Question: Can you help answer these? 5. Are both methods (i.e. NPV and IRR) good in these situations? What would you do? According to your opinion,

Can you help answer these?

5. Are both methods (i.e. NPV and IRR) good in these situations? What would you do? According to your opinion, which project is better for his company?

6. Does IRR always choose the same project whether a firm has a high cost of capital or low cost of capital?

7. How about NPV? Does NPV always choose the same project whether a firm has a high cost of capital or low cost of capital?

8. Michael finds his results confusing so he decides to prepare NPV Profiles for the two projects. How will the NPV profiles look like?

9. According to the NPV Profiles of the two projects, at what discount rate are these two projects equivalent?

10. Over what range of discount rates should we choose Project A? Project B?

11. If they were independent projects rather than mutually exclusive projects, what would we do?

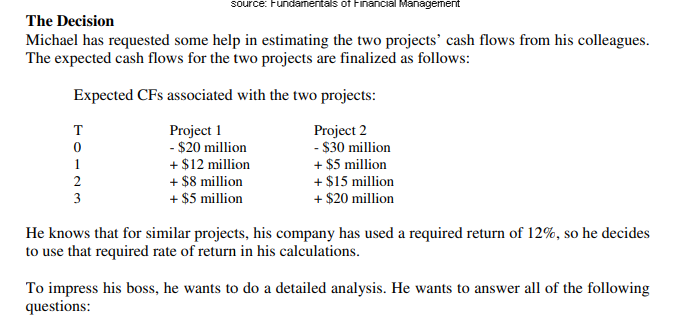

source: Fundamentals of Financial Management The Decision Michael has requested some help in estimating the two projects' cash flows from his colleagues. The expected cash flows for the two projects are finalized as follows: Expected CFs associated with the two projects: 0 1 2 3 Project 1 - $20 million + $12 million + $8 million + $5 million Project 2 - $30 million + $5 million + $15 million + $20 million He knows that for similar projects, his company has used a required return of 12%, so he decides to use that required rate of return in his calculations. To impress his boss, he wants to do a detailed analysis. He wants to answer all of the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts