Question: can you help me solve this question please? With the steps on how to solve? thank you (: The Solar Partnership makes a proportionate distribution

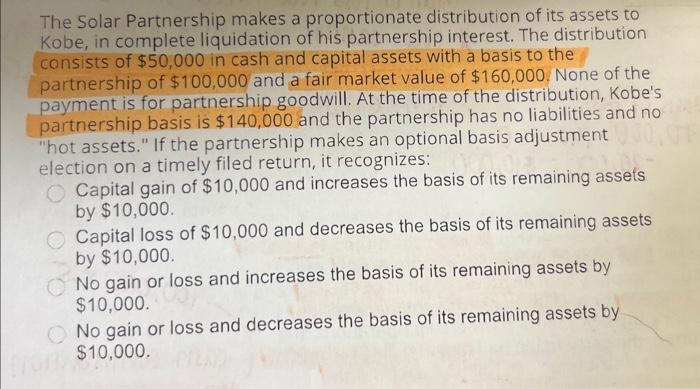

The Solar Partnership makes a proportionate distribution of its assets to Kobe, in complete liquidation of his partnership interest. The distribution consists of $50,000 in cash and capital assets with a basis to the partnership of $100,000 and a fair market value of $160,000. None of the payment is for partnership goodwill. At the time of the distribution, Kobe's partnership basis is $140,000 and the partnership has no liabilities and no "hot assets." If the partnership makes an optional basis adjustment election on a timely filed return, it recognizes: Capital gain of $10,000 and increases the basis of its remaining assets by $10,000. Capital loss of $10,000 and decreases the basis of its remaining assets by $10,000. No gain or loss and increases the basis of its remaining assets by $10,000. No gain or loss and decreases the basis of its remaining assets by $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts