Question: can you explain how to get the answer without excel and a financial calculator since this is a written exam 3. (25 pts) Superserv Inc.

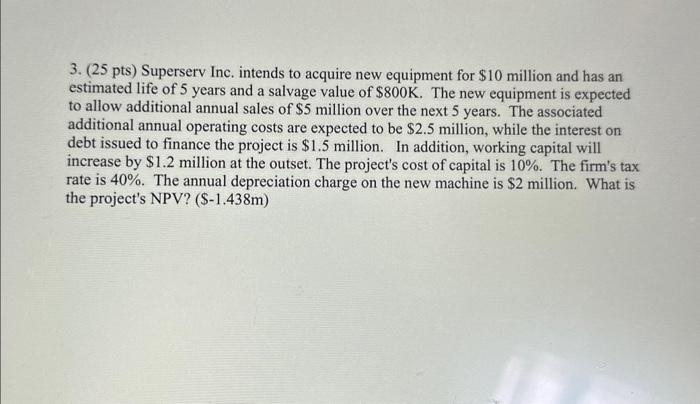

3. (25 pts) Superserv Inc. intends to acquire new equipment for $10 million and has an estimated life of 5 years and a salvage value of $800K. The new equipment is expected to allow additional annual sales of $5 million over the next 5 years. The associated additional annual operating costs are expected to be $2.5 million, while the interest on debt issued to finance the project is $1.5 million. In addition, working capital will increase by $1.2 million at the outset. The project's cost of capital is 10%. The firm's tax rate is 40%. The annual depreciation charge on the new machine is $2 million. What is the project's NPV? ($1.438m)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts