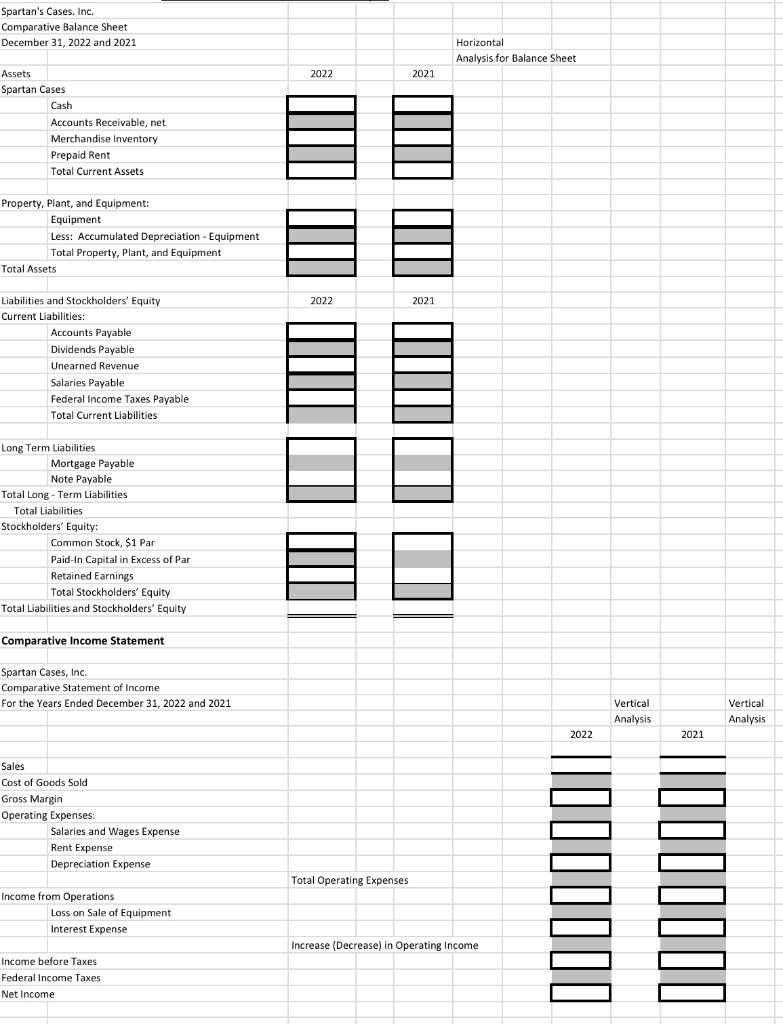

Question: Can you help me do horizontal and vertical analysis with steps please? Spartan's Cases. Inc. Comparative Balance Sheet December 31,2022 and 2021 Horizontal Analysis for

Can you help me do horizontal and vertical analysis with steps please?

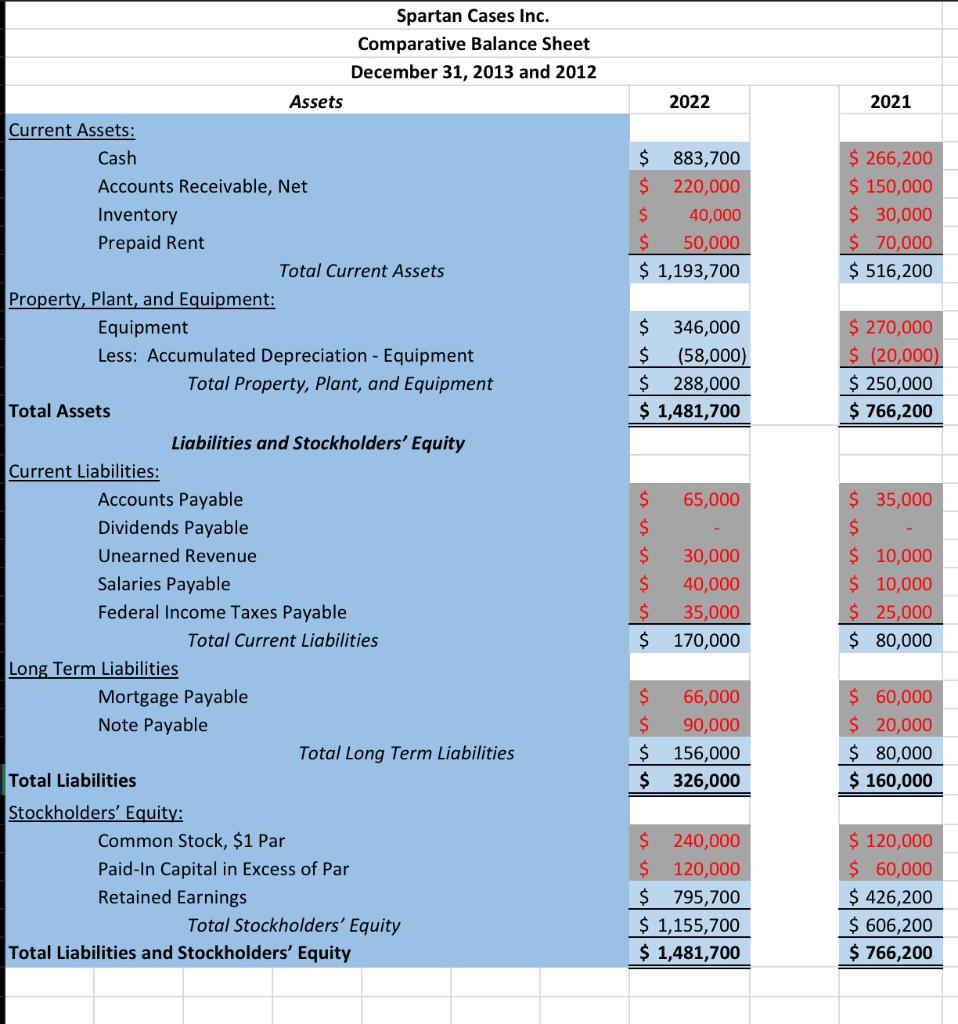

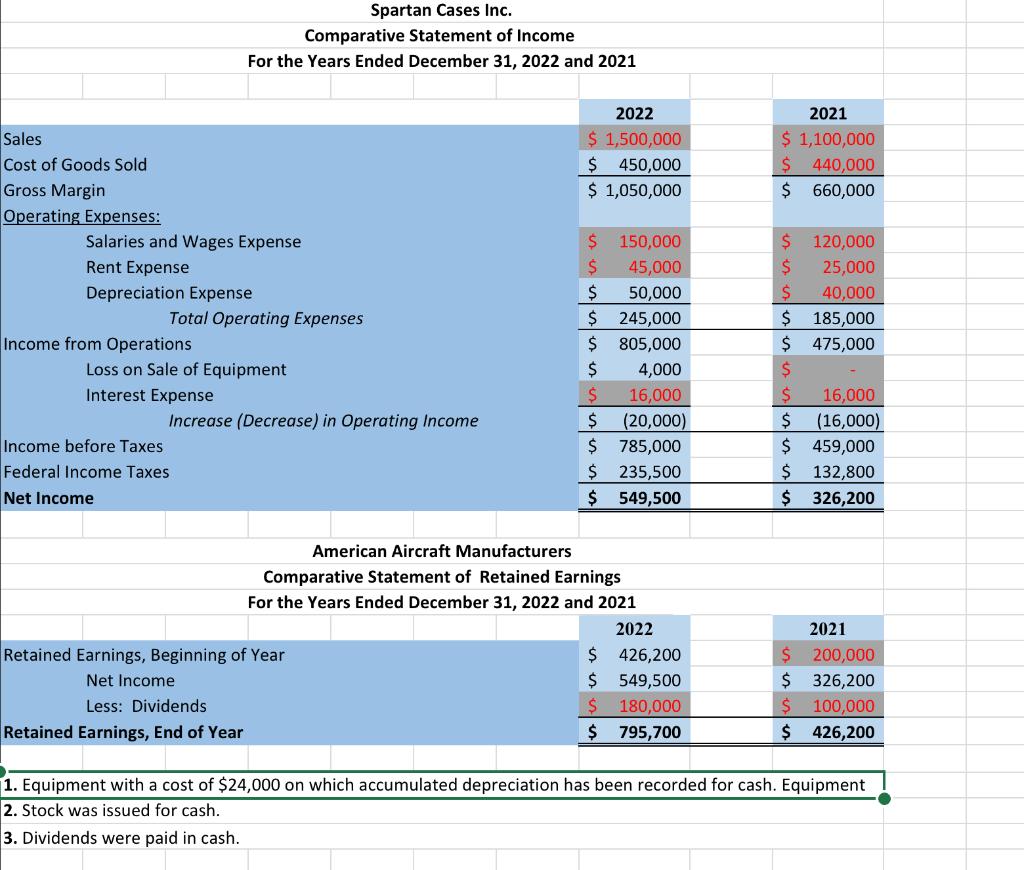

Spartan's Cases. Inc. Comparative Balance Sheet December 31,2022 and 2021 Horizontal Analysis for Balance Sheet Assets \begin{tabular}{|} 2022 \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} Property, Plant, and Equipment: Comparative Income Statement Spartan Cases, Inc. Comparative Statement of Income For the Years Ended December 31, 2022 and 2021 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Income from Operations Loss on Sale of Equipment Interest Expense Total Operating Expenses \begin{tabular}{|} \\ \hline \\ \hline \\ \hline \end{tabular} Spartan Cases Inc. Comparative Balance Sheet December 31, 2013 and 2012 Current Assets: Cash Accounts Receivable, Net Inventory Prepaid Rent Total Current Assets Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets \begin{tabular}{l|l|c|} \hline \multicolumn{2}{|c|}{2022} & 2021 \\ \hline & & \\ \hline$ & 883,700 & $266,200 \\ \hline$ & 220,000 & $150,000 \\ $ & 40,000 & $30,000 \\ $ & 50,000 \\ \hline$1,193,700 & $70,000 \\ \hline$ & 346,000 & $516,200 \\ $ & (58,000) \\ \hline$ & 288,000 & $270,000 \\ \hline$1,481,700 & $(20,000) \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Dividends Payable Unearned Revenue Salaries Payable Federal Income Taxes Payable Total Current Liabilities Long Term Liabilities Mortgage Payable Note Payable Total Liabilities Total Long Term Liabilities Stockholders' Equity: Common Stock, \$1 Par Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity \begin{tabular}{cc} $ & 65,000 \\ $ & \\ $ & 30,000 \\ $ & 40,000 \\ $ & 35,000 \\ \hline$ & 170,000 \\ $ & 66,000 \\ $ & 90,000 \\ $ & 156,000 \\ \hline$ & 326,000 \\ \hline \hline & \\ \hline$ & 240,000 \\ $ & 120,000 \\ \hline$ & 795,700 \\ \hline$1,155,700 \\ \hline$ & 1,481,700 \\ \hline \hline \end{tabular} \begin{tabular}{cc} $ & 35,000 \\ $ & \\ $ & 10,000 \\ $ & 10,000 \\ $ & 25,000 \\ \hline$ & 80,000 \\ $ & \\ $ & 60,000 \\ $ & 20,000 \\ $ & 80,000 \\ \hline$160,000 \\ \hline \hline \end{tabular} $120,000$60,000$426,200$606,200$766,200 Spartan Cases Inc. Comparative Statement of Income For the Years Ended December 31, 2022 and 2021 Sales Cost of Goods Sold Gross Margin \begin{tabular}{c|c|} \hline \multicolumn{1}{c|}{2022} & \multicolumn{2}{c}{2021} \\ \hline$1,500,000 & $1,100,000 \\ \hline$450,000 & $440,000 \\ \hline$1,050,000 & $660,000 \\ \hline \end{tabular} Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income \begin{tabular}{rr|rr} $ & 150,000 & $ & 120,000 \\ $ & 45,000 & $ & 25,000 \\ $ & 50,000 & $ & 40,000 \\ \hline$ & 245,000 & $ & 185,000 \\ \hline$ & 805,000 & $ & 475,000 \\ $ & 4,000 & $ & \\ $ & 16,000 & $ & 16,000 \\ \hline$ & (20,000) & $ & (16,000) \\ \hline$ & 785,000 & $ & 459,000 \\ $ & 235,500 & $ & 132,800 \\ \hline$ & 549,500 & $ & 326,200 \\ \hline \hline \end{tabular} American Aircraft Manufacturers Comparative Statement of Retained Earnings For the Years Ended December 31, 2022 and 2021 1. Equipment with a cost of $24,000 on which accumulated depreciation has been recorded for cash. Equipment 2. Stock was issued for cash. 3. Dividends were paid in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts