Question: can you help me to do the solution 2. Through November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to

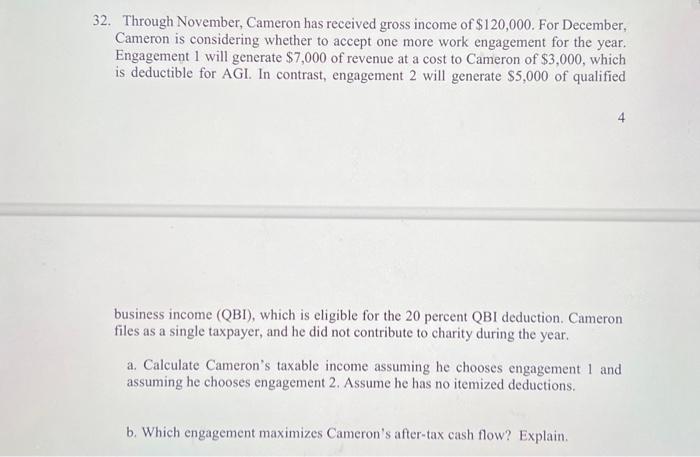

2. Through November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $7,000 of revenue at a cost to Cameron of $3,000, which is deductible for AGI. In contrast, engagement 2 will generate $5,000 of qualified 4 business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. a. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2 . Assume he has no itemized deductions. b. Which engagement maximizes Cameron's after-tax cash flow? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts