Question: Can you help me solve a. and b. as it relates to the information presented in this problem? 51. During 2016, Jane Mason incurred the

Can you help me solve a. and b. as it relates to the information presented in this problem?

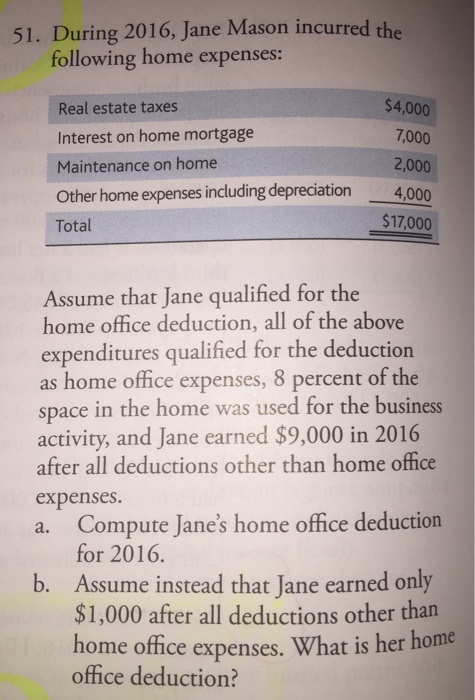

Can you help me solve a. and b. as it relates to the information presented in this problem?51. During 2016, Jane Mason incurred the following home expenses Real estate taxes $4,000 Interest on home mortgage 7,000 Maintenance on home 2,000 Other home expenses including depreciation 4,000 $17,000 Total Assume that Jane qualified for the home office deduction, all of the above expenditures qualified for the deduction as home office expenses, 8 percent of the space in the home was used for the business activity, and Jane earned $9,000 in 2016 after all deductions other than home office expenses. a. Compute Jane's home office deduction for 2016. b. Assume instead that Jane earned only $1,000 after all deductions other than home office expenses. What is her home office deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts