Question: can you go step by step place, to help me understand? Required information E8-7 (Algo) Recording Depreciation and Repairs (Straight-Line Depreciation) LO8-2, 8-3 [The following

can you go step by step place, to help me understand?

![following information applies to the questions displayed below.] Hulme Company operates a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1f3706ddcb_52766f1f36fccef8.jpg)

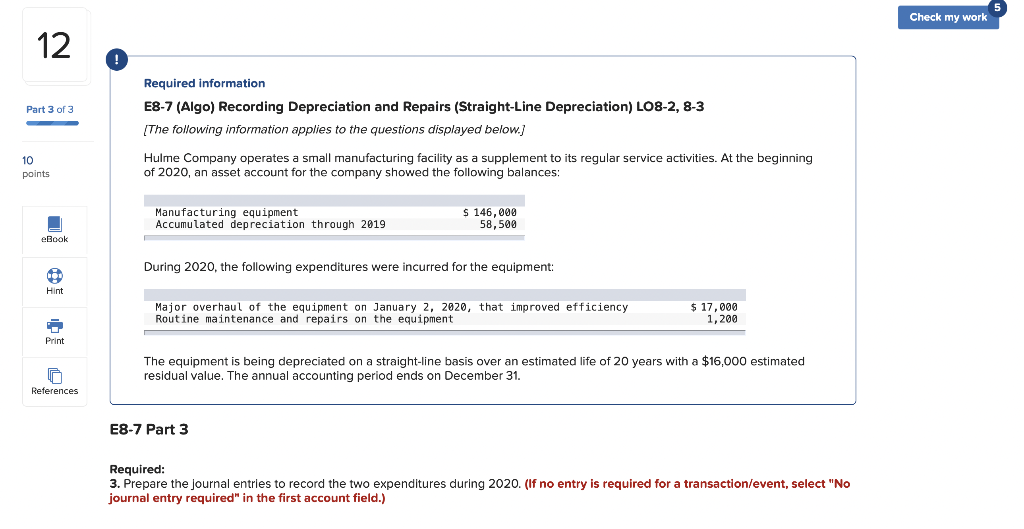

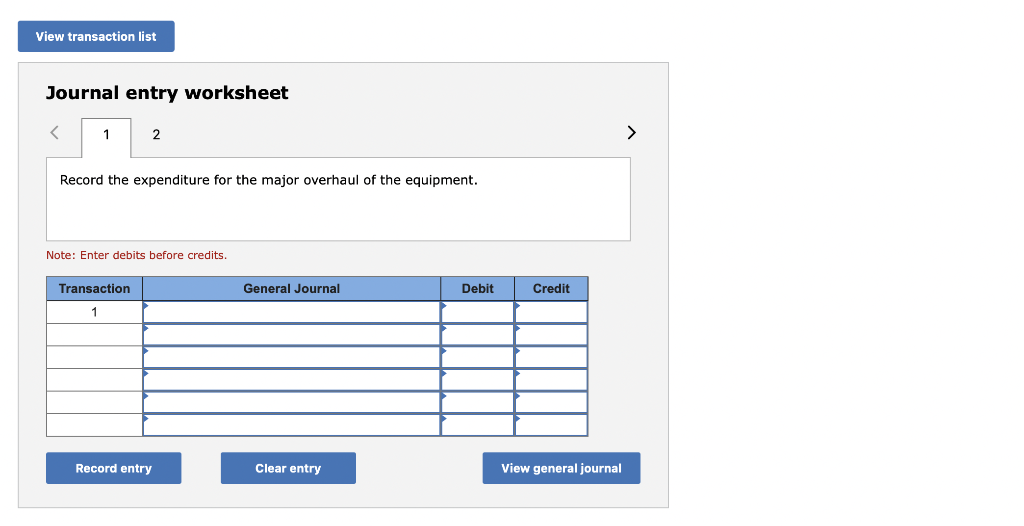

Required information E8-7 (Algo) Recording Depreciation and Repairs (Straight-Line Depreciation) LO8-2, 8-3 [The following information applies to the questions displayed below.] Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2020 , an asset account for the company showed the following balances: During 2020, the following expenditures were incurred for the equipment: The equipment is being depreciated on a straight-line basis over an estimated life of 20 years with a $16,000 estimated residual value. The annual accounting period ends on December 31. E8-7 Part 3 Required: 3. Prepare the journal entries to record the two expenditures during 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the expenditure for the major overhaul of the equipment. Note: Enter debits before credits. Journal entry worksheet Record the expenditure for routine maintenance and repairs on the equipment. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts