Example: Computing Long-term Solvency Ratios Balance Sheet - 2019 98 188 422 708 2,922 3,630

Example: Computing Long-term Solvency Ratios Balance Sheet - 2019 98 188 422 708 2,922 3,630 Liabilities & Owners Equity Current Liabilities Accounts Payable Notes Payable Total Long term debt Owners' Equity Common Stock and paid in surplus Retained Earnings Total Total Liabilties & Owners' Equity 344 204 548 457 510 2,115 2,625 3,630 Income Statement Sales COGS Depreciation EBIT I nterest Taxable Income Taxes (21%) Net Income Dividends Addition to RE - 2019 2,361 1,344 276 741 141 600 126 474 158 316 Total Debt Ratio = (TA E) / TA (3,630 2,625) / 3,630 = 0.28 28% of total assets are financed by debt Debt/Equity = TD / (0.28 / 0.72) = 0.38 times Total debt is 0.38 times of total equity Equity Multiplier = TA/TE = 1 + 1 + 0.38 = 1.38 Total asset is 1.38 times of total equity, or shareholders increased their wealth by 1.38 times through debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts