Question: can you explain why highlighted is right 2. The above order should have the price of A. $12.5 B. $10.0 C. $60.0 (D) $62.5 E.

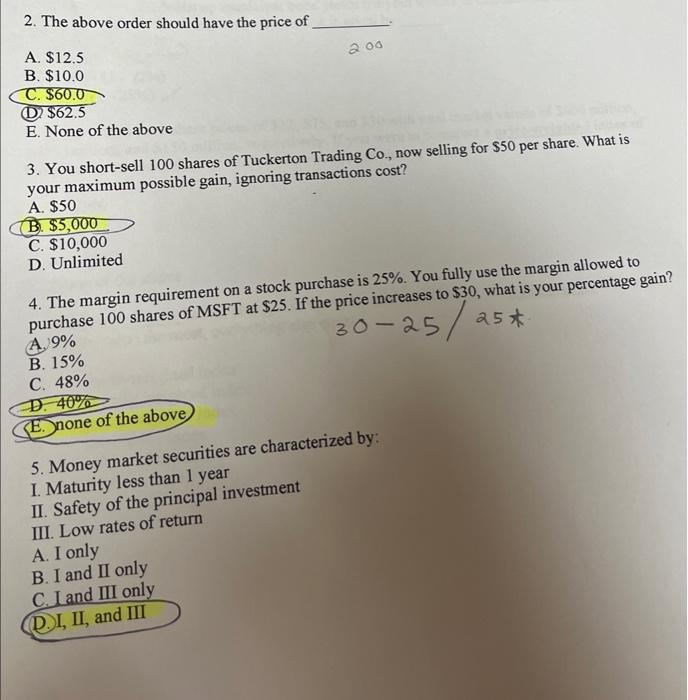

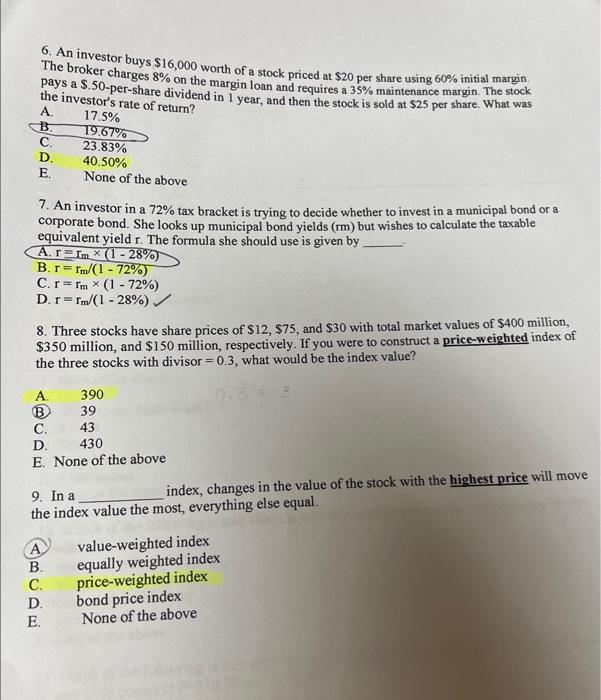

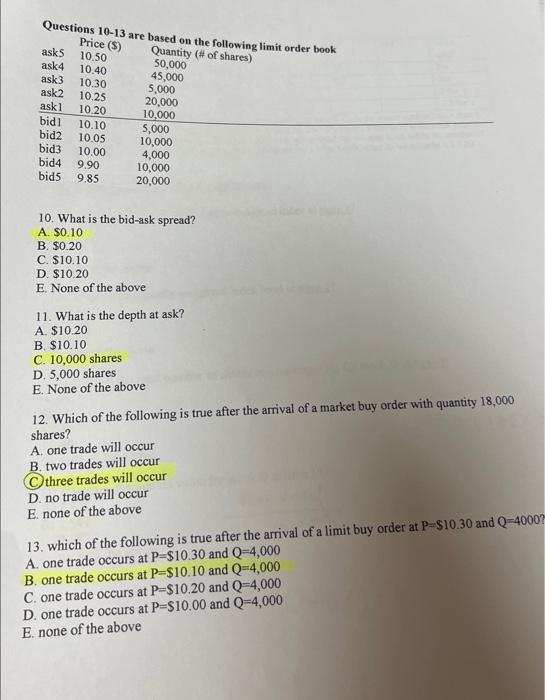

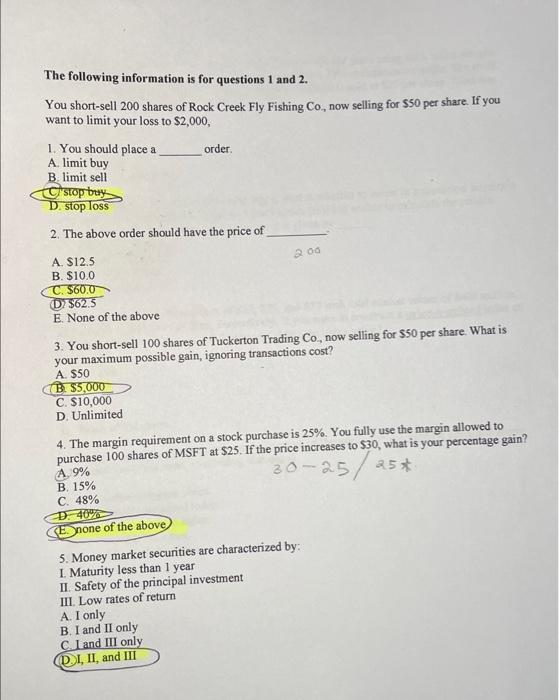

2. The above order should have the price of A. $12.5 B. $10.0 C. $60.0 (D) $62.5 E. None of the above 3. You short-sell 100 shares of Tuckerton Trading Co., now selling for $50 per share. What is your maximum possible gain, ignoring transactions cost? A. $50 (B) $5,000 D. Unlimited 4. The margin requirement on a stock purchase is 25%. You fully use the margin allowed to purchase 100 shares of MSFT at $25. If the price increases to $30, what is your percentage gain? A. 9% 3025/25* B. 15% C. 48% D. 40% 5. Money market securities are characterized by: I. Maturity less than 1 year II. Safety of the principal investment III. Low rates of return A. I only B. I and II only C. Land III only (D.), II, and III 6. An investor buys $16,000 worth of a stock priced at $20 per share using 60% initial margin The broker charges 8% on the margin loan and requires a 35% maintenance margin. The stock pays a \$.50-per-share dividend in 1 year, and then the stock is sold at $25 per share. What was the investor's rata no dividend 7. An investor in a 72% tax bracket is trying to decide whether to invest in a municipal bond or a corporate bond. She looks up municipal bond yields (rm) but wishes to calculate the taxable equivalent yield r. The formula she should use is given by A. rImm(128%) B. r=rm/(172%) C. r=rm(172%) D. r=rm/(128%) 8. Three stocks have share prices of $12,$75, and $30 with total market values of $400 million, $350 million, and $150 million, respectively. If you were to construct a price-weighted index of the three stocks with divisor =0.3, what would be the index value? A. 390 (B) 39 C. 43 D. 430 E. None of the above 9. In a index, changes in the value of the stock with the highest price will move the index value the most, everything else equal. A. value-weighted index B. equally weighted index C. price-weighted index D. bond price index E. None of the above Questions 10-13 are based on the following limit order book 10. What is the bid-ask spread? A. $0.10 B. $0.20 C. $10.10 D. $10.20 E. None of the above 11. What is the depth at ask? A. $10.20 B. $10.10 C. 10,000 shares D. 5,000 shares E. None of the above 12. Which of the following is true after the arrival of a market buy order with quantity 18,000 shares? A. one trade will occur B. two trades will occur C. three trades will occur D. no trade will occur E. none of the above 13. which of the following is true after the arrival of a limit buy order at P=$10.30 and Q=4000 ? A. one trade occurs at P=$10.30 and Q=4,000 B. one trade occurs at P=$10.10 and Q=4,000 C. one trade occurs at P=$10.20 and Q=4,000 D. one trade occurs at P=$10.00 and Q=4,000 E. none of the above The following information is for questions 1 and 2 . You short-sell 200 shares of Rock Creek Fly Fishing Co, now selling for $50 per share. If you want to limit your loss to $2,000, 1. You should place a order. A. limit buy B. limit sell 2. The above order should have the price of A. $12.5 B. $10.0 C. $60.0 (D) $62.5 E. None of the above 3. You short-sell 100 shares of Tuckerton Trading Co, now selling for $50 per share. What is your maximum possible gain, ignoring transactions cost? A. 550 B. $5,000 C. $10,000 D. Unlimited 4. The margin requirement on a stock purchase is 25%. You fully use the margin allowed to purchase 100 shares of MSFT at $25. If the price increases to $30, what is your percentage gain? A. 9% B. 15% C. 48% D. 40% 5. Money market securities are characterized by: I. Maturity less than 1 year II Safety of the principal investment III. Low rates of return A. I only B. I and II only C. Land III only (D.), II, and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts