Question: Can you help me find the correct solution for this question? 53% Page 2 SECTION A- Answer all FIVE questions. 1. (a) Compare how the

Can you help me find the correct solution for this question?

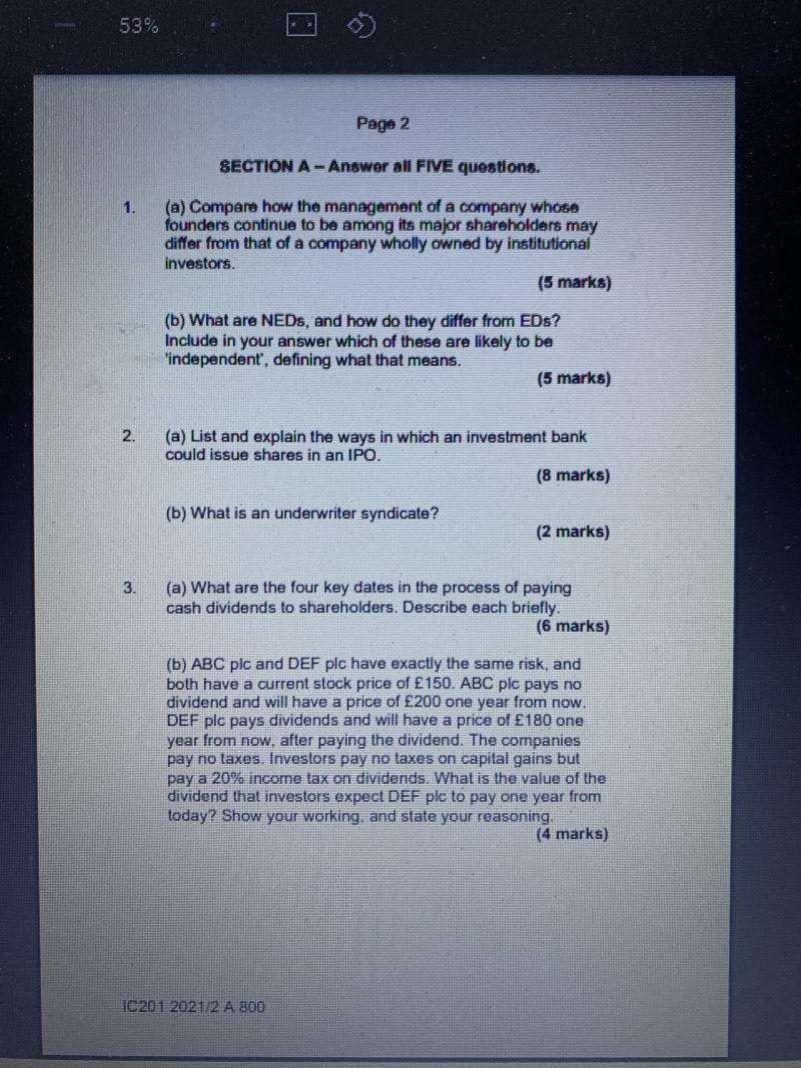

53% Page 2 SECTION A- Answer all FIVE questions. 1. (a) Compare how the management of a company whose founders continue to be among its major shareholders may differ from that of a company wholly owned by institutional investors. (5 marks) (b) What are NEDs, and how do they differ from EDS? Include in your answer which of these are likely to be 'independent', defining what that means. (5 marks) 2. (a) List and explain the ways in which an investment bank could issue shares in an IPO. (8 marks) (b) What is an underwriter syndicate? (2 marks) 3. (a) What are the four key dates in the process of paying cash dividends to shareholders. Describe each briefly. (6 marks) (b) ABC plc and DEF plc have exactly the same risk, and both have a current stock price of 150. ABC plc pays no dividend and will have a price of 200 one year from now. DEF plc pays dividends and will have a price of 180 one year from now, after paying the dividend. The companies pay no taxes. Investors pay no taxes on capital gains but pay a 20% income tax on dividends. What is the value of the dividend that investors expect DEF pic to pay one year from today? Show your working, and slate your reasoning (4 marks) 10201 2021/2 A 800 53% Page 2 SECTION A- Answer all FIVE questions. 1. (a) Compare how the management of a company whose founders continue to be among its major shareholders may differ from that of a company wholly owned by institutional investors. (5 marks) (b) What are NEDs, and how do they differ from EDS? Include in your answer which of these are likely to be 'independent', defining what that means. (5 marks) 2. (a) List and explain the ways in which an investment bank could issue shares in an IPO. (8 marks) (b) What is an underwriter syndicate? (2 marks) 3. (a) What are the four key dates in the process of paying cash dividends to shareholders. Describe each briefly. (6 marks) (b) ABC plc and DEF plc have exactly the same risk, and both have a current stock price of 150. ABC plc pays no dividend and will have a price of 200 one year from now. DEF plc pays dividends and will have a price of 180 one year from now, after paying the dividend. The companies pay no taxes. Investors pay no taxes on capital gains but pay a 20% income tax on dividends. What is the value of the dividend that investors expect DEF pic to pay one year from today? Show your working, and slate your reasoning (4 marks) 10201 2021/2 A 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts