Question: Can you help me understand quick study 8-3, 8-4, 8-5, 8-6 please and thank you QS 8-3 Bad debts, write-off, recovery LO2 Record the following

Can you help me understand quick study 8-3, 8-4, 8-5, 8-6 please and thank you

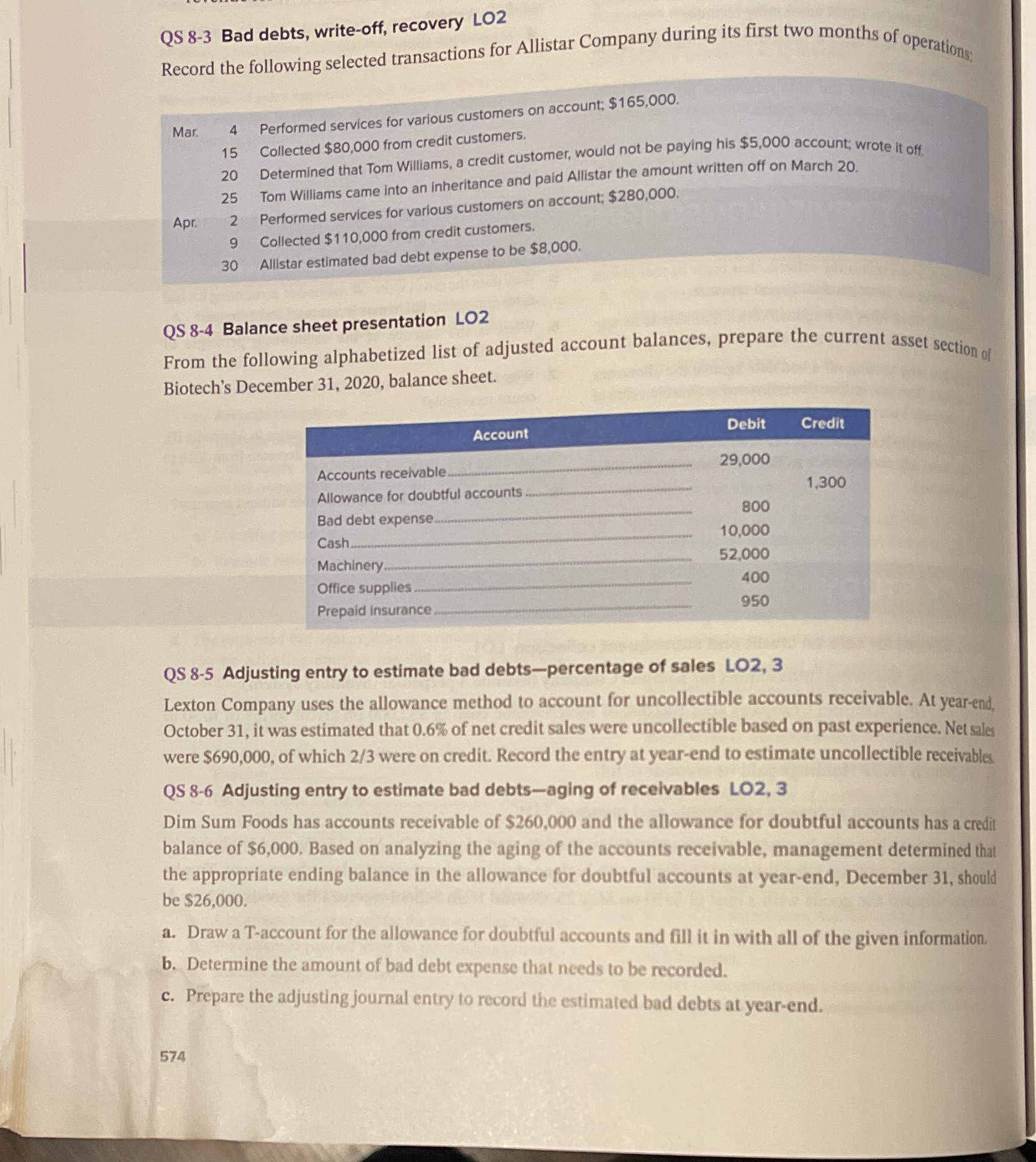

QS 8-3 Bad debts, write-off, recovery LO2 Record the following selected transactions for Allistar Company during its first two months of operations. 4 Performed services for various customers on account; $165,000. Mar. 15 Collected $80,000 from credit customers. 20 Determined that Tom Williams, a credit customer, would not be paying his $5,000 account; wrote it off. 25 Tom Williams came into an inheritance and paid Allistar the amount written off on March 20. Performed services for various customers on account; $280,000. Apr. Collected $110,000 from credit customers. 30 Allistar estimated bad debt expense to be $8,000. QS 8-4 Balance sheet presentation LO2 From the following alphabetized list of adjusted account balances, prepare the current asset section of Biotech's December 31, 2020, balance sheet. Account Debit Credit 29,000 Accounts receivable. 1,300 Allowance for doubtful accounts . 800 Bad debt expense. Cash 10,000 Machinery .. 52,000 Office supplies 400 Prepaid insurance. 950 QS 8-5 Adjusting entry to estimate bad debts-percentage of sales LO2, 3 Lexton Company uses the allowance method to account for uncollectible accounts receivable. At year-end. October 31, it was estimated that 0.6% of net credit sales were uncollectible based on past experience. Net sales were $690,000, of which 2/3 were on credit. Record the entry at year-end to estimate uncollectible receivables. QS 8-6 Adjusting entry to estimate bad debts-aging of receivables LO2, 3 Dim Sum Foods has accounts receivable of $260,000 and the allowance for doubtful accounts has a credit balance of $6,000. Based on analyzing the aging of the accounts receivable, management determined that the appropriate ending balance in the allowance for doubtful accounts at year-end, December 31, should be $26,000. a. Draw a T-account for the allowance for doubtful accounts and fill it in with all of the given information. b. Determine the amount of bad debt expense that needs to be recorded. c. Prepare the adjusting journal entry to record the estimated bad debts at year-end. 574