Question: can you explain it step by step . thanks Part C). XYZ has 12 million shares of equity outstanding. The current share price is 50

can you explain it step by step . thanks

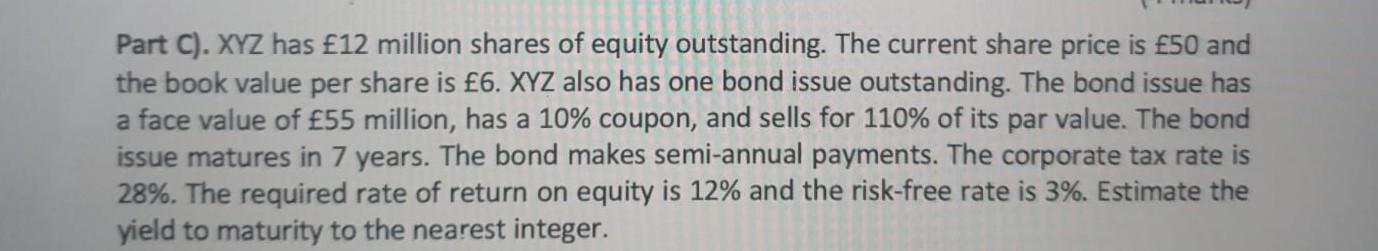

Part C). XYZ has 12 million shares of equity outstanding. The current share price is 50 and the book value per share is 6.XYZ also has one bond issue outstanding. The bond issue has a face value of 55 million, has a 10% coupon, and sells for 110% of its par value. The bond issue matures in 7 years. The bond makes semi-annual payments. The corporate tax rate is 28%. The required rate of return on equity is 12% and the risk-free rate is 3%. Estimate the yield to maturity to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts