Question: can you help me please? Below is the monthly return distribution of 3 different stocks, XU market index and Rf risk free financial asset (%).

can you help me please?

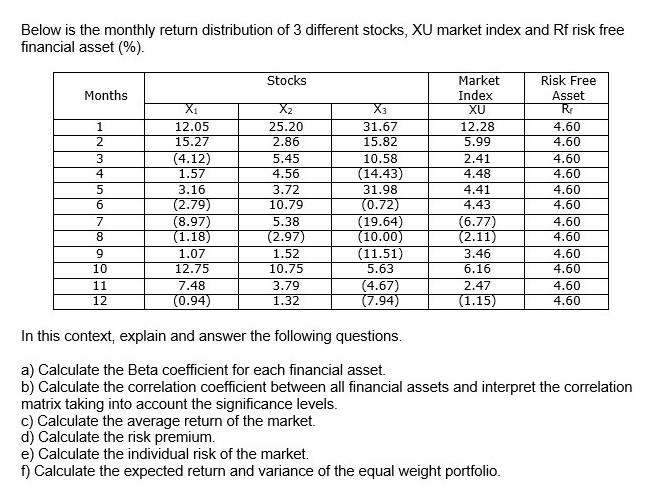

Below is the monthly return distribution of 3 different stocks, XU market index and Rf risk free financial asset (%). Stocks Months 1 2 3 4 5 6 7 8 9 10 11 12 X1 12.05 15.27 (4.12) 1.57 3.16 (2.79) (8.97) (1.18) 1.07 12.75 7.48 (0.94) X2 25.20 2.86 5.45 4.56 3.72 10.79 5.38 (2.97) 1.52 10.75 3.79 1.32 X3 31.67 15.82 10.58 (14.43) 31.98 (0.72) (19.64) (10.00) (11.51) 5.63 (4.67) (7.94) Market Index XU 12.28 5.99 2.41 4.48 4.41 4.43 (6.77) (2.11) 3.46 6.16 2.47 (1.15) Risk Free Asset R 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.60 In this context, explain and answer the following questions. a) Calculate the Beta coefficient for each financial asset. b) Calculate the correlation coefficient between all financial assets and interpret the correlation matrix taking into account the significance levels. c) Calculate the average return of the market. d) Calculate the risk premium. e) Calculate the individual risk of the market. f) Calculate the expected return and variance of the equal weight portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts