Question: can you help me to do it without excel You are considering the acquisition of a multi-family residential building for rent. The purchase price is

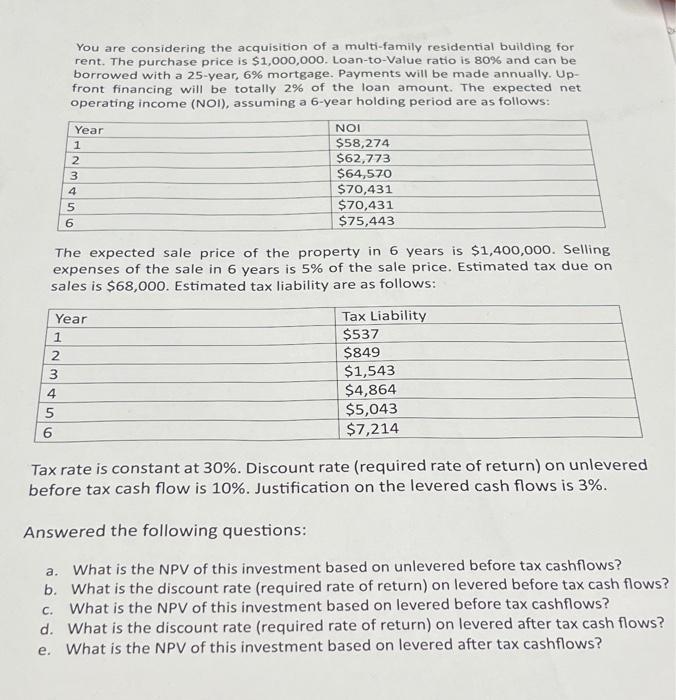

You are considering the acquisition of a multi-family residential building for rent. The purchase price is $1,000,000. Loan-to-Value ratio is 80% and can be borrowed with a 25 -year, 6% mortgage. Payments will be made annually. Upfront financing will be totally 2% of the loan amount. The expected net operating income (NOI), assuming a 6-year holding period are as follows: The expected sale price of the property in 6 years is $1,400,000. Selling expenses of the sale in 6 years is 5% of the sale price. Estimated tax due on sales is $68,000. Estimated tax liability are as follows: Tax rate is constant at 30%. Discount rate (required rate of return) on unlevered before tax cash flow is 10%. Justification on the levered cash flows is 3%. Answered the following questions: a. What is the NPV of this investment based on unlevered before tax cashflows? b. What is the discount rate (required rate of return) on levered before tax cash flows? c. What is the NPV of this investment based on levered before tax cashflows? d. What is the discount rate (required rate of return) on levered after tax cash flows? e. What is the NPV of this investment based on levered after tax cashflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts