Question: Can you help me please with the partial balance sheet? I did preferred stock, common stock, and retained earnings but now stuck at the rest.

Can you help me please with the partial balance sheet? I did preferred stock, common stock, and retained earnings but now stuck at the rest. Here is the question:

The ledger of Sheffield Corp. at December 31, 2022, after the books have been closed, contains the following stockholders equity accounts.

| Preferred Stock (11,500 shares issued) | $1,161,500 | |

| Common Stock (305,000 shares issued) | 1,830,000 | |

| Paid-in Capital in Excess of Par ValuePreferred Stock | 180,000 | |

| Paid-in Capital in Excess of Stated ValueCommon Stock | 1,650,000 | |

| Retained Earnings | 2,725,500 |

A review of the accounting records reveals this information:

| 1. | Preferred stock is 8%, $101 par value, noncumulative. Since January 1, 2021, 11,500 shares have been outstanding; 23,000 shares are authorized. | |

| 2. | Common stock is no-par with a stated value of $6 per share; 610,000 shares are authorized. | |

| 3. | The January 1, 2022, balance in Retained Earnings was $2,285,000. | |

| 4. | On October 1, 58,500 shares of common stock were sold for cash at $9 per share. | |

| 5. | A cash dividend of $395,500 was declared and properly allocated to preferred and common stock on November 1. No dividends were paid to preferred stockholders in 2021. | |

| 6. | Net income for the year was $836,000. | |

| 7. | On December 31, 2022, the directors authorized disclosure of a $165,000 restriction of retained earnings for plant expansion. (Use Note A.) |

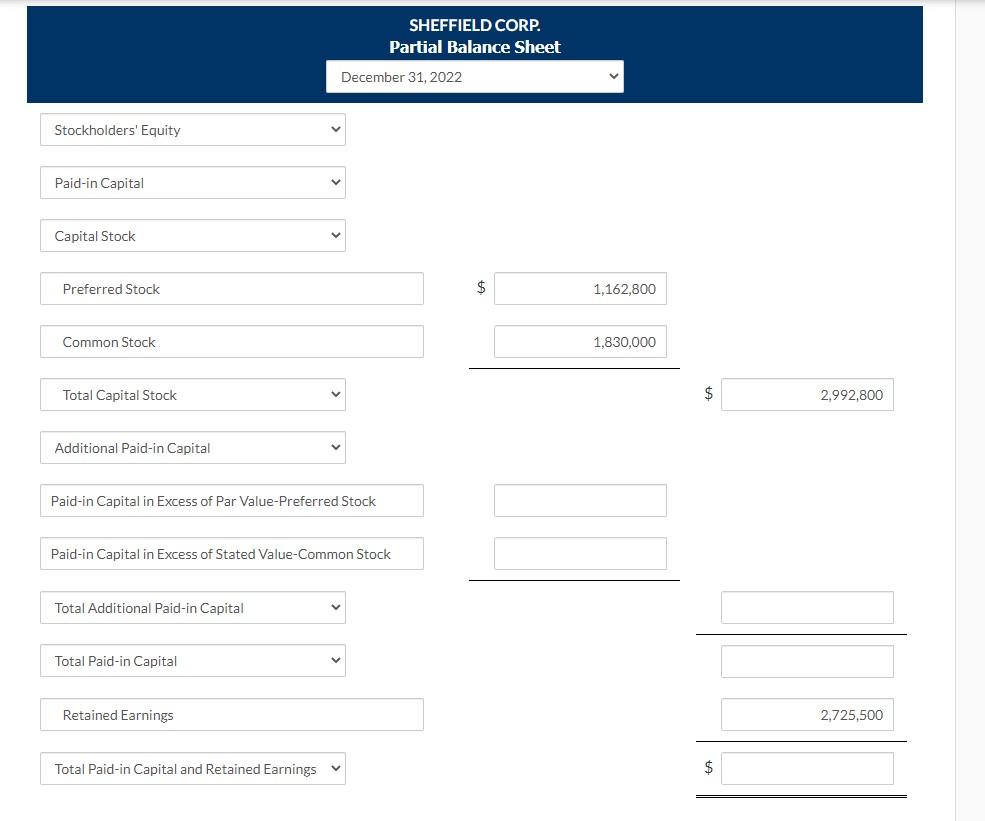

SHEFFIELD CORP. Partial Balance Sheet December 31, 2022 Stockholders' Equity Paid-in Capital Capital Stock Preferred Stock $ 1,162,800 Common Stock 1,830,000 Total Capital Stock $ 2.992,800 Additional Paid-in Capital Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Total Additional Paid-in Capital Total Paid-in Capital Retained Earnings 2,725,500 Total Paid-in Capital and Retained Earnings $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts