Question: Can you explain more about the problem? 15) Presented below is an excerpt from Rowing Inc.'s pro forma statements. Estimate the company's long-term value using

Can you explain more about the problem?

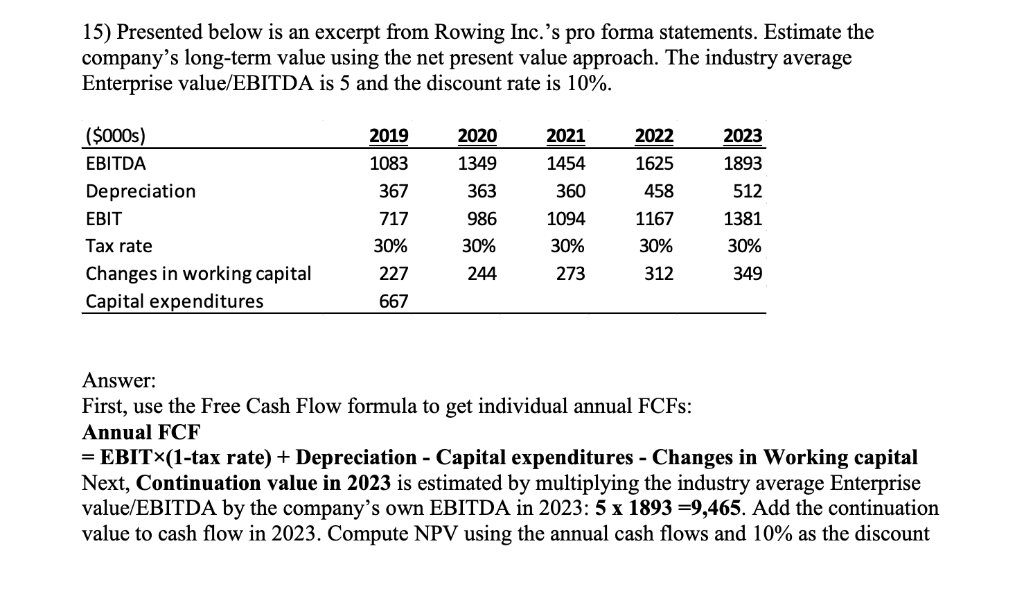

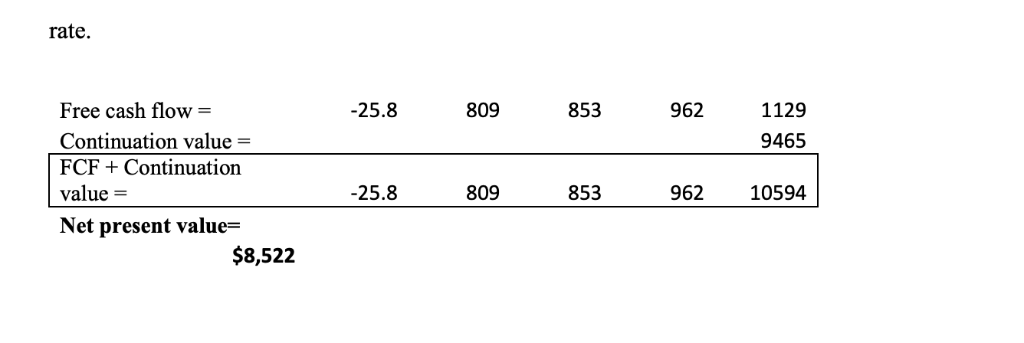

15) Presented below is an excerpt from Rowing Inc.'s pro forma statements. Estimate the company's long-term value using the net present value approach. The industry average Enterprise value/EBITDA is 5 and the discount rate is 10%. ($000s) EBITDA Depreciation EBIT Tax rate Changes in working capital Capital expenditures 2019 1083 367 2020 1349 363 986 30% 244 2021 1454 360 1094 30% 273 2022 1625 458 1167 30% 312 2023 1893 512 1381 30% 349 30% 227 667 Answer First, use the Free Cash Flow formula to get individual annual FCFs: Annual FCF -EBITx(1-tax rate) + Depreciation - Capital expenditures - Changes in Working capital Next, Continuation value in 2023 is estimated by multiplying the industry average Enterprise value/EBITDA by the company's own EBITDA in 2023: 5 x 1893-9,465. Add the continuation value to cash flow in 2023 . Compute NPV using the annual cash flows and 10% as the discount rate Free cash flow Continuation value - FCF Continuation value - Net present value- 809 853 962 1129 9465 25.8 25.8 809 853 96210594 $8,522

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts