Question: Can you help me answer this question? it is written in two languages firstly Malaysian and then in English. Just read it in English and

Can you help me answer this question?

it is written in two languages firstly Malaysian and then in English. Just read it in English and answer it in English.

Thanks in Advance.

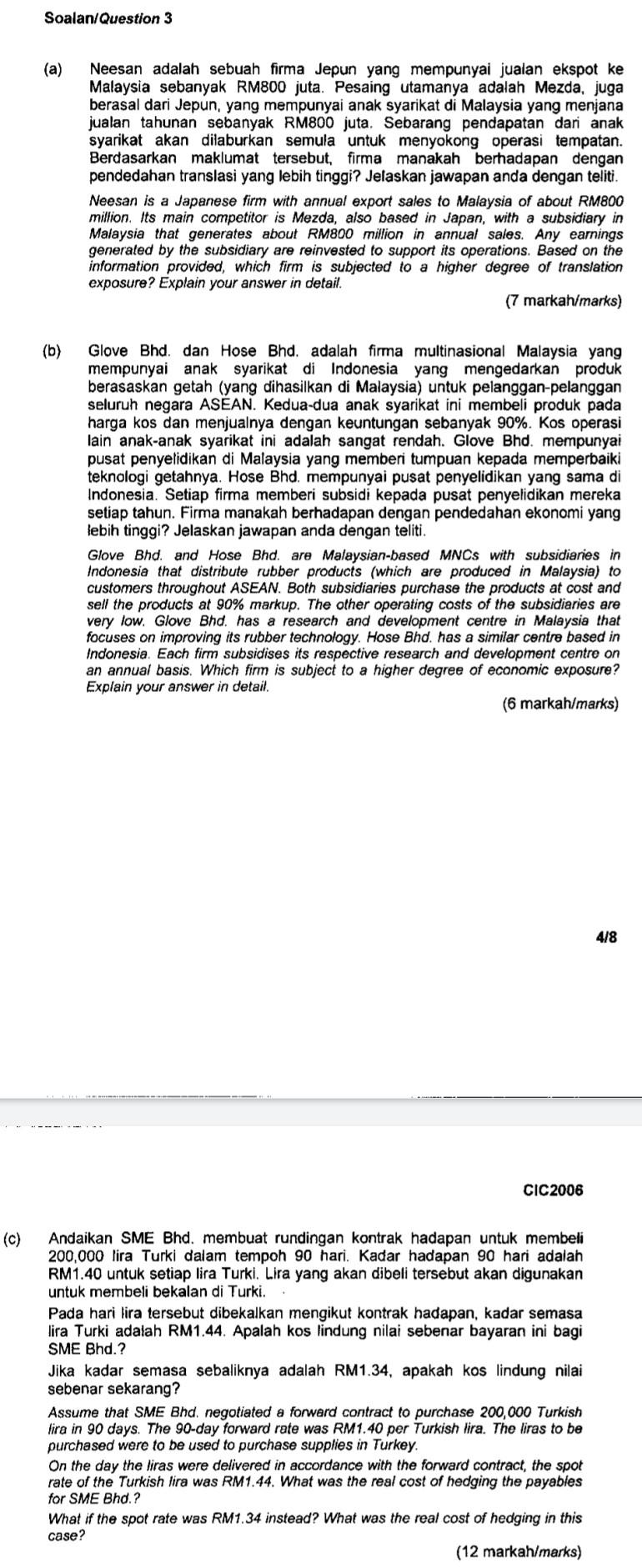

Soalan/Question 3 (a) Neesan adalah sebuah firma Jepun yang mempunyai jualan ekspot ke Malaysia sebanyak RM800 juta. Pesaing utamanya adalah Mezda, juga berasal dari Jepun, yang mempunyai anak syarikat di Malaysia yang menjana jualan tahunan sebanyak RM800 juta. Sebarang pendapatan dari anak syarikat akan dilaburkan semula untuk menyokong operasi tempatan. Berdasarkan maklumat tersebut, firma manakah berhadapan dengan pendedahan translasi yang lebih tinggi? Jelaskan jawapan anda dengan teliti. Neesan is a Japanese firm with annual export sales to Malaysia of about RM800 million. Its main competitor is Mezda, also based in Japan, with a subsidiary in Malaysia that generates about RM800 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations. Based on the information provided, which firm is subjected to a higher degree of translation exposure? Explain your answer in detail. (7 markah/marks) (b) Glove Bhd. dan Hose Bhd. adalah firma multinasional Malaysia yang mempunyai anak syarikat di Indonesia yang mengedarkan produk berasaskan getah (yang dihasilkan di Malaysia) untuk pelanggan-pelanggan seluruh negara ASEAN. Kedua-dua anak syarikat ini membeli produk pada harga kos dan menjualnya dengan keuntungan sebanyak 90%. Kos operasi lain anak-anak syarikat ini adalah sangat rendah. Glove Bhd. mempunyai pusat penyelidikan di Malaysia yang memberi tumpuan kepada memperbaiki teknologi getahnya. Hose Bhd. mempunyai pusat penyelidikan yang sama di Indonesia. Setiap firma memberi subsidi kepada pusat penyelidikan mereka setiap tahun. Firma manakah berhadapan dengan pendedahan ekonomi yang lebih tinggi? Jelaskan jawapan anda dengan teliti. Glove Bhd. and Hose Bhd. are Malaysian-based MNCs with subsidiaries in Indonesia that distribute rubber products (which are produced in Malaysia) to customers throughout ASEAN. Both subsidiaries purchase the products at cost and sell the products at 90% markup. The other operating costs of the subsidiaries are very low. Glove Bhd. has a research and development centre in Malaysia that focuses on improving its rubber technology. Hose Bhd. has a similar centre based in Indonesia. Each firm subsidises its respective research and development centre on an annual basis. Which firm is subject to a higher degree of economic exposure? Explain your answer in detail. (6 markah/marks) 4/8 CIC2006 (c) Andaikan SME Bhd. membuat rundingan kontrak hadapan untuk membeli 200,000 lira Turki dalam tempoh 90 hari. Kadar hadapan 90 hari adalah RM1.40 untuk setiap lira Turki. Lira yang akan dibeli tersebut akan digunakan untuk membeli bekalan di Turki. Pada hari lira tersebut dibekalkan mengikut kontrak hadapan, kadar semasa lira Turki adalah RM1.44. Apalah kos lindung nilai sebenar bayaran ini bagi SME Bhd.? Jika kadar semasa sebaliknya adalah RM1.34, apakah kos lindung nilai sebenar sekarang? Assume that SME Bhd. negotiated a forward contract to purchase 200,000 Turkish lira in 90 days. The 90-day forward rate was RM1.40 per Turkish lira. The liras to be purchased were to be used to purchase supplies in Turkey. On the day the liras were delivered in accordance with the forward contract, the spot rate of the Turkish lira was RM1.44. What was the real cost of hedging the payables for SME Bhd.? What if the spot rate was RM1.34 instead? What was the real cost of hedging in this case? (12 markah/marks) Soalan/Question 3 (a) Neesan adalah sebuah firma Jepun yang mempunyai jualan ekspot ke Malaysia sebanyak RM800 juta. Pesaing utamanya adalah Mezda, juga berasal dari Jepun, yang mempunyai anak syarikat di Malaysia yang menjana jualan tahunan sebanyak RM800 juta. Sebarang pendapatan dari anak syarikat akan dilaburkan semula untuk menyokong operasi tempatan. Berdasarkan maklumat tersebut, firma manakah berhadapan dengan pendedahan translasi yang lebih tinggi? Jelaskan jawapan anda dengan teliti. Neesan is a Japanese firm with annual export sales to Malaysia of about RM800 million. Its main competitor is Mezda, also based in Japan, with a subsidiary in Malaysia that generates about RM800 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations. Based on the information provided, which firm is subjected to a higher degree of translation exposure? Explain your answer in detail. (7 markah/marks) (b) Glove Bhd. dan Hose Bhd. adalah firma multinasional Malaysia yang mempunyai anak syarikat di Indonesia yang mengedarkan produk berasaskan getah (yang dihasilkan di Malaysia) untuk pelanggan-pelanggan seluruh negara ASEAN. Kedua-dua anak syarikat ini membeli produk pada harga kos dan menjualnya dengan keuntungan sebanyak 90%. Kos operasi lain anak-anak syarikat ini adalah sangat rendah. Glove Bhd. mempunyai pusat penyelidikan di Malaysia yang memberi tumpuan kepada memperbaiki teknologi getahnya. Hose Bhd. mempunyai pusat penyelidikan yang sama di Indonesia. Setiap firma memberi subsidi kepada pusat penyelidikan mereka setiap tahun. Firma manakah berhadapan dengan pendedahan ekonomi yang lebih tinggi? Jelaskan jawapan anda dengan teliti. Glove Bhd. and Hose Bhd. are Malaysian-based MNCs with subsidiaries in Indonesia that distribute rubber products (which are produced in Malaysia) to customers throughout ASEAN. Both subsidiaries purchase the products at cost and sell the products at 90% markup. The other operating costs of the subsidiaries are very low. Glove Bhd. has a research and development centre in Malaysia that focuses on improving its rubber technology. Hose Bhd. has a similar centre based in Indonesia. Each firm subsidises its respective research and development centre on an annual basis. Which firm is subject to a higher degree of economic exposure? Explain your answer in detail. (6 markah/marks) 4/8 CIC2006 (c) Andaikan SME Bhd. membuat rundingan kontrak hadapan untuk membeli 200,000 lira Turki dalam tempoh 90 hari. Kadar hadapan 90 hari adalah RM1.40 untuk setiap lira Turki. Lira yang akan dibeli tersebut akan digunakan untuk membeli bekalan di Turki. Pada hari lira tersebut dibekalkan mengikut kontrak hadapan, kadar semasa lira Turki adalah RM1.44. Apalah kos lindung nilai sebenar bayaran ini bagi SME Bhd.? Jika kadar semasa sebaliknya adalah RM1.34, apakah kos lindung nilai sebenar sekarang? Assume that SME Bhd. negotiated a forward contract to purchase 200,000 Turkish lira in 90 days. The 90-day forward rate was RM1.40 per Turkish lira. The liras to be purchased were to be used to purchase supplies in Turkey. On the day the liras were delivered in accordance with the forward contract, the spot rate of the Turkish lira was RM1.44. What was the real cost of hedging the payables for SME Bhd.? What if the spot rate was RM1.34 instead? What was the real cost of hedging in this case? (12 markah/marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts