Question: can you explain me this question step by step 3. a. At $2 million in expenses per $100 million in loans, administrative costs come to

can you explain me this question step by step

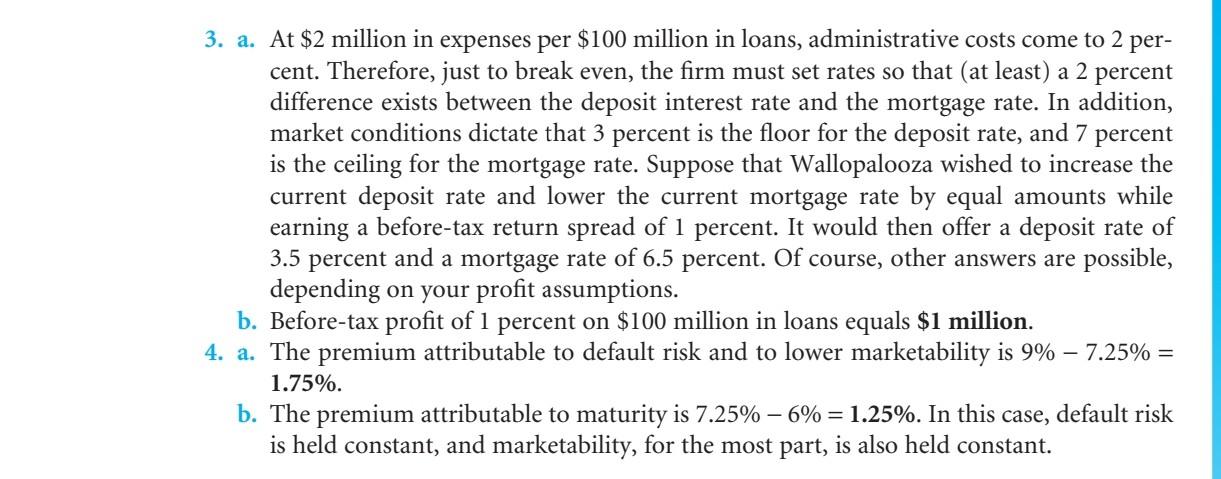

3. a. At $2 million in expenses per $100 million in loans, administrative costs come to 2 per- cent. Therefore, just to break even, the firm must set rates so that (at least) a 2 percent difference exists between the deposit interest rate and the mortgage rate. In addition, market conditions dictate that 3 percent is the floor for the deposit rate, and 7 percent is the ceiling for the mortgage rate. Suppose that Wallopalooza wished to increase the current deposit rate and lower the current mortgage rate by equal amounts while earning a before-tax return spread of 1 percent. It would then offer a deposit rate of 3.5 percent and a mortgage rate of 6.5 percent. Of course, other answers are possible, depending on your profit assumptions. b. Before-tax profit of 1 percent on $100 million in loans equals $1 million. 4. a. The premium attributable to default risk and to lower marketability is 9% 7.25% = 1.75%. b. The premium attributable to maturity is 7.25% 6% = 1.25%. In this case, default risk is held constant, and marketability, for the most part, is also held constant. 3. a. At $2 million in expenses per $100 million in loans, administrative costs come to 2 per- cent. Therefore, just to break even, the firm must set rates so that (at least) a 2 percent difference exists between the deposit interest rate and the mortgage rate. In addition, market conditions dictate that 3 percent is the floor for the deposit rate, and 7 percent is the ceiling for the mortgage rate. Suppose that Wallopalooza wished to increase the current deposit rate and lower the current mortgage rate by equal amounts while earning a before-tax return spread of 1 percent. It would then offer a deposit rate of 3.5 percent and a mortgage rate of 6.5 percent. Of course, other answers are possible, depending on your profit assumptions. b. Before-tax profit of 1 percent on $100 million in loans equals $1 million. 4. a. The premium attributable to default risk and to lower marketability is 9% 7.25% = 1.75%. b. The premium attributable to maturity is 7.25% 6% = 1.25%. In this case, default risk is held constant, and marketability, for the most part, is also held constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts