Question: Can you help me to answer this questions?Step by step process and explanation would be helpful for me. Thank you!Questions:1. What is the average bad

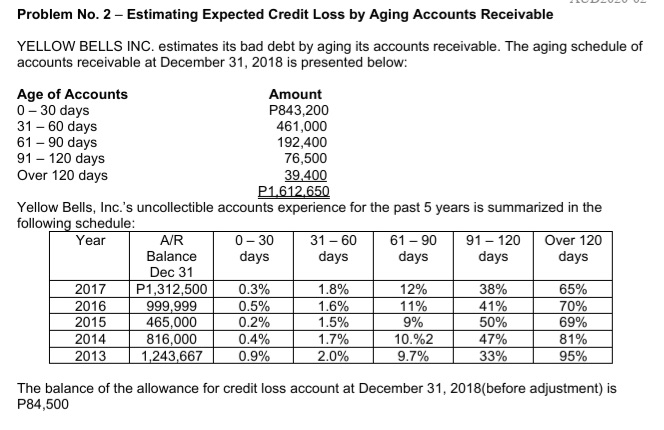

Can you help me to answer this questions?Step by step process and explanation would be helpful for me. Thank you!Questions:1. What is the average bad debt expense rate for "91 - 120 days" accounts?a. 76%b. 8.6%c. 10.38%d. 41.80%2. What is the average bad debt expense rate for "31 - 60 days" accounts?a. 10.38%b. 41.80%c. 0.46%d. 1.72%3. The net realizable value of the company's accounts receivable on December 31, 2018 should bea. P1,518,887b. P1,612,650c. P1,528,150d. P1,603,3584. What entry should be made to adjust the allowance for credit loss on December 31, 2018a. Expected credit loss 178,263 Allowance for credit loss 178,263b. Expected credit loss 93,763 Allowance for credit loss 93,673c. Expected credit loss 9,263 Allowance for credit loss 9,263d. Allowance for credit loss 9,263 Expected credit loss 9,2635. In evaluating the adequacy of the allowance for credit loss, an auditor most likely reviews the entity's aging of receivables to support management's financial statement assertion ofa. Existenceb. Valuation and allocationc. Completenessd. Rights and obligations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts