Question: can you explain why this is the correct answer 30. Suppose a stock trades for $320 and it pays dividends with a present value of

can you explain why this is the correct answer

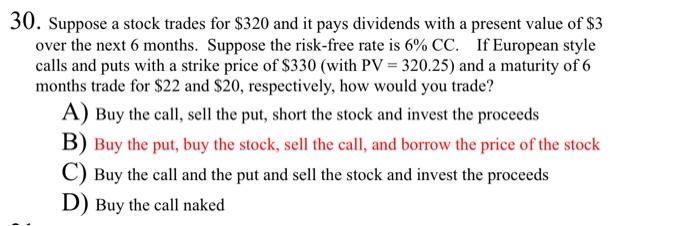

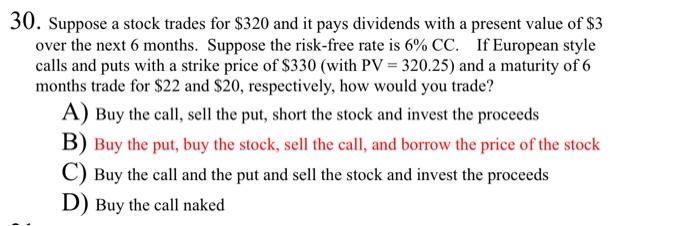

30. Suppose a stock trades for $320 and it pays dividends with a present value of $3 over the next 6 months. Suppose the risk-free rate is 6% CC. If European style calls and puts with a strike price of $330 (with PV=320.25 ) and a maturity of 6 months trade for $22 and $20, respectively, how would you trade? A) Buy the call, sell the put, short the stock and invest the proceeds B) Buy the put, buy the stock, sell the call, and borrow the price of the stock C) Buy the call and the put and sell the stock and invest the proceeds D) Buy the call naked

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock