Question: can you guys help me with question 4?? Notes to the financial statements: 1. Advertising is committed to at the beginning of the period by

can you guys help me with question 4??

can you guys help me with question 4??

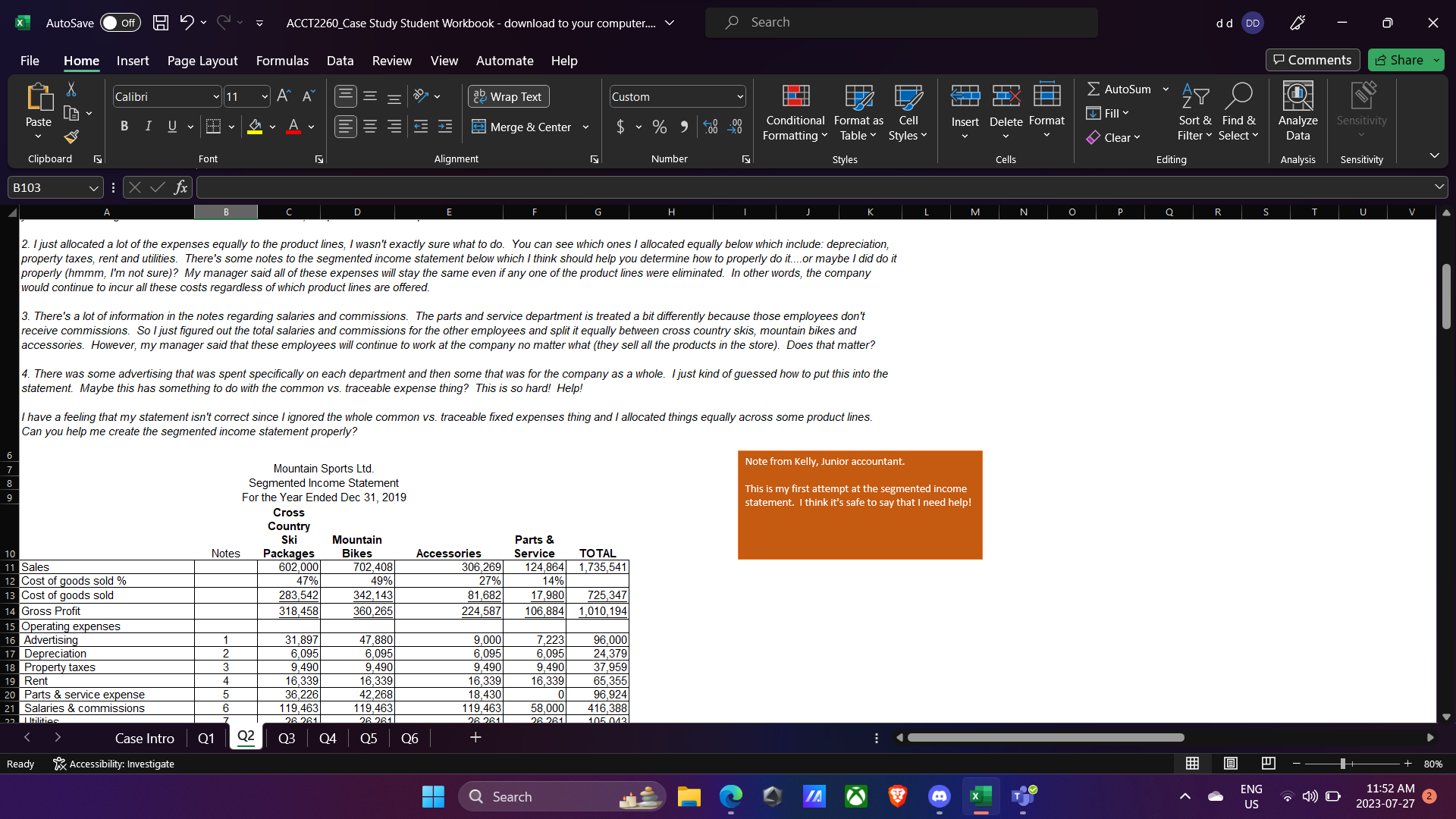

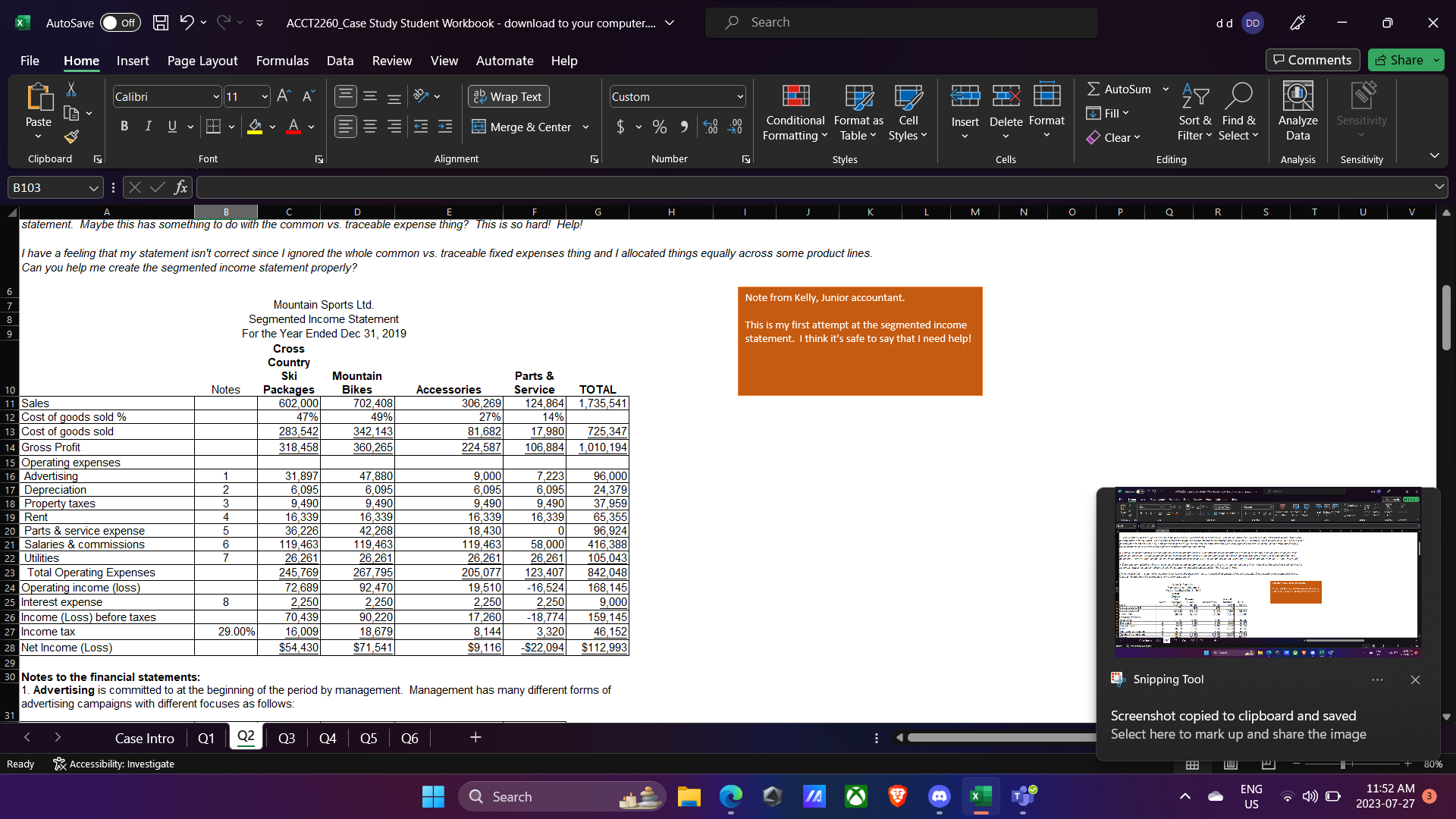

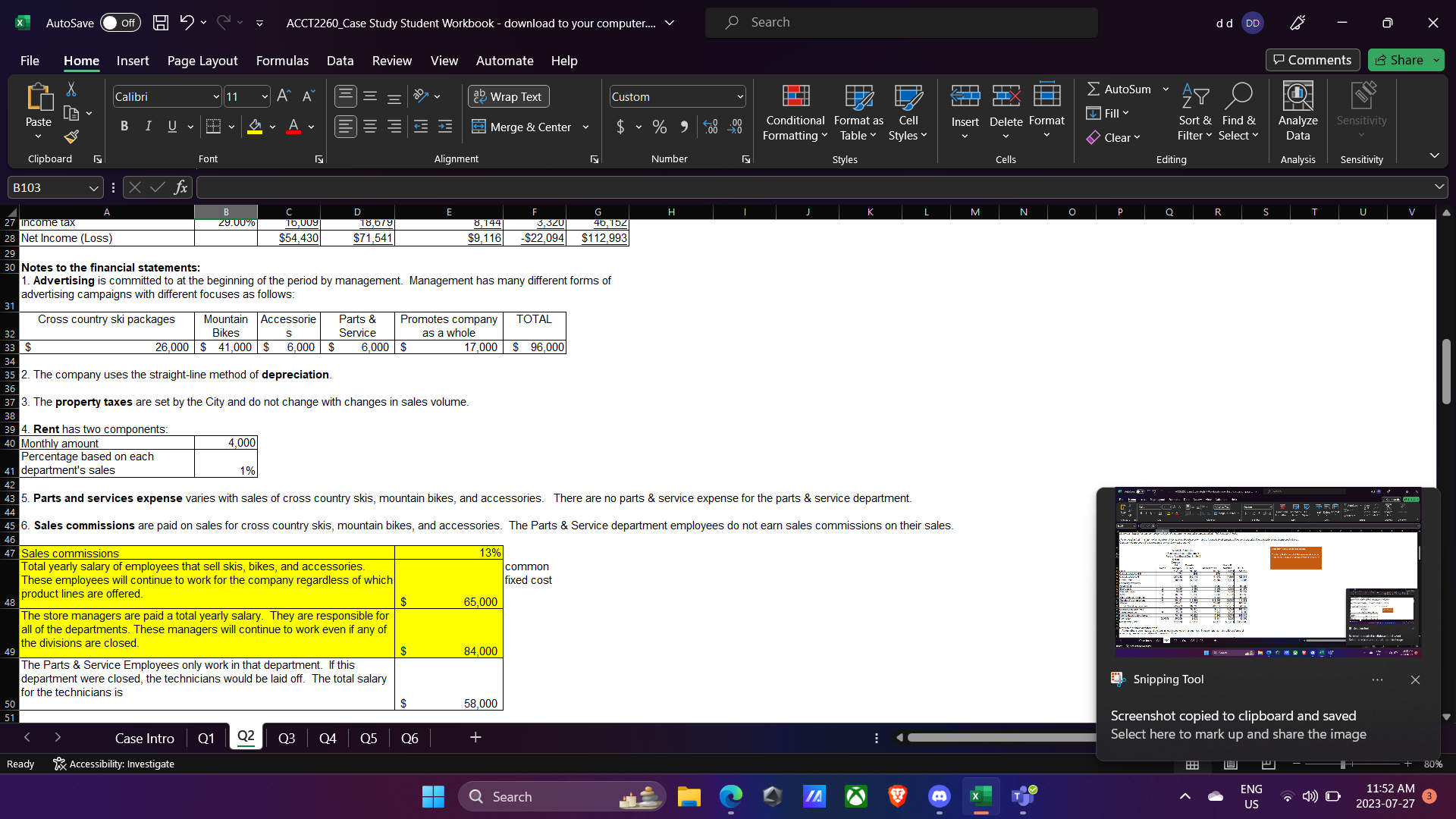

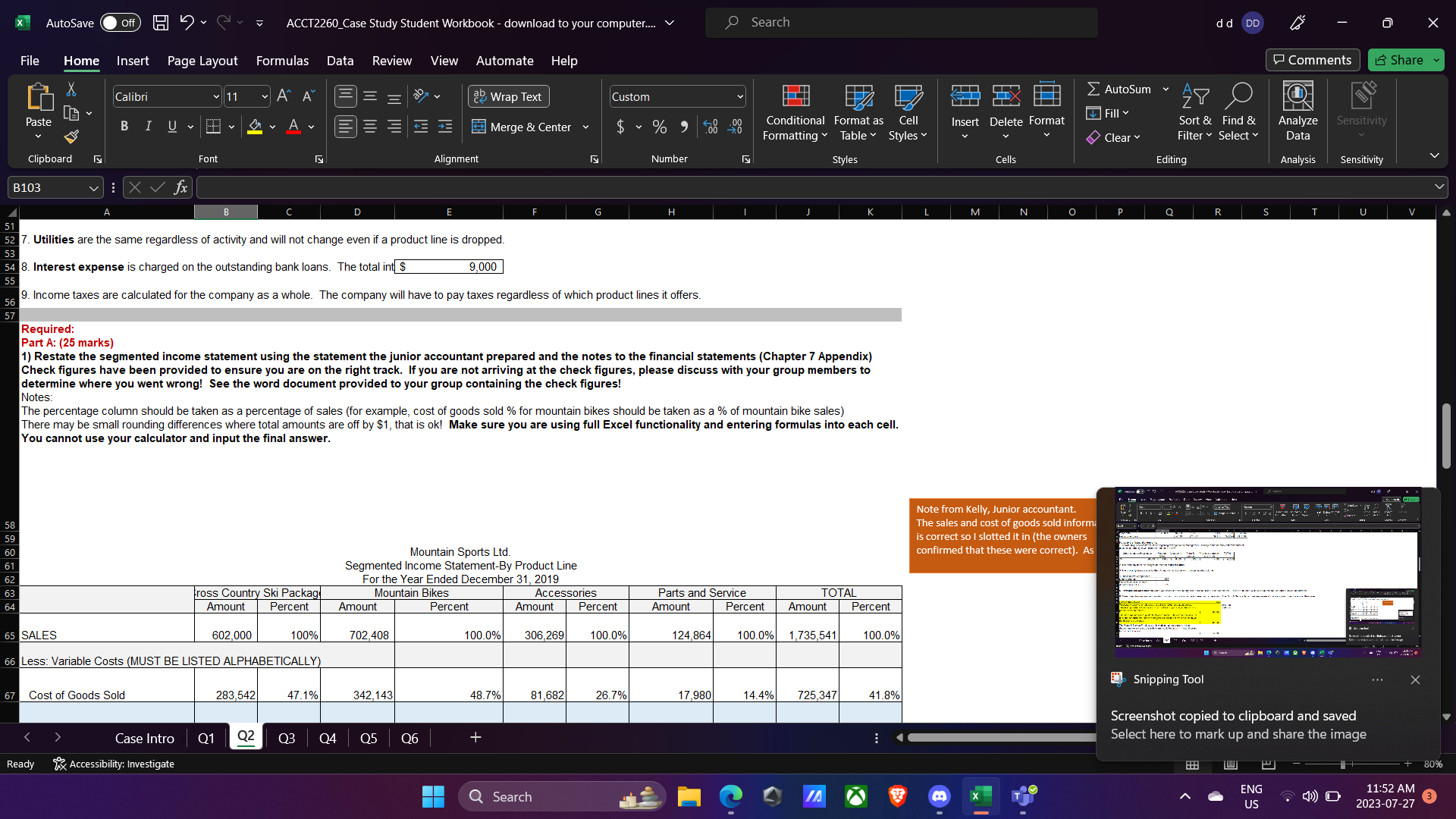

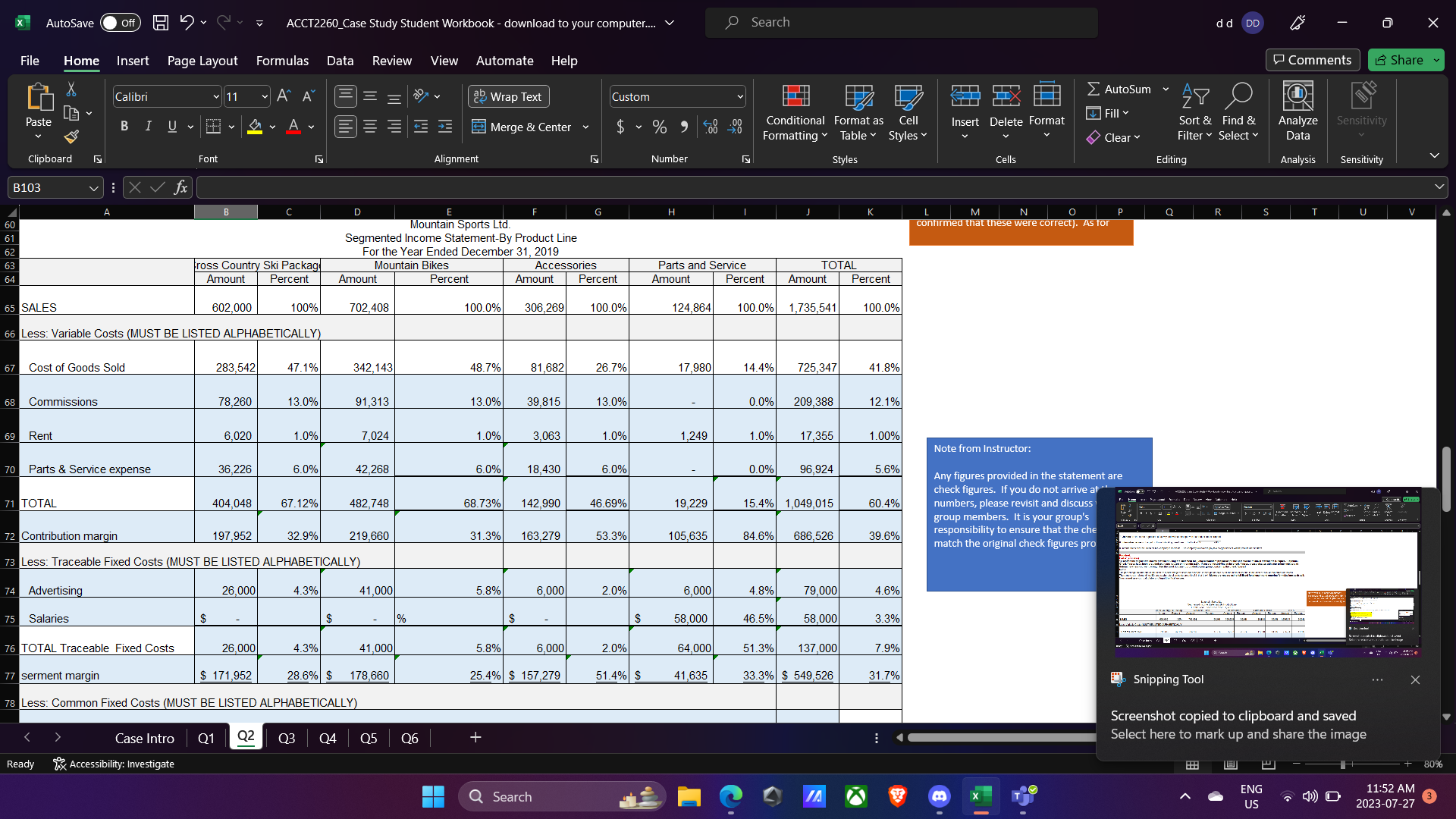

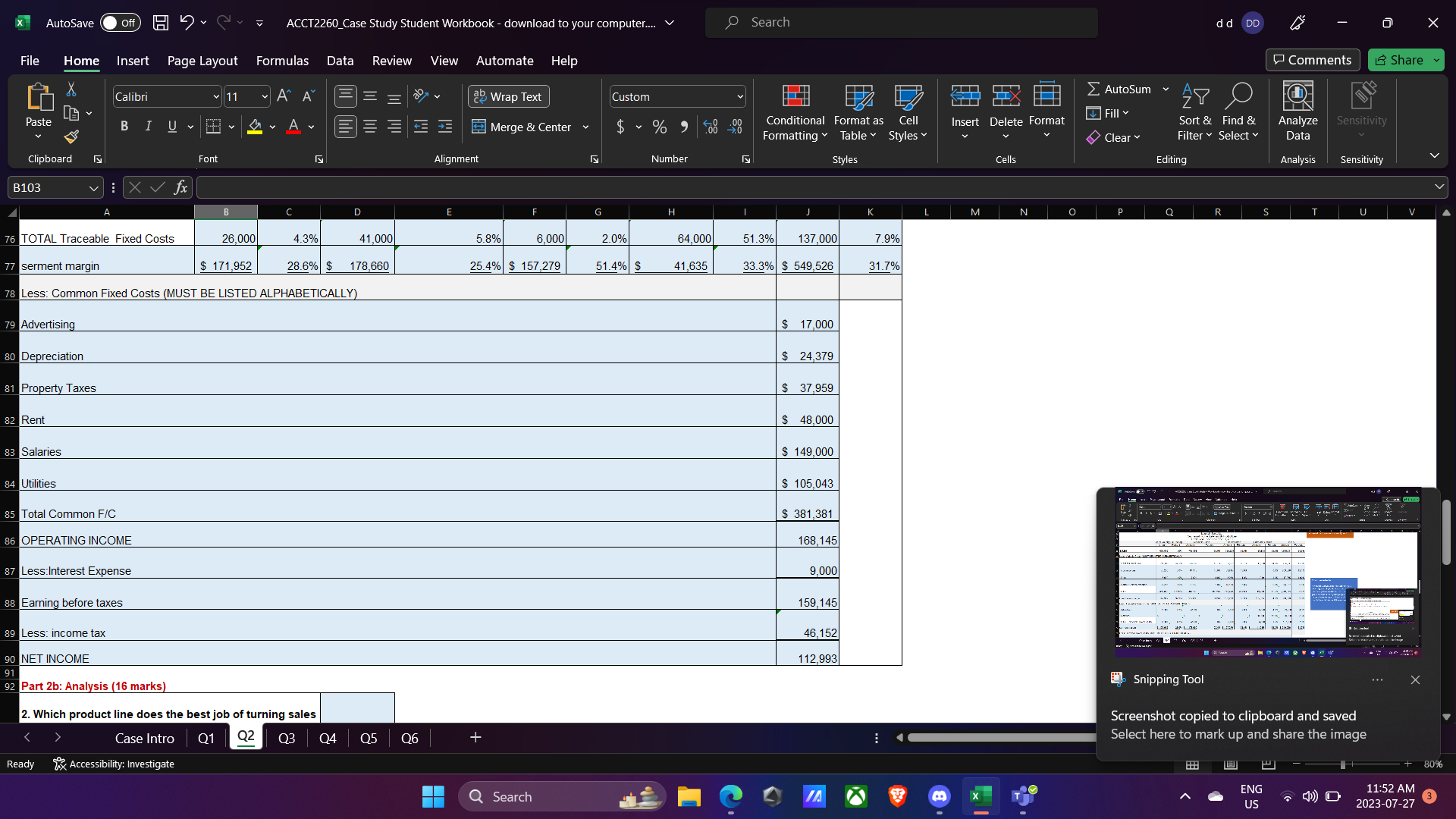

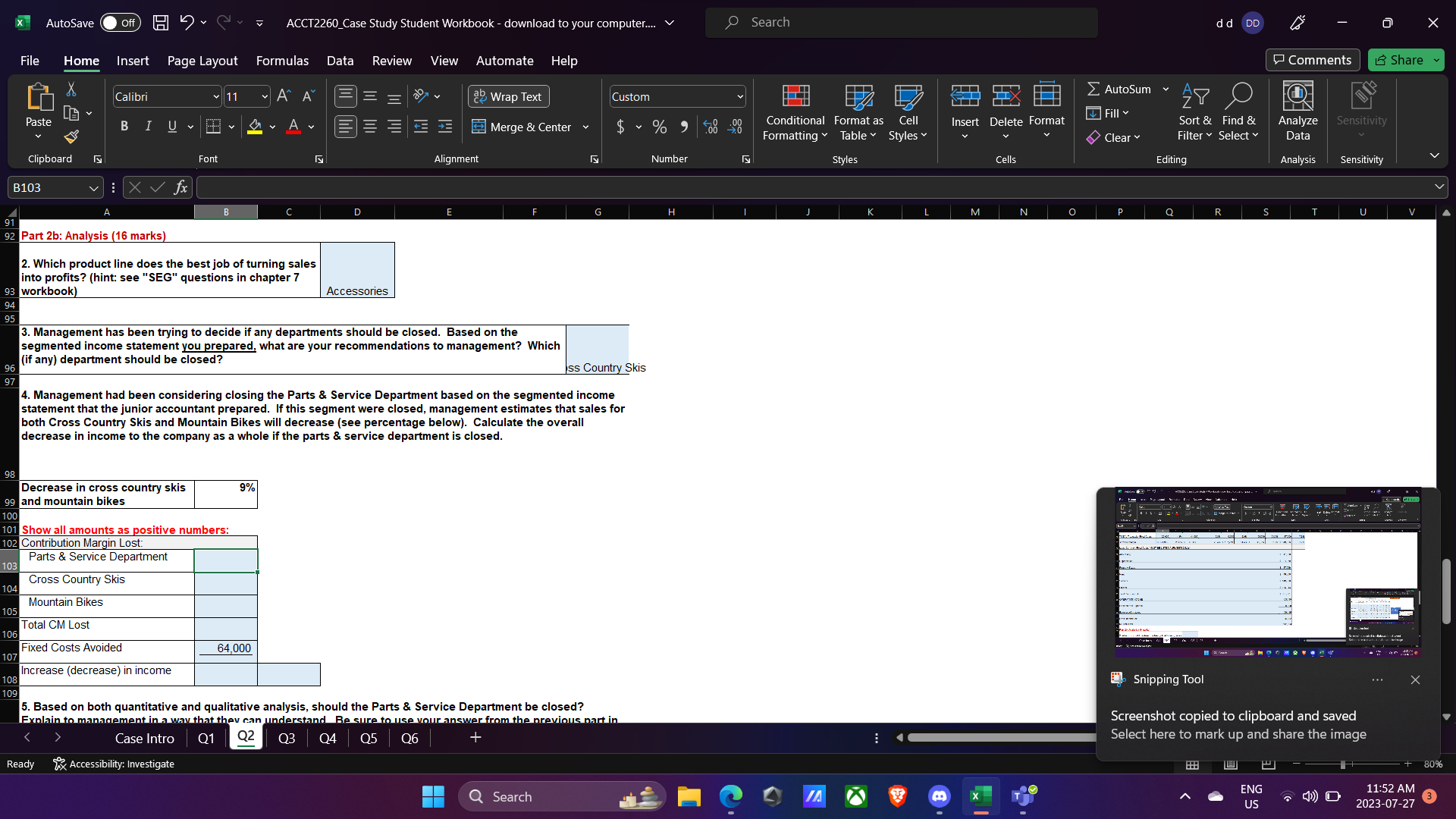

Notes to the financial statements: 1. Advertising is committed to at the beginning of the period by management. Management has many different forms of advertising campaigns with different focuses as follows: 2. The company uses the straight-line method of depreciation. 3. The property taxes are set by the City and do not change with changes in sales volume. 5. Parts and services expense varies with sales of cross country skis, mountain bikes, and accessories. There are no parts \& service expense for the parts \& service department. 6. Sales commissions are paid on sales for cross country skis, mountain bikes, and accessories. The Parts \& Service department employees do not earn sales commissions on their sales. I have a feeling that my statement isn't correct since I ignored the whole common vs. traceable fixed expenses thing and I allocated things equally across some product lines. Can you help me create the segmented income statement properly? Note from Kelly, Junior accountant. This is my first attempt at the segmented income statement. I think it's safe to say that I need help! Notes to the financial statements: 1. Advertising is committed to at the beginning of the period by management. Management has many different forms of advertising campaigns with different focuses as follows: 2. I just allocated a lot of the expenses equally to the product lines, I wasn't exactly sure what to do. You can see which ones I allocated equally below which include: depreciation, property taxes, rent and utilities. There's some notes to the segmented income statement below which I think should help you determine how to properly do it...or maybe I did do it properly (hmmm, I'm not sure)? My manager said all of these expenses will stay the same even if any one of the product lines were eliminated. In other words, the company would continue to incur all these costs regardless of which product lines are offered. 3. There's a lot of information in the notes regarding salaries and commissions. The parts and service department is treated a bit differently because those employees don't receive commissions. So I just figured out the total salaries and commissions for the other employees and split it equally between cross country skis, mountain bikes and accessories. However, my manager said that these employees will continue to work at the company no matter what (they sell all the products in the store). Does that matter? 4. There was some advertising that was spent specifically on each department and then some that was for the company as a whole. I just kind of guessed how to put this into the statement. Maybe this has something to do with the common vs. traceable expense thing? This is so hard! Help! I have a feeling that my statement isn't correct since I ignored the whole common vs. traceable fixed expenses thing and I allocated things equally across some product lines. Can you help me create the segmented income statement properly? Note from Kelly, Junior accountant. This is my first attempt at the segmented income statement. I think it's safe to say that I need help! 7. Utilities are the same regardless of activity and will not change even if a product line is dropped. 9. Income taxes are calculated for the company as a whole. The company will have to pay taxes regardless of which product lines it offers. Required: Part A: (25 marks) 1) Restate the segmented income statement using the statement the junior accountant prepared and the notes to the financial statements (Chapter 7 Appendix) Check figures have been provided to ensure you are on the right track. If you are not arriving at the check figures, please discuss with your group members to determine where you went wrong! See the word document provided to your group containing the check figures! Notes: The percentage column should be taken as a percentage of sales (for example, cost of goods sold \% for mountain bikes should be taken as a \% of mountain bike sales) There may be small rounding differences where total amounts are off by $1, that is ok! Make sure you are using full Excel functionality and entering formulas into each cell. You cannot use your calculator and input the final answer. Mountain Sports Ltd. Segmented Income Statement-By Product Line Note from Kelly, Junior accountant. The sales and cost of goods sold inform is correct so I slotted it in (the owners confirmed that these were correct). As 2. Which product line does the best job of turning sales into profits? (hint: see "SEG" questions in chapter 7 workbook) Accessories 3. Management has been trying to decide if any departments should be closed. Based on the segmented income statement you prepared, what are your recommendations to management? Which (if any) department should be closed? 4. Management had been considering closing the Parts \& Service Department based on the segmented income statement that the junior accountant prepared. If this segment were closed, management estimates that sales for both Cross Country Skis and Mountain Bikes will decrease (see percentage below). Calculate the overall decrease in income to the company as a whole if the parts \& service department is closed. 5. Based on both quantitative and qualitative analysis, should the Parts \& Service Department be closed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts