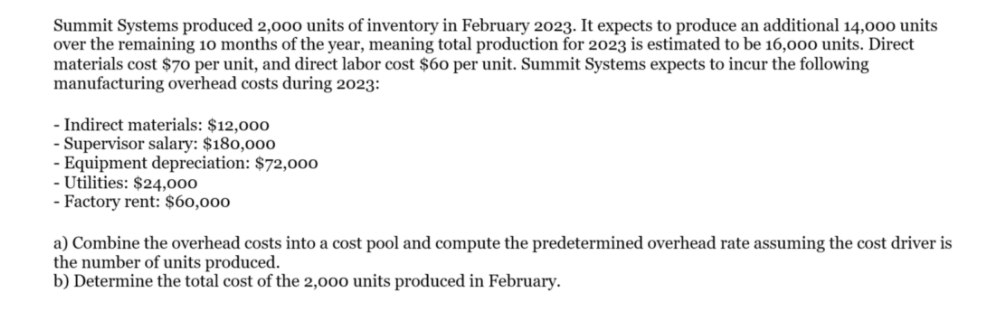

Question: Can you explain the correct approach to solve this general accounting question? Summit Systems produced 2,000 units of inventory in February 2023. It expects to

Can you explain the correct approach to solve this general accounting question?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts