Question: Can you explain this question ? How did she found these numbers and why answer is this ? 7-8. G chegg: Fundamentals of ( aioc

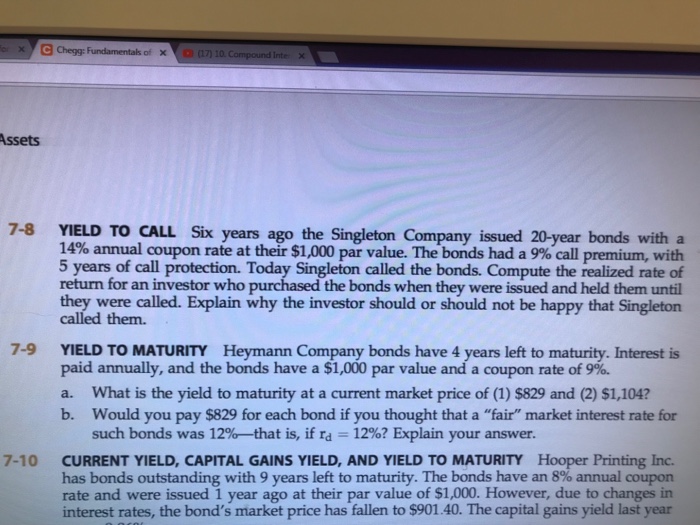

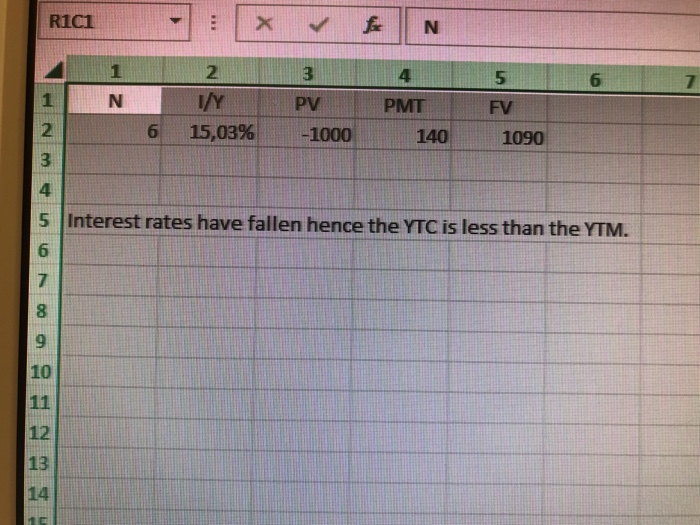

G chegg: Fundamentals of ( aioc Assets 7-8 YIELD TO CALL Six years ago the Singleton Company issued 20-year bonds with a 14% annual coupon rate at their $1,000 par value. The bonds had a 9% call premium, with 5 years of call protection. Today Singleton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Explain why the investor should or should not be happy that Singleton called them. 7-9 YIELD TO MATURITY paid annually, and the bonds have a $1,000 par value and a coupon rate of 9%. Heymann Company bonds have 4 years left to maturity. Interest is What is the yield to maturity at a current market price of (1) $829 and (2) $1,104? a. Would you pay $829 for each bond if you thought that a "fair" market interest rate for such bonds was 12%--that is, if rd-12%? Explain your answer. b. CURRENT YIELD, CAPITAL GAINS YIELD, AND YIELD TO MATURITY Hooper Printing Inc. has bonds outstanding with 9 years left to maturity. The bonds have an 8% annual coupon rate and were issued 1 year ago at their par value of $1,000. However, due to changes in interest rates, the bond's market price has fallen to $901.40. The capital gains yield last year 7-10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts