Question: Can you help me calculate #3 without Excel Body Text List Paragraph No a. Credit Risk The risk that the issuer will allow its financial

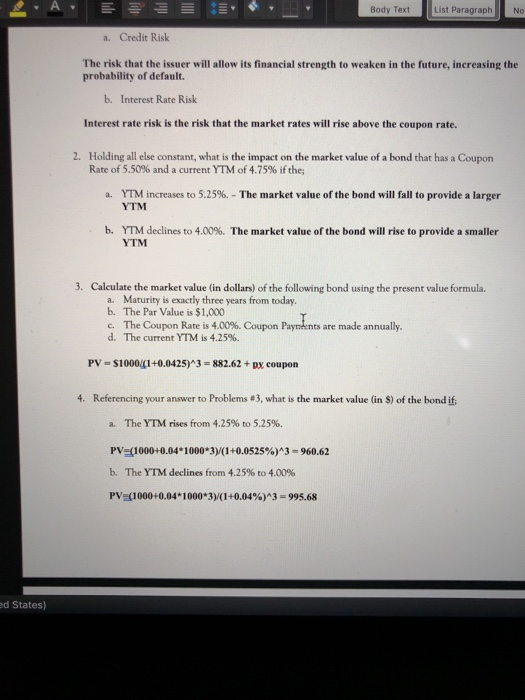

Body Text List Paragraph No a. Credit Risk The risk that the issuer will allow its financial strength to weaken in the future, increasing the probability of default. b. Interest Rate Risk Interest rate risk is the risk that the market rates will rise above the coupon rate Holding all else constant, what is the impact on the market value of a bond that has a Coupon Rate of 5.50% and a current rn( of 4.75% if the 2. nf increases to 5.25%.-The market value of the bond will fall to provide a larger YTM a. b- YTM declines to 4.00%. The market value of the bond will rise to provide a smaller YTM 3. Calculate the market value (in dollars) of the following bond using the present value formula. a. b. c. d. Maturity is exactly three years from today. The Par Value is $1,000 The Coupon Rate is 4.00%. Coupon The current is 4.25%. PayJn ts are made annually PV- $1000 1+0.0425)*3-882.62+ px coupon 4. Referencing your answer to Problems #3, what is the market value (in S) of the bond if a- The YTM rises from 4.25% to 5.25%. PV-(1000+0.04* 1000*3)(1 +0.0525%)^3-960.62 b, The YTM declines from 4.25% to 4.00% PV (1000 + 0.04 * 1 000*3)/(1 +0.04%)^3-995.68 d States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts