Question: Can you give the correct answer and calculation process? Thanks! Problem 6-1 (Algo) Upfront fees; performance obligations [ LO6-4, 6-5] -it & Slim (F&S) is

![6-1 (Algo) Upfront fees; performance obligations [ LO6-4, 6-5] -it \& Slim](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e403d17b440_21766e403d1040bb.jpg)

Can you give the correct answer and calculation process? Thanks!

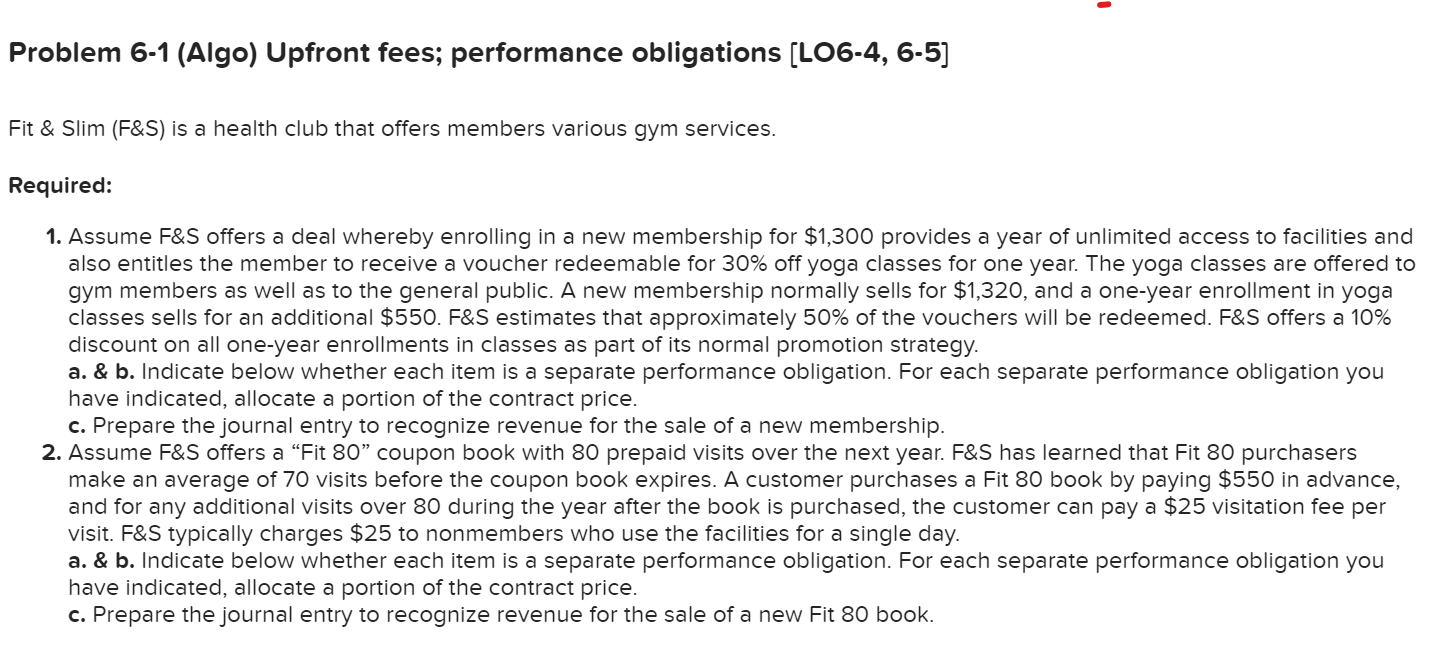

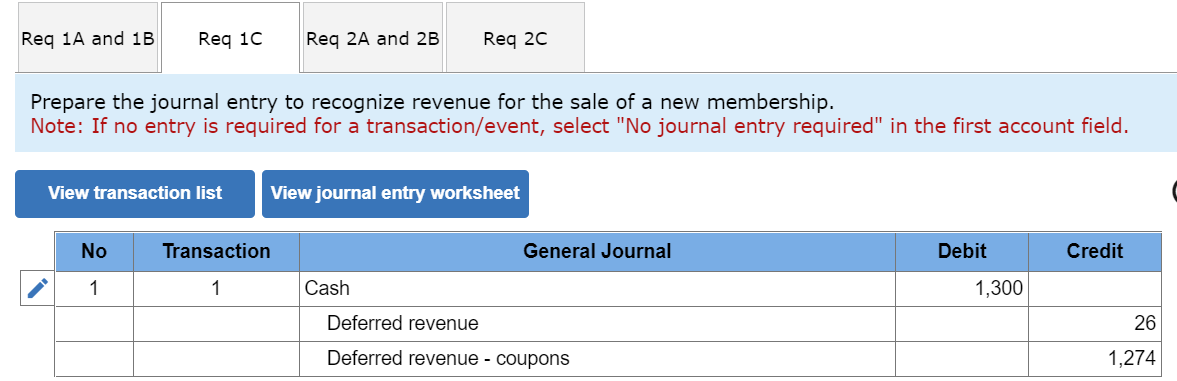

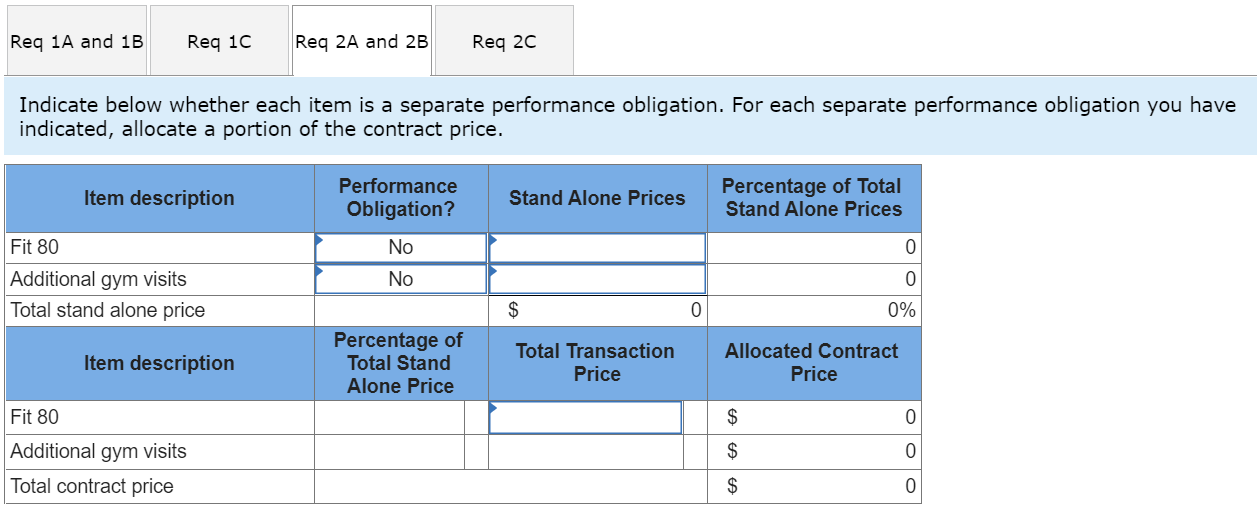

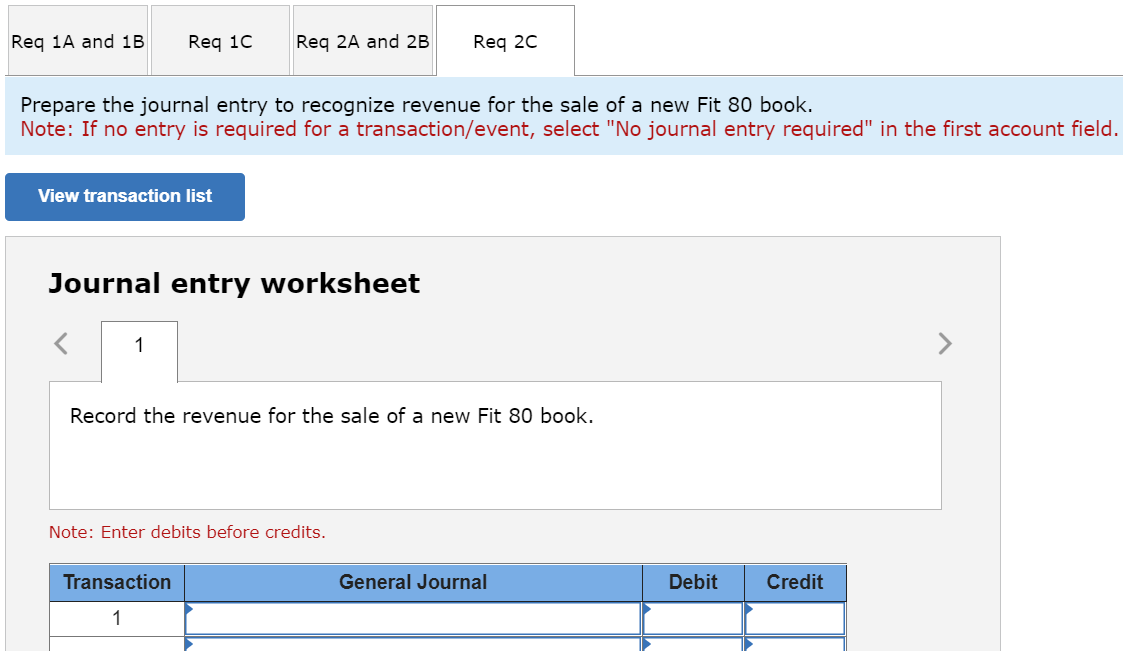

Problem 6-1 (Algo) Upfront fees; performance obligations [ LO6-4, 6-5] -it \& Slim (F\&S) is a health club that offers members various gym services. Required: 1. Assume F\&S offers a deal whereby enrolling in a new membership for $1,300 provides a year of unlimited access to facilities and also entitles the member to receive a voucher redeemable for 30% off yoga classes for one year. The yoga classes are offered to gym members as well as to the general public. A new membership normally sells for $1,320, and a one-year enrollment in yoga classes sells for an additional $550. F\&S estimates that approximately 50% of the vouchers will be redeemed. F\&S offers a 10% discount on all one-year enrollments in classes as part of its normal promotion strategy. a. \& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new membership. 2. Assume F\&S offers a "Fit 80 " coupon book with 80 prepaid visits over the next year. F\&S has learned that Fit 80 purchasers make an average of 70 visits before the coupon book expires. A customer purchases a Fit 80 book by paying $550 in advance, and for any additional visits over 80 during the year after the book is purchased, the customer can pay a $25 visitation fee per visit. F\&S typically charges $25 to nonmembers who use the facilities for a single day. a. \& b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new Fit 80 book. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. Prepare the journal entry to recognize revenue for the sale of a new membership. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. Prepare the journal entry to recognize revenue for the sale of a new Fit 80 book. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field Journal entry worksheet Record the revenue for the sale of a new Fit 80 book. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts