Question: Can you help me solve this problem? A 4.80 percent coupon municipal bond has 21 years left to maturity and has a price quote of

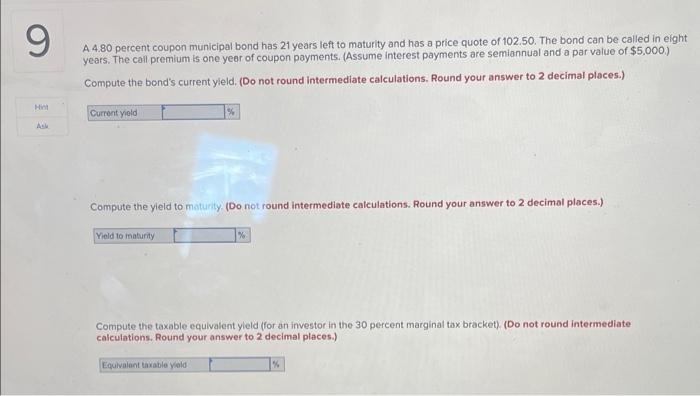

A 4.80 percent coupon municipal bond has 21 years left to maturity and has a price quote of 102.50. The bond can be called in eight years. The call premium is one yeer of coupon payments. (Assume interest payments are semiannual and a par value of $5.000.) Compute the bond's current yleld, (Do not round intermediate calculations. Round your answer to 2 decimal places.) Compute the yield to maturity. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Compute the taxable equivalent yleld (for an investor in the 30 percent marginal tax bracket). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Compute the yleid to call. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts