Question: Can you explain what a tariff shift is , using a product example and rules of origin? Annex 4 - B refers to Product -

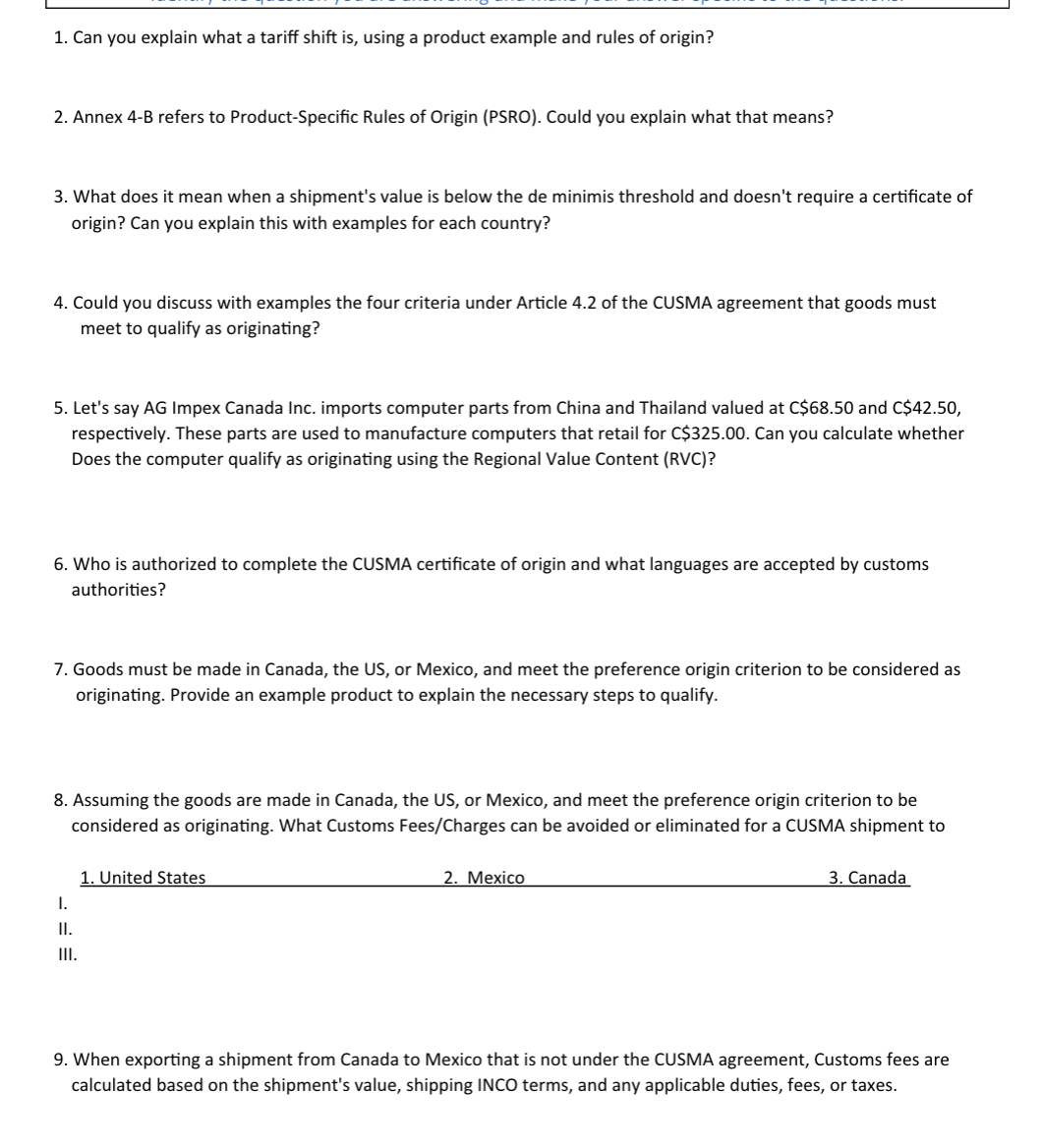

Can you explain what a tariff shift is using a product example and rules of origin?

Annex B refers to ProductSpecific Rules of Origin PSRO Could you explain what that means?

What does it mean when a shipment's value is below the de minimis threshold and doesn't require a certificate of

origin? Can you explain this with examples for each country?

Could you discuss with examples the four criteria under Article of the CUSMA agreement that goods must

meet to qualify as originating?

Let's say AG Impex Canada Inc. imports computer parts from China and Thailand valued at $ and $

respectively. These parts are used to manufacture computers that retail for $ Can you calculate whether

Does the computer qualify as originating using the Regional Value Content RVC

Who is authorized to complete the CUSMA certificate of origin and what languages are accepted by customs

authorities?

Goods must be made in Canada, the US or Mexico, and meet the preference origin criterion to be considered as

originating. Provide an example product to explain the necessary steps to qualify.

Assuming the goods are made in Canada, the US or Mexico, and meet the preference origin criterion to be

considered as originating. What Customs FeesCharges can be avoided or eliminated for a CUSMA shipment to

United States

Mexico

Canada

I.

II

III.

When exporting a shipment from Canada to Mexico that is not under the CUSMA agreement, Customs fees are

calculated based on the shipment's value, shipping INCO terms, and any applicable duties, fees, or taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock