Question: Can you help me how to solve this problem? Consider a company financed with 0.2 equity, 0.1 preferred stock, and the remaining debt subject to

Can you help me how to solve this problem?

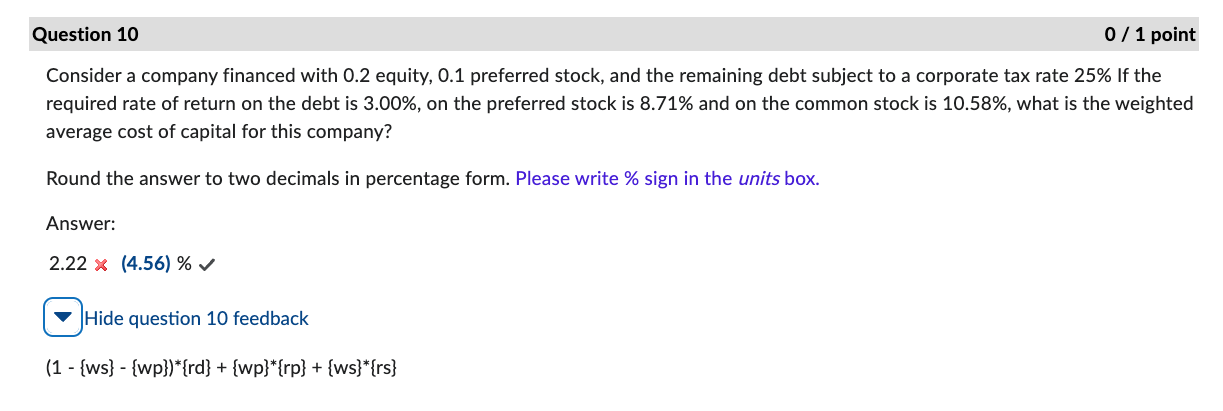

Consider a company financed with 0.2 equity, 0.1 preferred stock, and the remaining debt subject to a corporate tax rate 25% If the required rate of return on the debt is 3.00%, on the preferred stock is 8.71% and on the common stock is 10.58%, what is the weighted average cost of capital for this company? Round the answer to two decimals in percentage form. Please write \% sign in the units box. Answer: 2.22(4.56)% Hide question 10 feedback (1{ws}{wp}){rd}+{wp}{rp}+{ws}{rs}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts