Question: CAN YOU EXPLAIN ME THE SOLUTION PLEASE, WHERE THE CALCULATIONS IN THE SOLUTIONS COME FROM? Question 2 The practice of investing in a currency that

CAN YOU EXPLAIN ME THE SOLUTION PLEASE, WHERE THE CALCULATIONS IN THE SOLUTIONS COME FROM?

Question

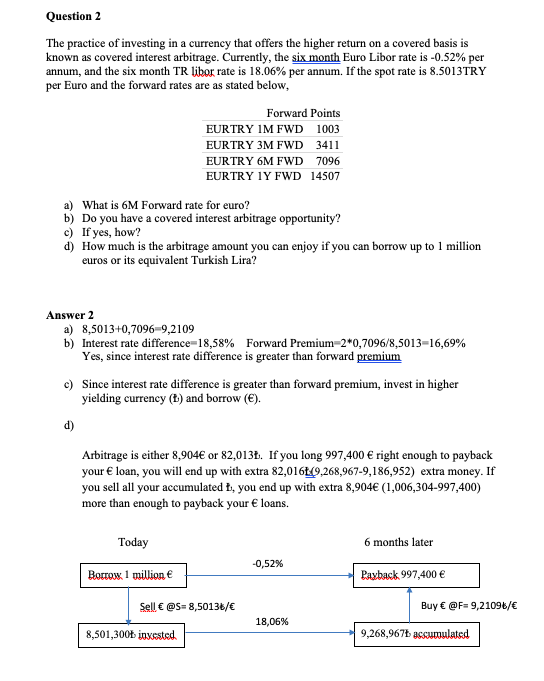

The practice of investing in a currency that offers the higher return on a covered basis is

known as covered interest arbitrage. Currently, the six month Euro Libor rate is per

annum, and the six month TR libor rate is per annum. If the spot rate is TRY

per Euro and the forward rates are as stated below,

a What is Forward rate for euro?

b Do you have a covered interest arbitrage opportunity?

c If yes, how?

d How much is the arbitrage amount you can enjoy if you can borrow up to million

euros or its equivalent Turkish Lira?

Answer

a

b Interest rate difference Forward Premium

Yes, since interest rate difference is greater than forward premium

c Since interest rate difference is greater than forward premium, invest in higher

yielding currency and borrow

d

Arbitrage is either or t If you long right enough to payback

you sell all your accumulated you end up with extra

more than enough to payback your loans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock