Question: can you help in the second part B CHAPTER 3: WORKING WITH FINANCIAL STATEMENTS DUE ON 5/12/2020 10 POINTS Assignment. Per cont r e ital

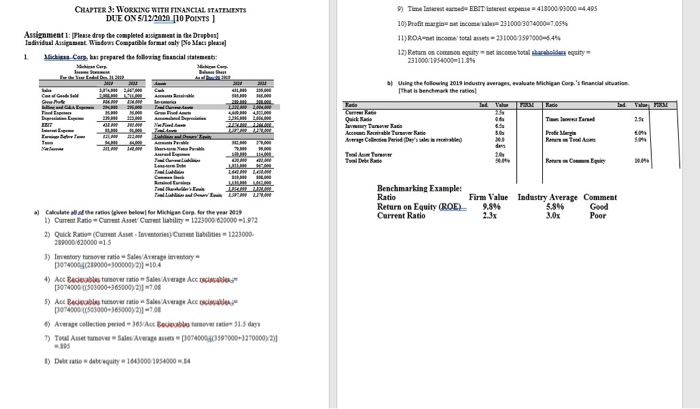

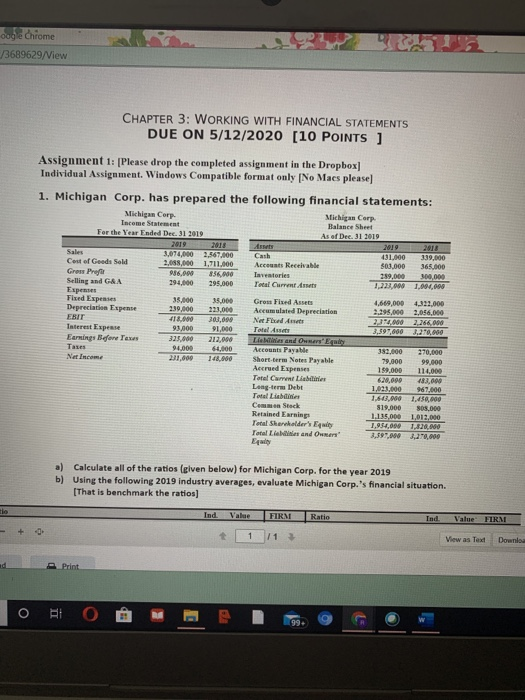

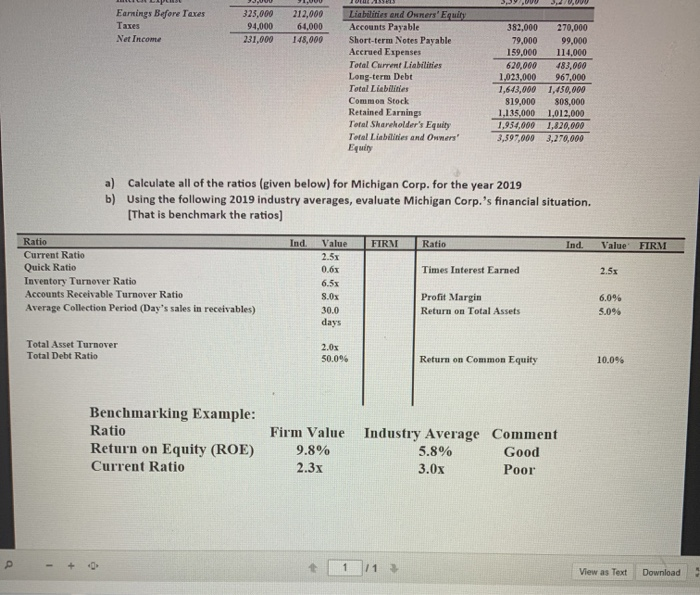

CHAPTER 3: WORKING WITH FINANCIAL STATEMENTS DUE ON 5/12/2020 10 POINTS Assignment. Per cont r e ital at Nata r aalai Pasip The 10) 48000 9000 495 3 31000000 P DIR Benchmarking Example: Ratio Return on Equity (ROE) Current Ratio Firm Value 9.8% Industry Average Comment 5.896 Good 3.0 Poor * Calculate the risentor M e ter the year 2010 1) Current Ratio Create C i ty 1323000 830000 1.923 3) Quick Ratio (Current A t ore) Current 1223000 239000 630000 15 3) mary tumo r e DO001000000000 -104 4) A Beb e rto Sales Ace 3074000000000169000 700 5) ARA S AAC po40000 30001650000 Avec AB > TASA 0 3200002 D 1) 1 60000 100014 ogle Chrome 3689629/View CHAPTER 3: WORKING WITH FINANCIAL STATEMENTS DUE ON 5/12/2020 [10 POINTS ] Assignment 1: [Please drop the completed assignment in the Dropbox Individual Assignment Windows Compatible format only (No Macs please] 1. Michigan Corp. has prepared the following financial statements: Michigan Corp Balance Sheet As of Dec. 313019 22 Michigan Corp Income Statement For the Year Ended Dec. 31 2019 2019 2011 TOT 15 Cost of Goods Sold 2,083.000 1.711.000 Grow Pre 836.000 Selling and GAA 294.000 295,000 Expenses Fired Expenses 35.000 Depreciatia Eupene Account Receivable Investories Total Current 22.000 .00 4669.000 40.000 Re d Depreciation Ne Fun 91.000 Teterest Expense Earnings ve Texas 90.000 60.000 Lienes and we Accounts Payable Short-term Notes Payable Accred Express Total Care Loger Dube Taal sana C e Stack Retained Earnings Toral Sharbadar Total d e INO 1,937,000 3.39.00 a) Calculate all of the ratios (given below) for Michigan Corp. for the year 2019 b) Using the following 2019 industry averages, evaluate Michigan Corp.'s financial situation (That is benchmark the ratios] View as Text Downlo OLO @MED. Earnings Before Taxes Taxes Net Income 325.000 94,000 231,000 212,000 64,000 148,000 Liabilities and Owners' Equity Accounts Payable Short-term Notes Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity 382,000 79.000 159,000 620,000 1.023.000 1,643,000 819,000 1.135,000 1,954.000 3,597,000 270,000 99,000 110.000 483,000 967,000 1,450,000 808,000 1.012,000 1.820,000 3,270,000 a) Calculate all of the ratios (given below) for Michigan Corp. for the year 2019 b) Using the following 2019 industry averages, evaluate Michigan Corp.'s financial situation. [That is benchmark the ratios) Ind. FIRM Ratio Ind. Value' FIRM Value 23 0.6% Times Interest Earned 2.53 Ratio Current Ratio Quick Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio Average Collection Period (Day's sales in receivables) S.Ox Profit Margin Return on Total Assets 6.0% 5.096 30.0 days Total Asset Turnover Total Debt Ratio 2.0 50.096 Return on Common Equity 10.096 Benchmarking Example: Ratio Return on Equity (ROE) Current Ratio Firm Value 9.8% 2.3x Industry Average Comment 5.8% Good 3.0x Poor View as Text Download

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts