Question: Can you fill this forms: 1)1040 https://www.irs.gov/pub/irs-pdf/f1040.pdf 2)schedule a https://www.irs.gov/pub/irs-pdf/f1040sa.pdf 3)schedule b https://www.irs.gov/pub/irs-pdf/f1040sb.pdf 4)schedule c https://www.irs.gov/pub/irs-pdf/f1040sc.pdf 5)schedule d https://www.irs.gov/pub/irs-pdf/f1040sd.pdf 6)schedule e https://www.irs.gov/pub/irs-pdf/f1040se.pdf 7)schedule se https://www.irs.gov/pub/irs-pdf/f1040sse.pdf

Can you fill this forms:

1)1040

https://www.irs.gov/pub/irs-pdf/f1040.pdf

2)schedule a

https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

3)schedule b

https://www.irs.gov/pub/irs-pdf/f1040sb.pdf

4)schedule c

https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

5)schedule d

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

6)schedule e

https://www.irs.gov/pub/irs-pdf/f1040se.pdf

7)schedule se

https://www.irs.gov/pub/irs-pdf/f1040sse.pdf

8)8949 form

https://www.irs.gov/pub/irs-pdf/f8949.pdf

using the following information

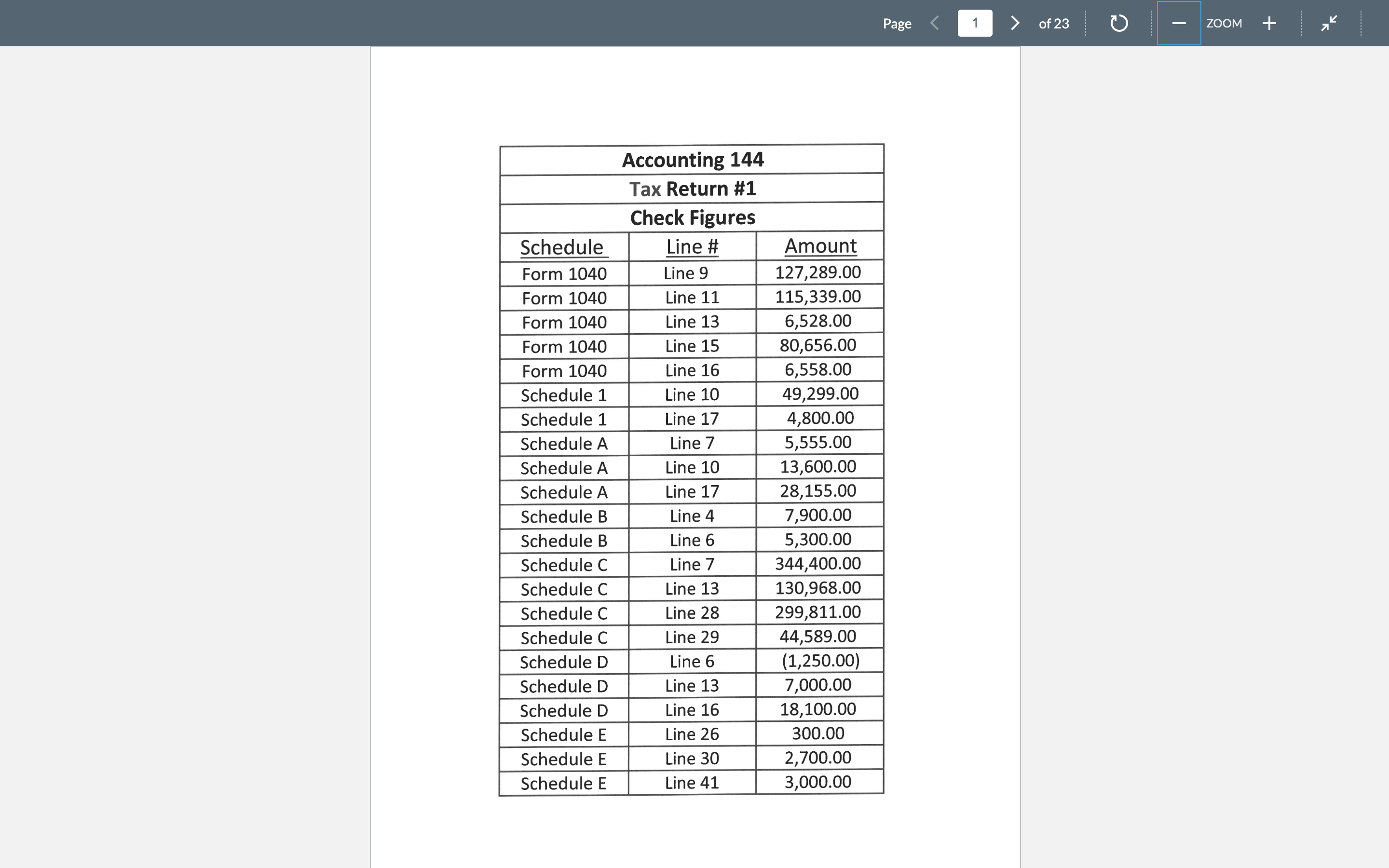

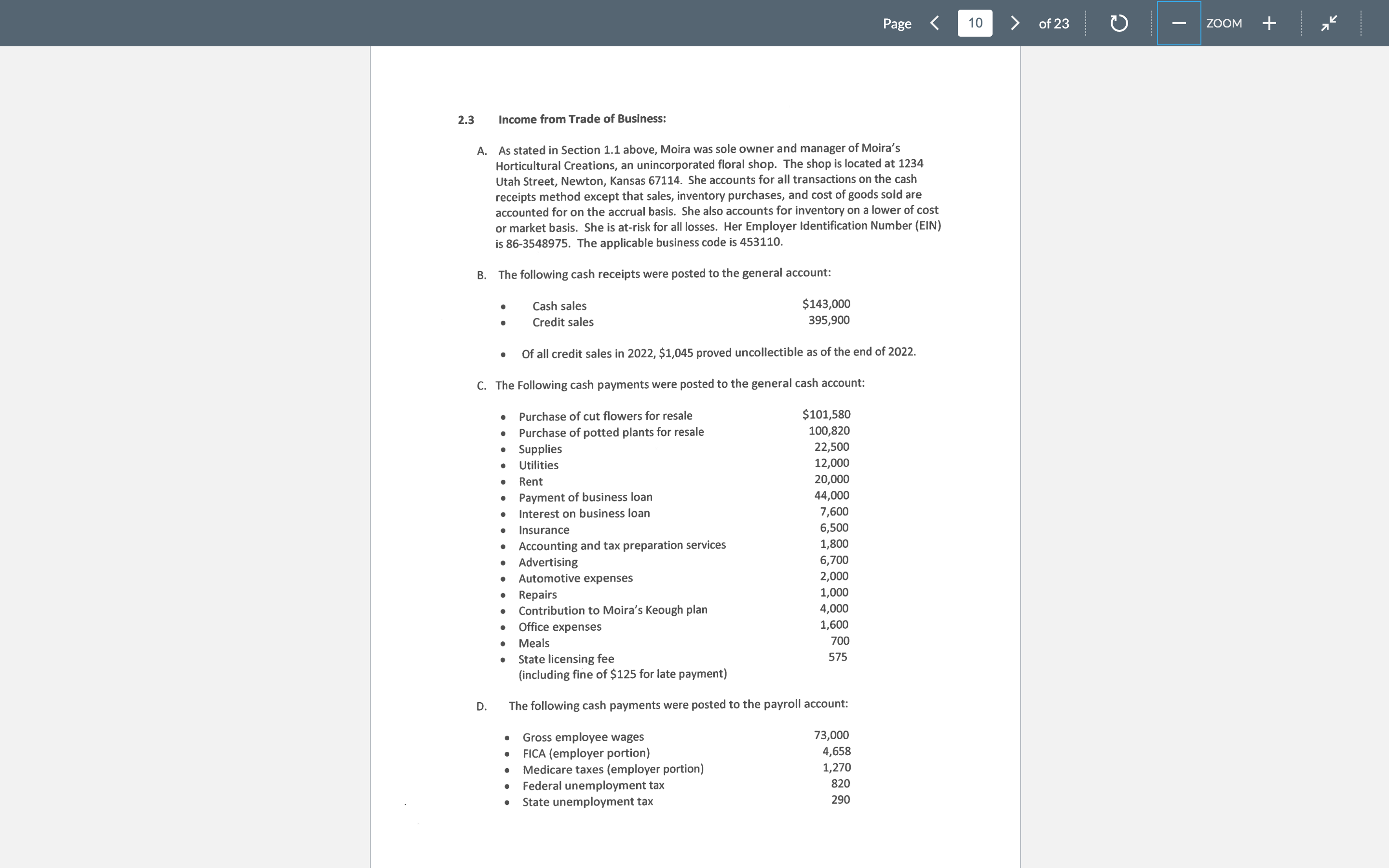

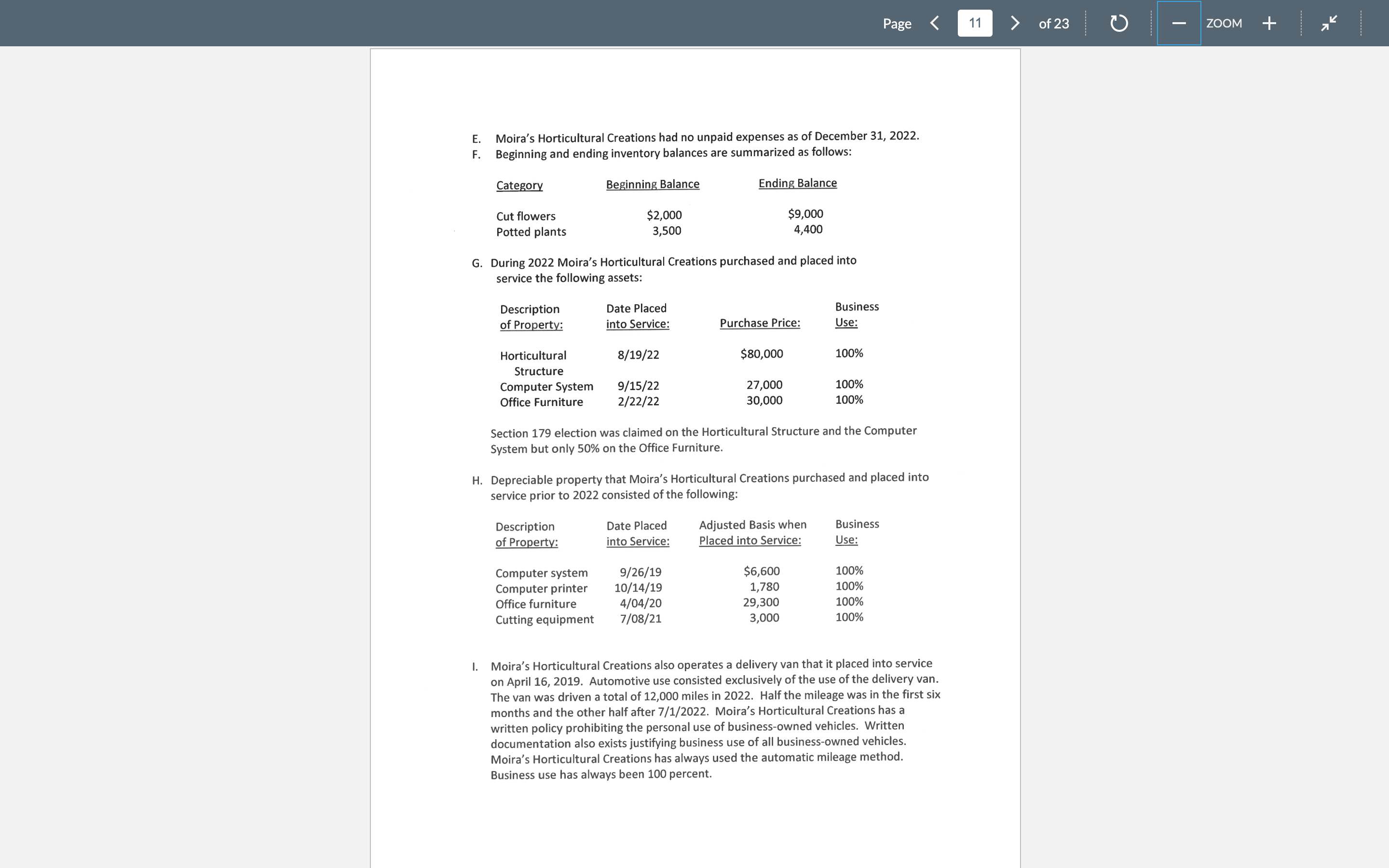

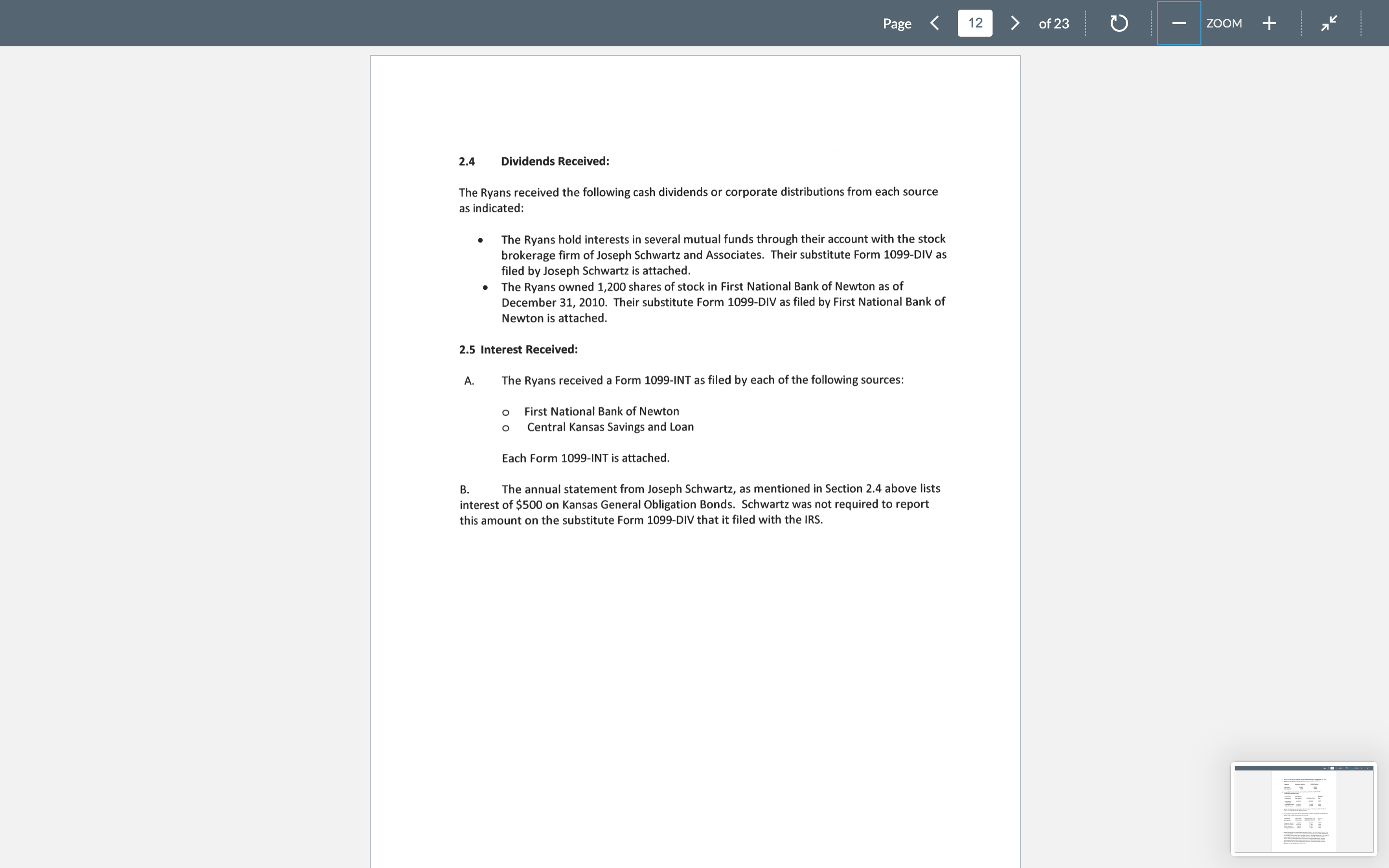

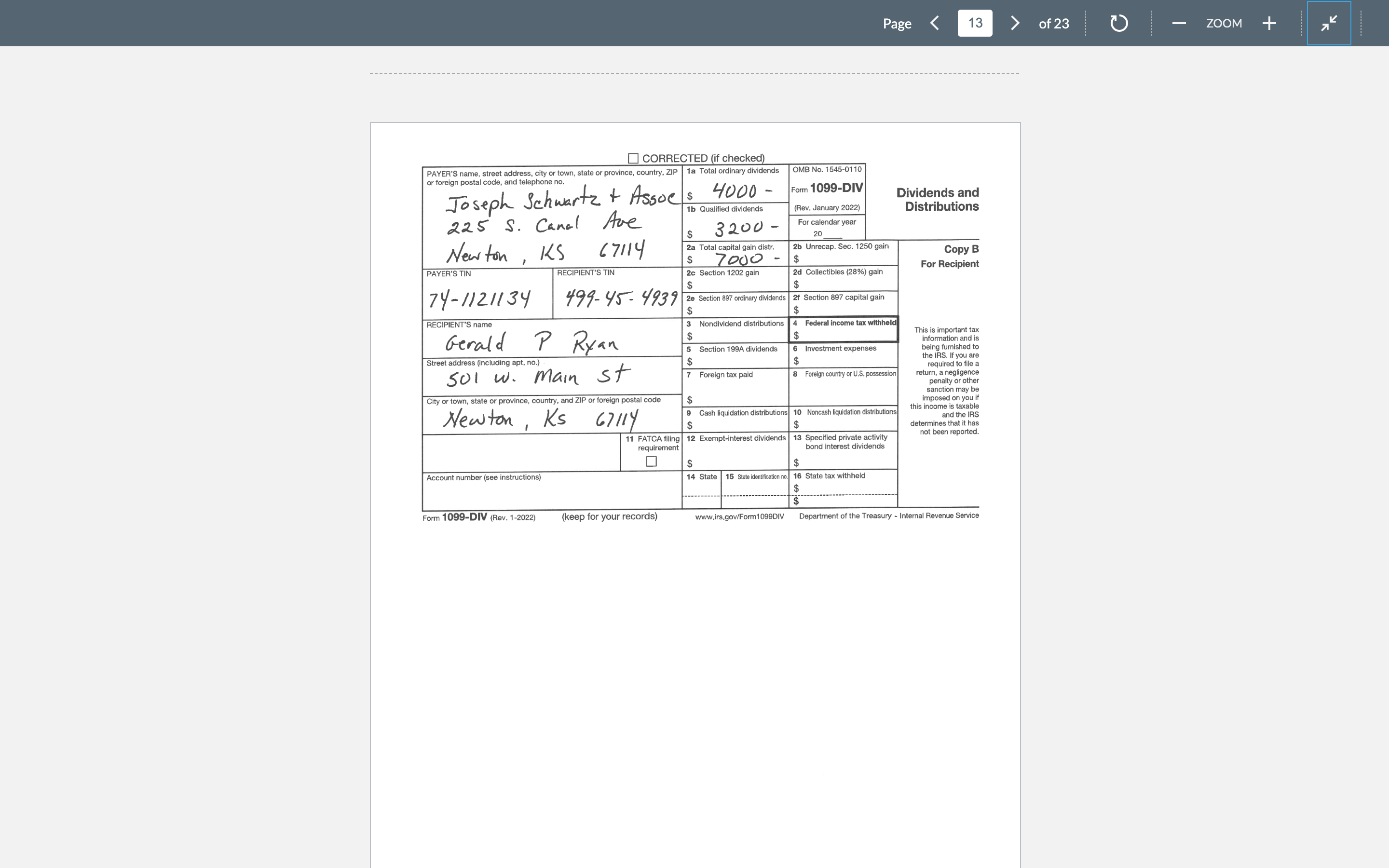

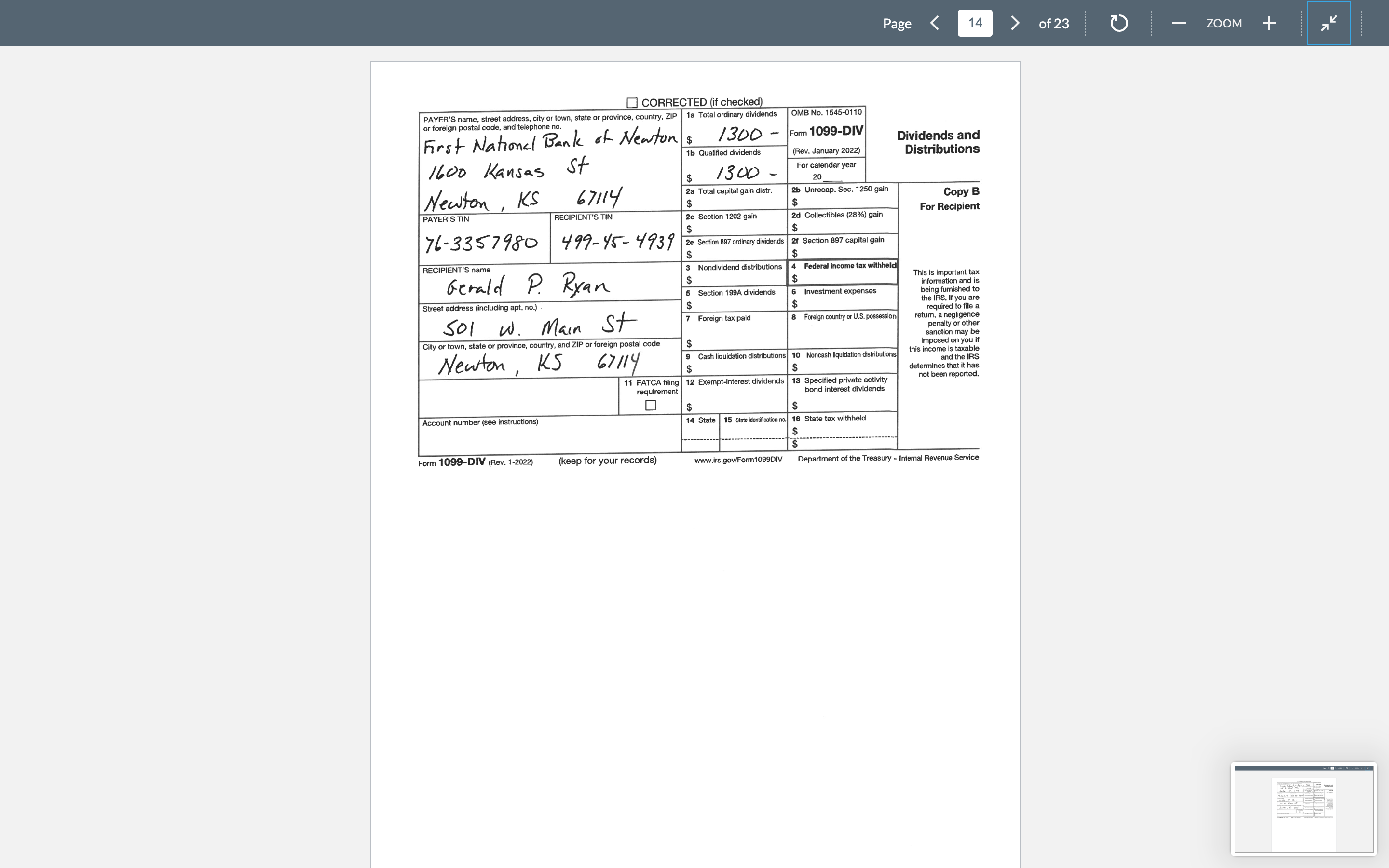

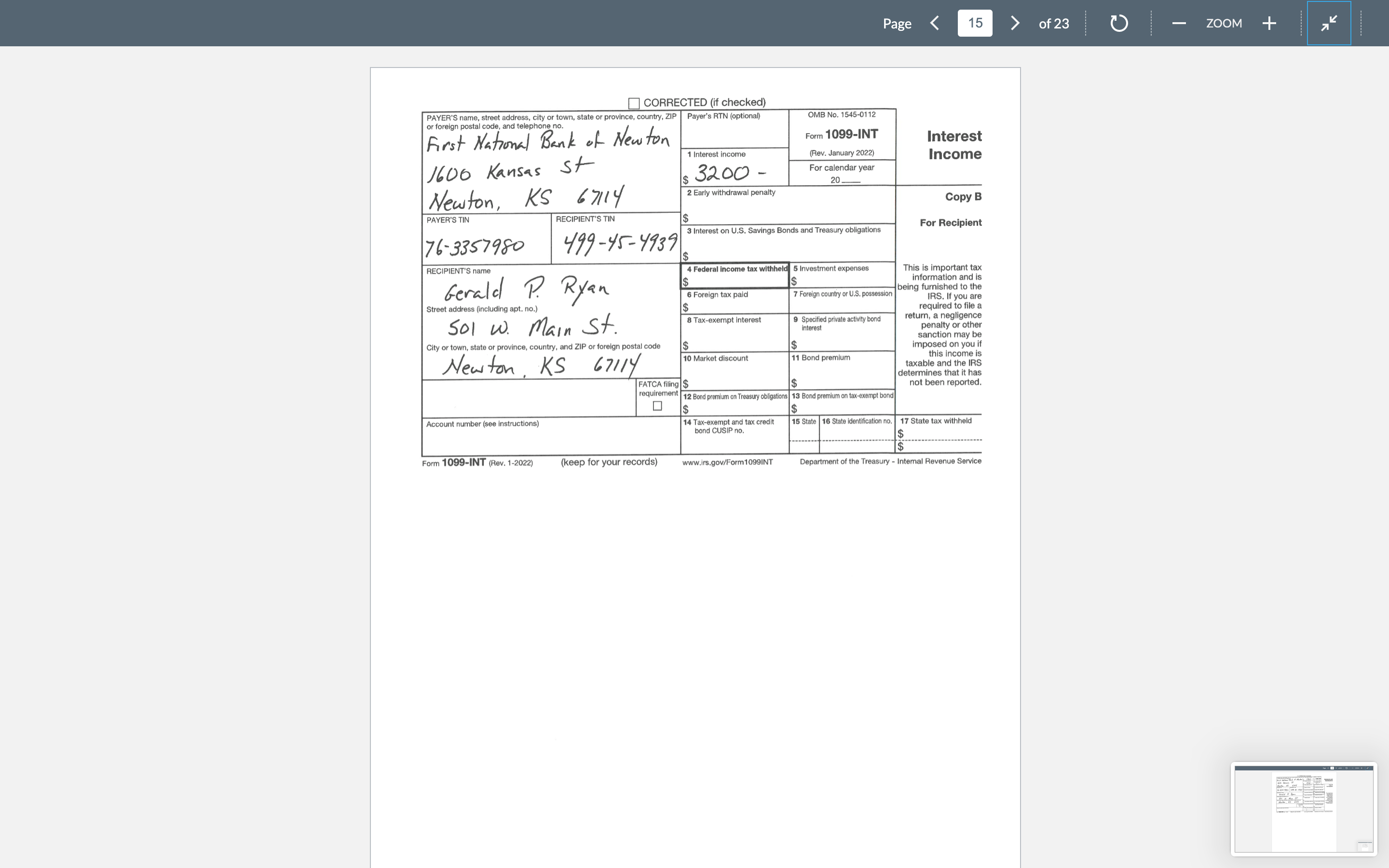

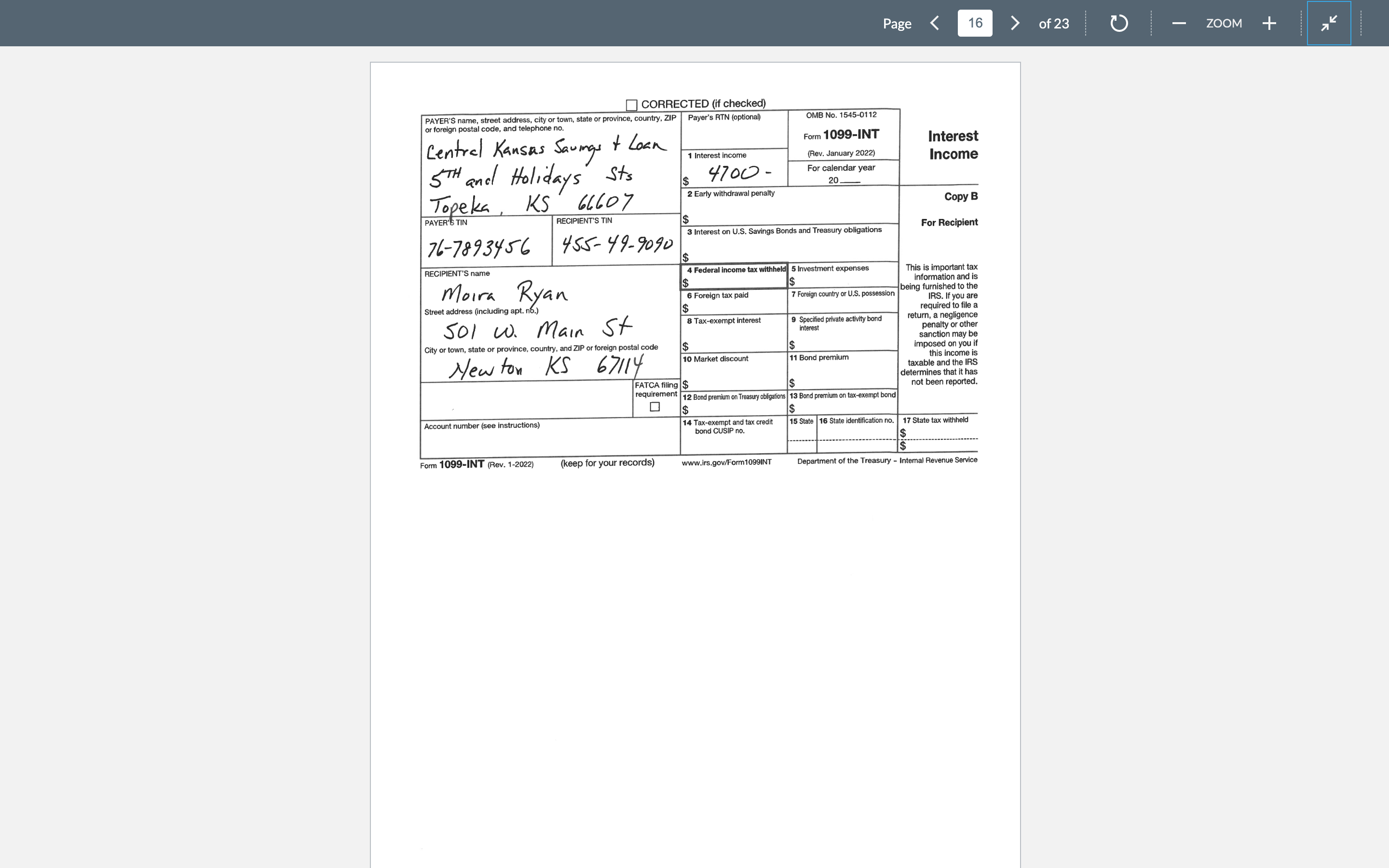

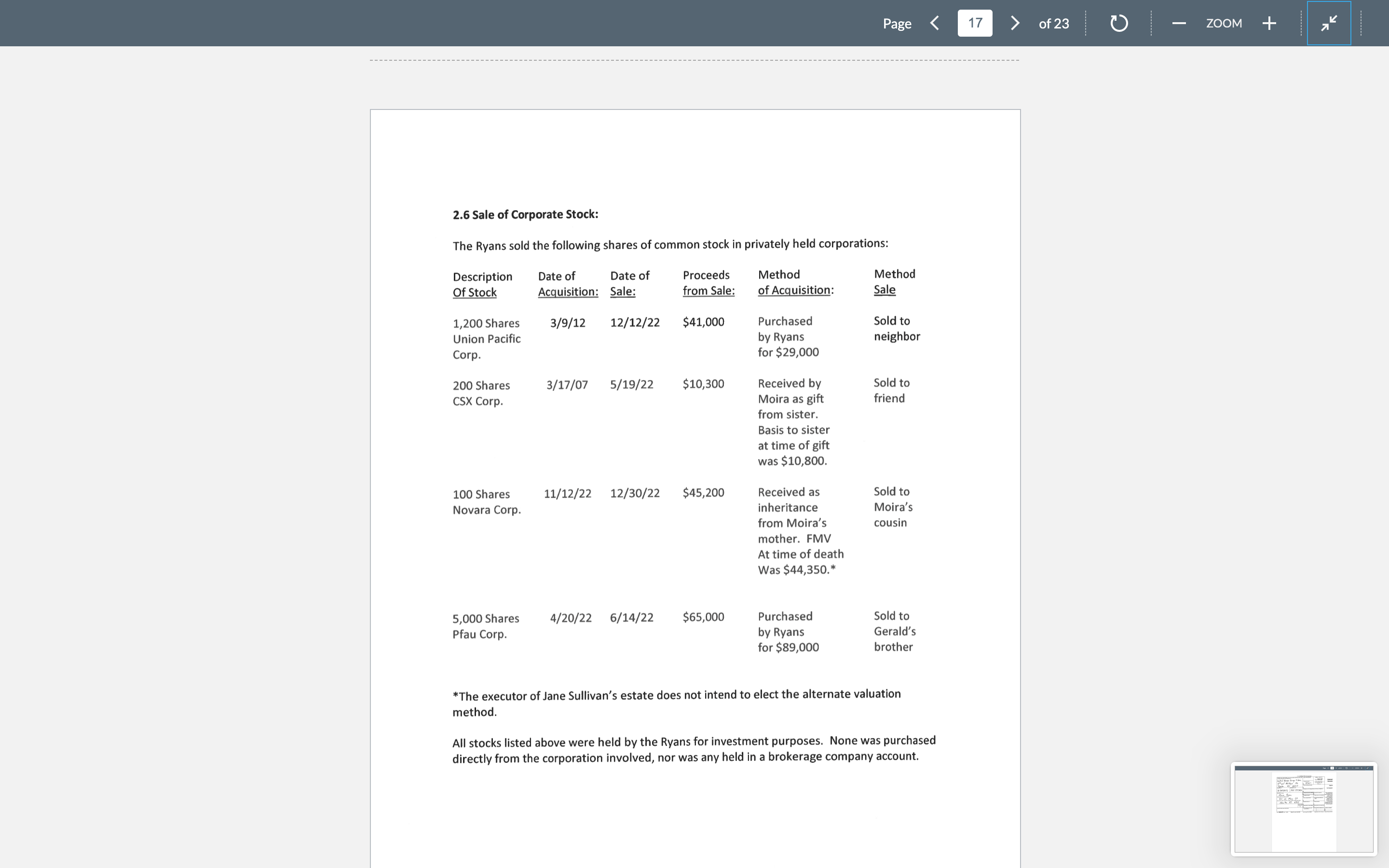

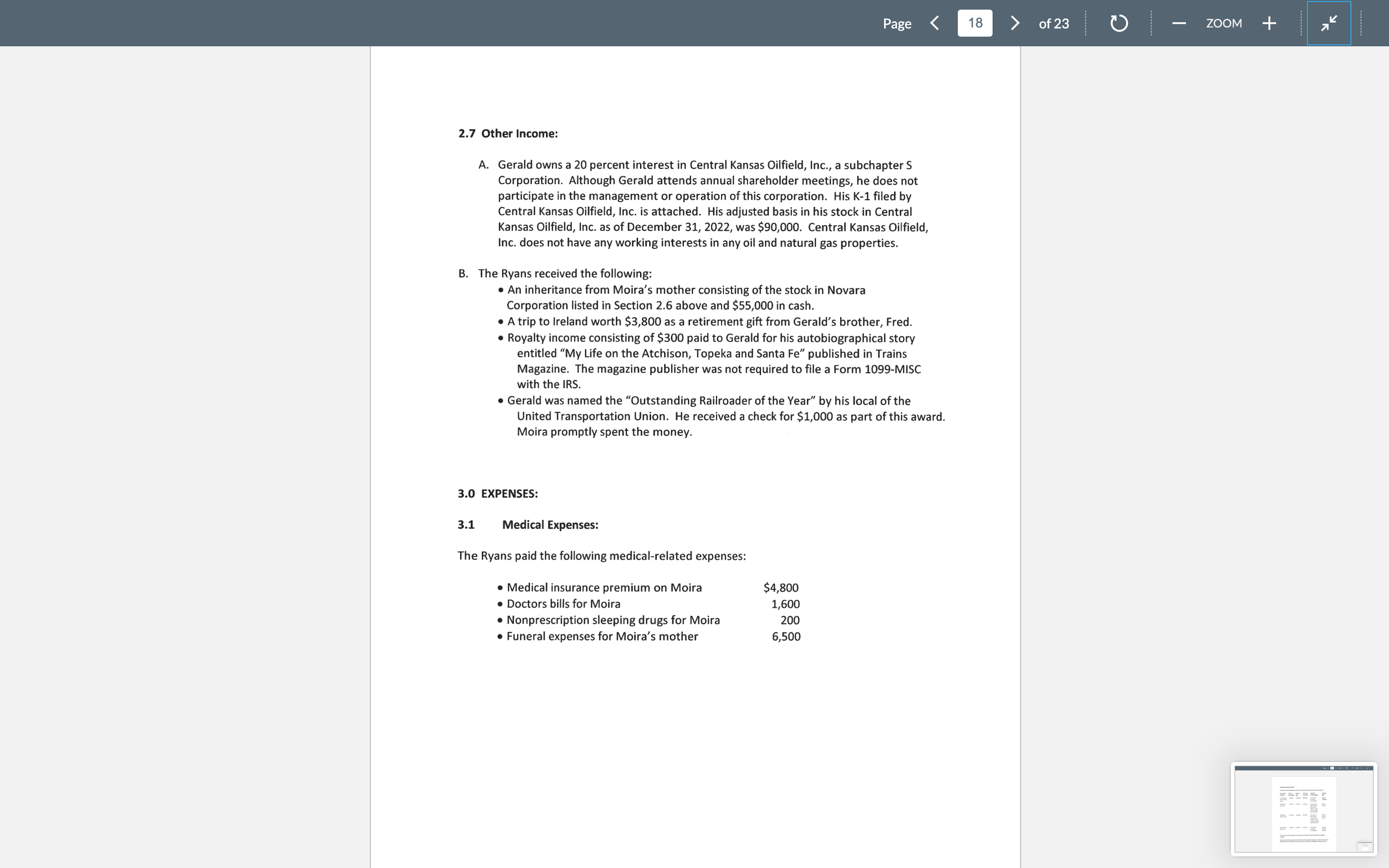

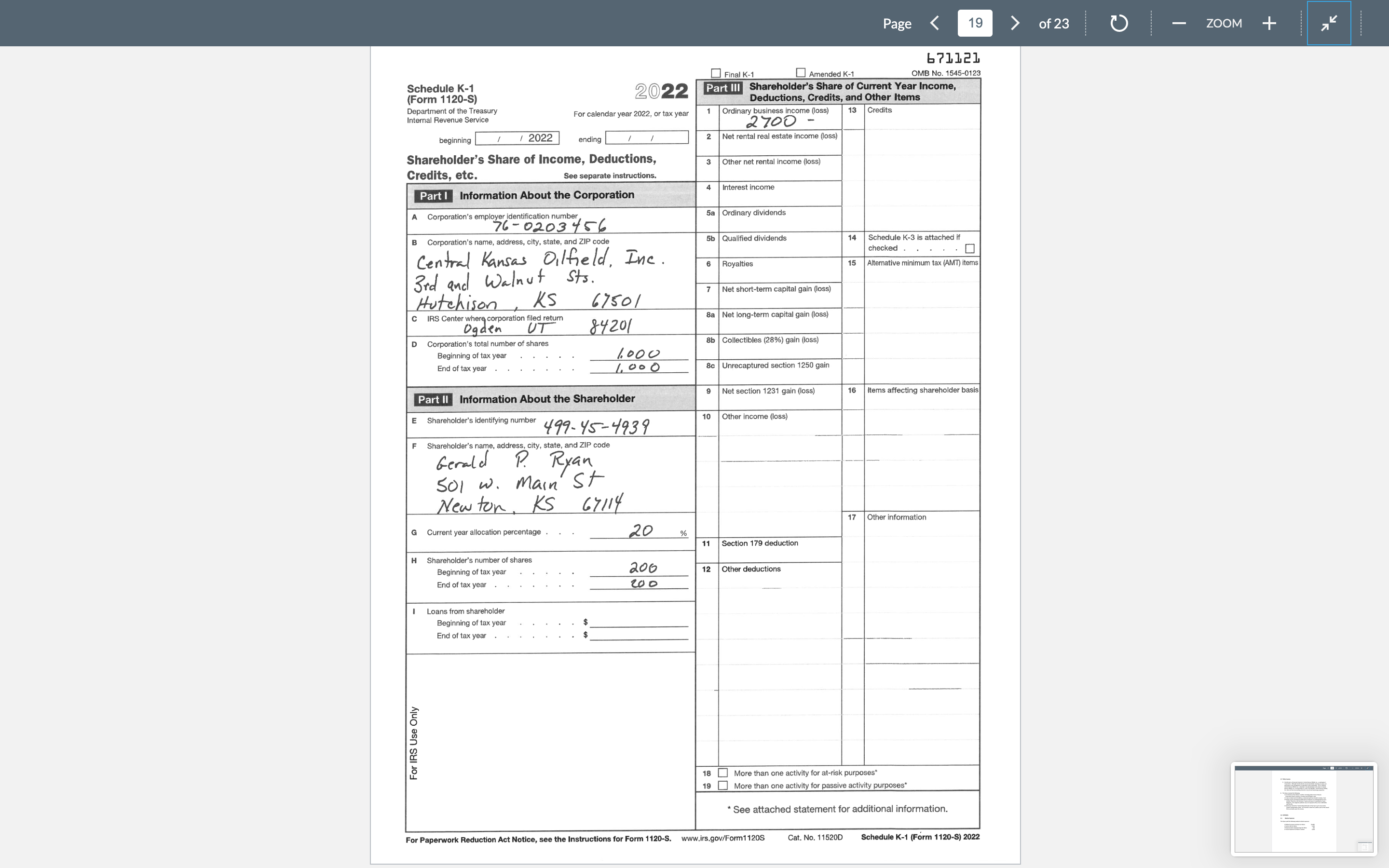

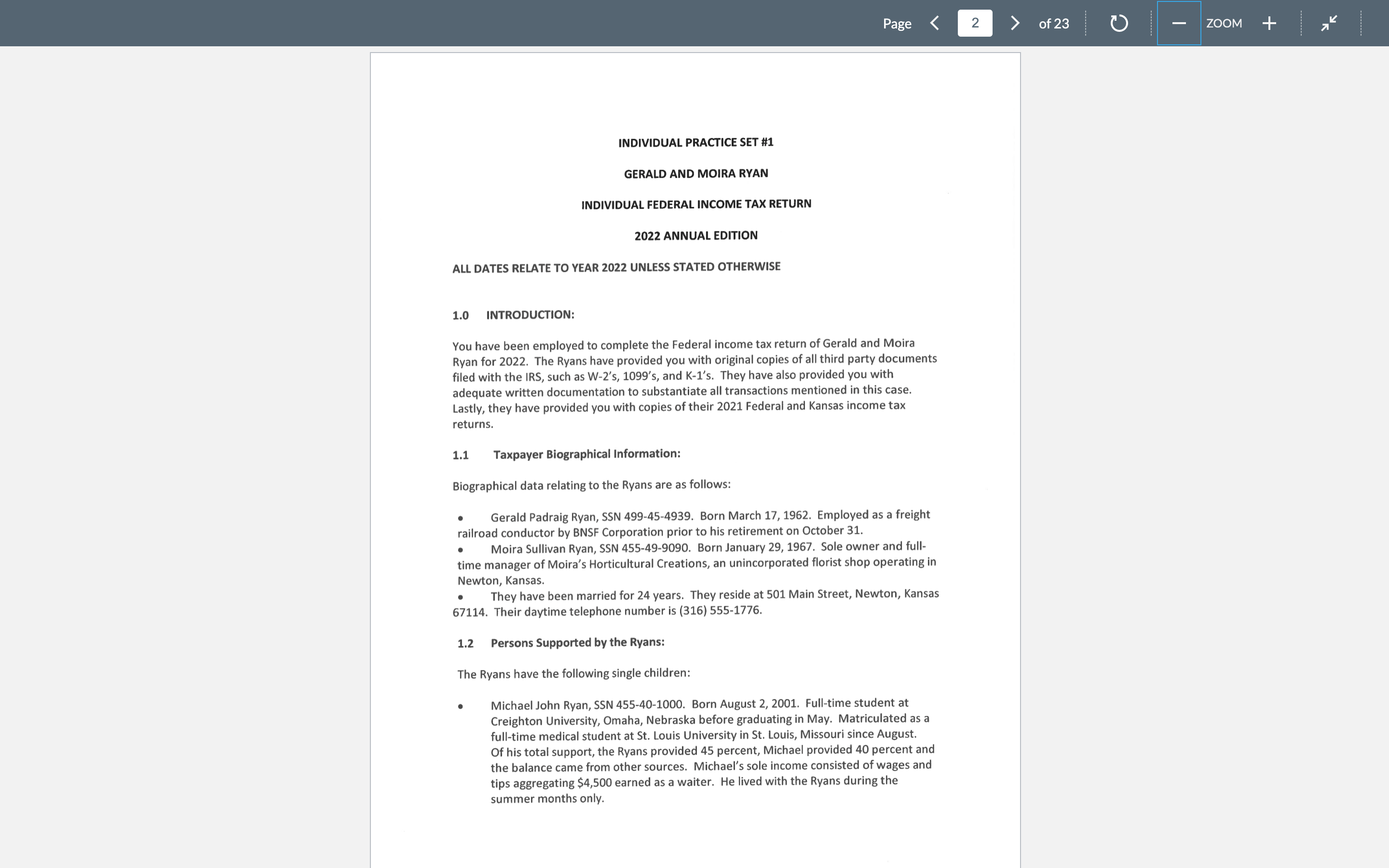

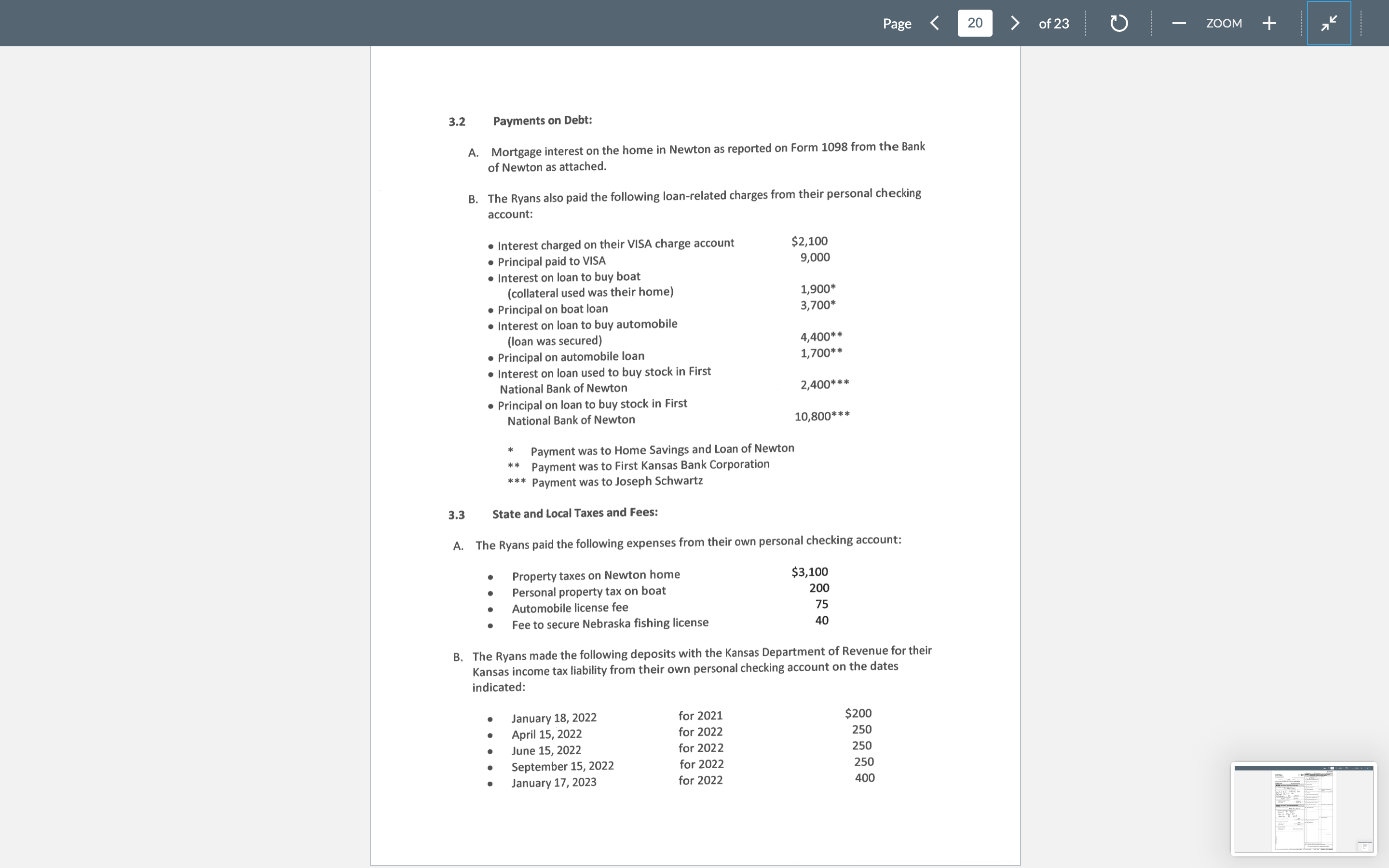

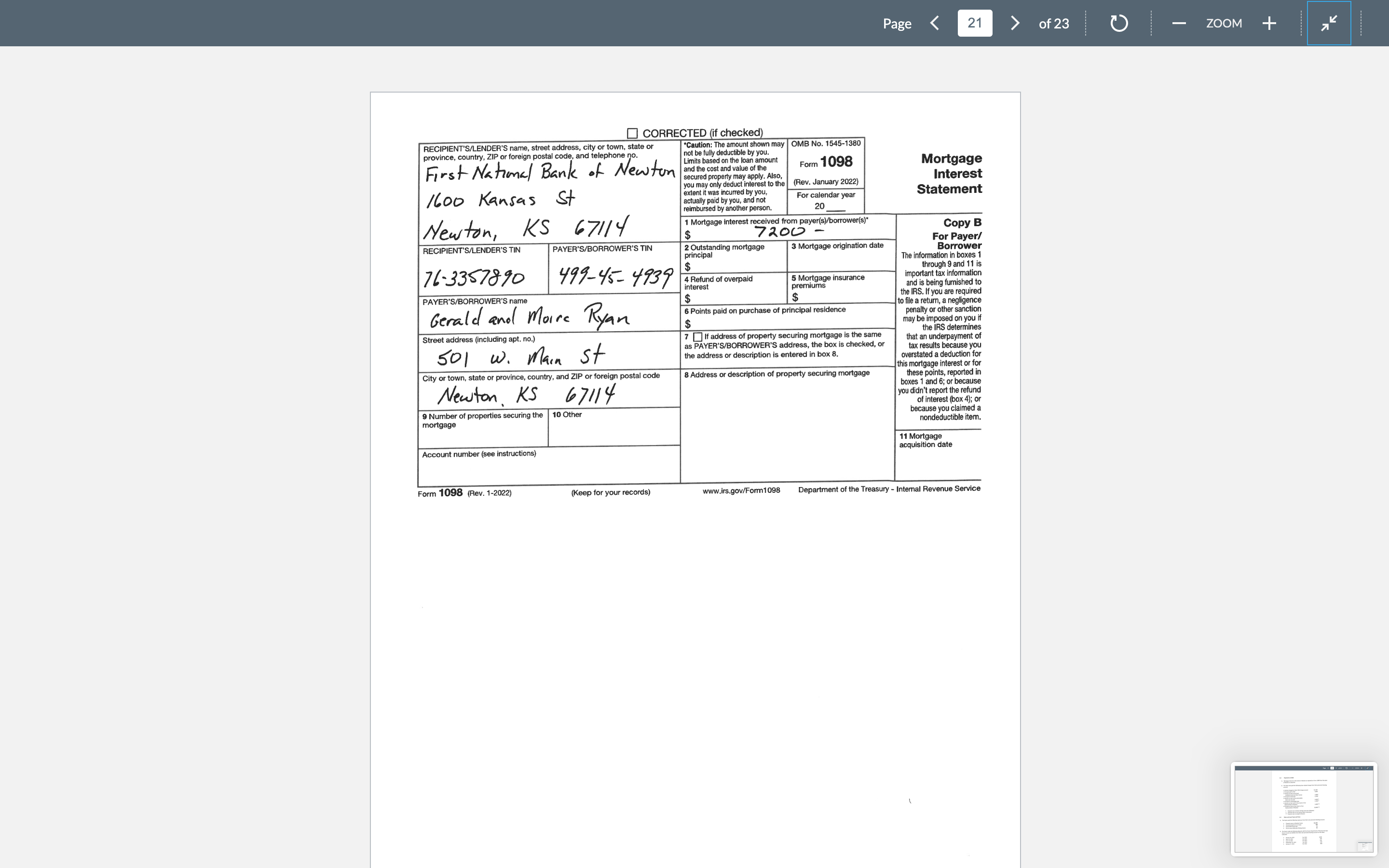

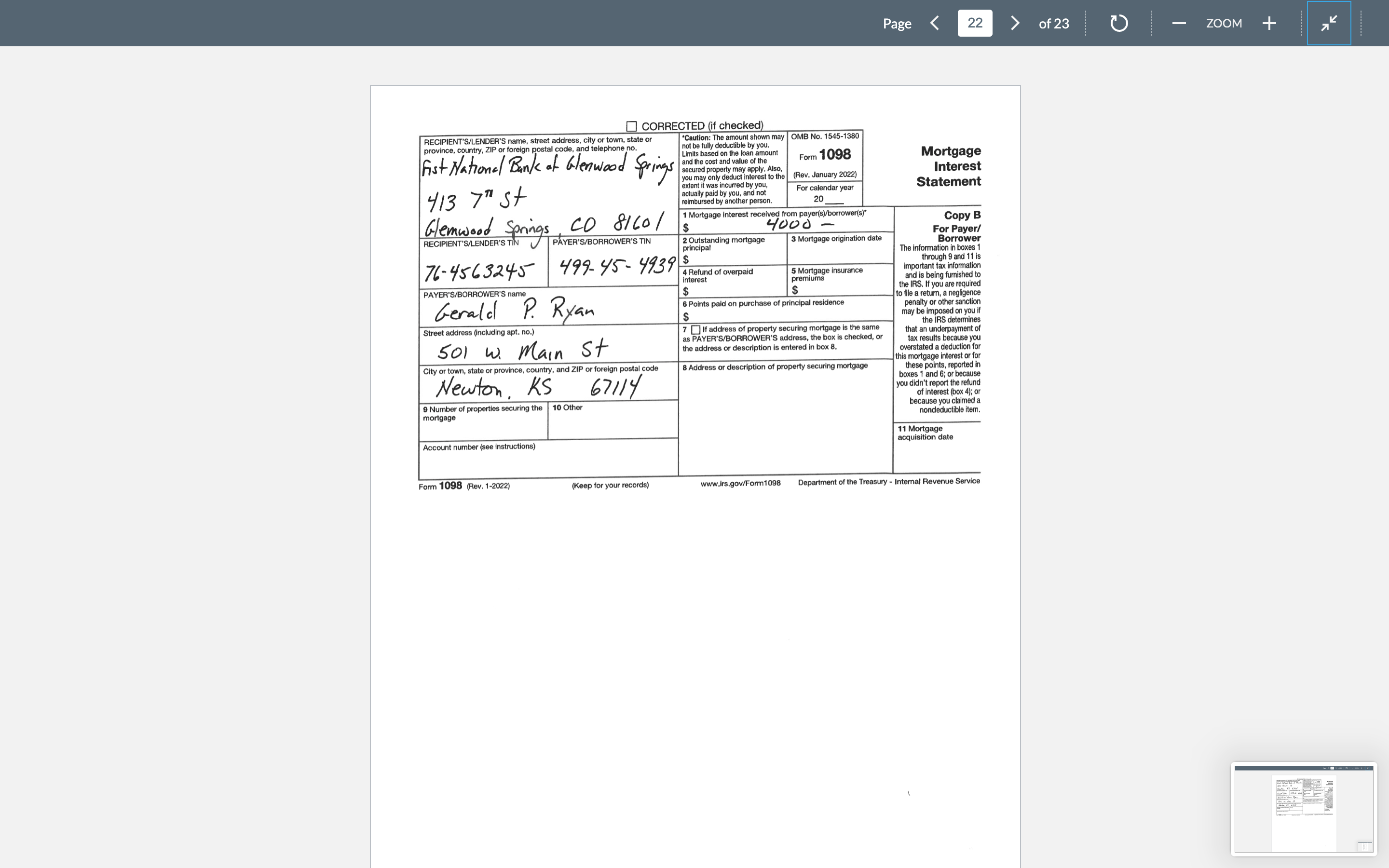

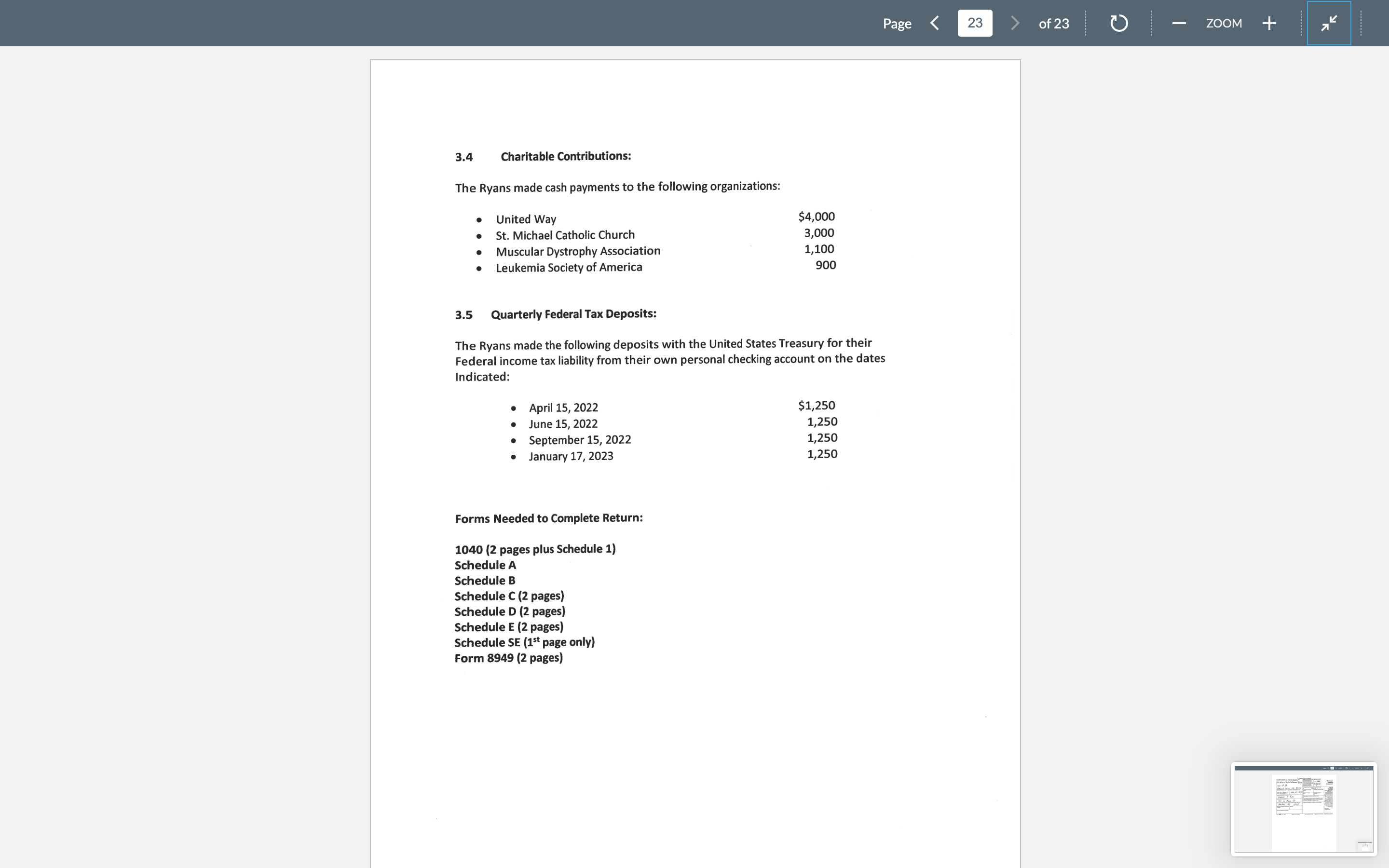

Page of 23 ZOOM + CORRECTED (if checked) RECIPIENT'S/LENDER'S name, street address, city or town, state or Caution: The amount shown may OMB No. 1545-1380 province, country, ZIP or al code, and telephone n y deductible by you. First National Bank of Newton Limits based on the loan amoun and the cost and value of the Form 1098 Mortgage ecured property may apply. you may only deduct interest to the (Rev. January 2022) Interest 1600 Kansas St extent it was incurred by you, actually paid by you, and not For calendar year Statement reimbursed by another person 20 Newton, KS 67114 1 Mortgage interest received from payer(s)/borrower(s 7200 Copy B For Payer/ RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN 2 Outstanding mortgage 3 Mortgage origination date Borrower principal The information in boxes 1 $ through 9 and 11 is 71-33578 90 499-45- 4939 4 Refund of overpaid 5 Mortgage important tax information interest premiums and is being furnished to PAYER'S/BORROWER'S name the IRS. If you are required $ to file a return, a negligence Gerald and Morre Ryan 6 Points paid on purchase of principal residence penalty or other sanction may be imposed on you if the IRS determine Street address (including apt. no.) 7 if address of property securing mortgage is the same s PAYER'S/BORROWER'S address, the box is checked, or that an underpayment 501 W. Main st tax results because yo the address or description is entered in box 8. overstated a deduction f is mortgage interest or for City or town, state or province, country, and ZIP or foreign postal code 8 Address or description of property securing mortgage these points, reported in boxes 1 and 6; or because Newton KS 67114 you didn't report the refund of interest (box 4); or 9 Number of properties securing the 10 Other because you claimed a mortgage nondeductible item. 11 Mortgage Account number (see instructions) acquisition date Form 1098 (Rev. 1-2022) Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue ServicePage 22 of 23 ZOOM + CORRECTED (if checked) RECIPIENT'S/LENDER'S name, street address, city or town, state or Caution: The amount shown may OMB No. 1545-1380 province, country, ZIP or foreign postal code, and telephone no. it be fully deductible by you. Fist National Bank of Glenwood Springs Limits based on the loan am and value of the Form 1098 Mortgage Interest you may only deduct interest to the (Rev. January 2022) 413 7 " st paid by you, and not For calendar year Statement reimbursed by another person 20 Glenwood Springs CO 8160 1 1 Mortgage interest received from payer(s)/borrower(s)" 4000 - Copy B RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN For Payer/ 2 Outstanding mortgage 3 Mortgage origination date principal Borrower The information in boxes ! 76- 4563245 499- 45- 4939 5 through 9 and 17 IS 4 Refund of overpaid 5 Mortgage insurance ortant tax information interest premiums and is being PAYER'S/BORROWER'S name $ the IRS. If you are required Gerald P. Ryan o file a return, a negligence 6 Points paid on purchase of principal residence or other sanction $ may be imposed on you if Street address (including apt. no.) 7 if address of property securing mortgage is the same the IRS dete as PAYER'S/BORROWER'S address, the box is checked, or that an underpayment 501 W. Main St tax results because you the address or description is entered in box 8. overstated a deduction for is mortgage interest or for City or town, state or province, country, and ZIP or foreign postal code 8 Address or description of property securing mortgage these points, reported in Newton. KS 67114 boxes 1 and 6; or because you didn't report the refund of interest (box 4); or 9 Number of properties securing the 10 Other because you claimed a mortgage nondeductible item. 11 Mortgage Account number (see instructions) acquisition date Form 1098 (Rev. 1-2022) Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue ServicePage 23 of 23 ZOOM + 3.4 Charitable Contributions: The Ryans made cash payments to the following organizations: United Way $4,000 . St. Michael Catholic Church 3,000 . Muscular Dystrophy Association 1,100 Leukemia Society of America 900 3.5 Quarterly Federal Tax Deposits: The Ryans made the following deposits with the United States Treasury for their Federal income tax liability from their own personal checking account on the dates Indicated: April 15, 2022 $1,250 June 15, 2022 1,250 . September 15, 2022 1,250 January 17, 2023 1,250 Forms Needed to Complete Return: 1040 (2 pages plus Schedule 1) Schedule A Schedule B Schedule C (2 pages) Schedule D (2 pages) Schedule E (2 pages) Schedule SE (1st page only) Form 8949 (2 pagesPage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts