Question: can you help me with 1 and 2? #1 the bid and ask orove needs to be calcukated the question is to calcukate the exchange.

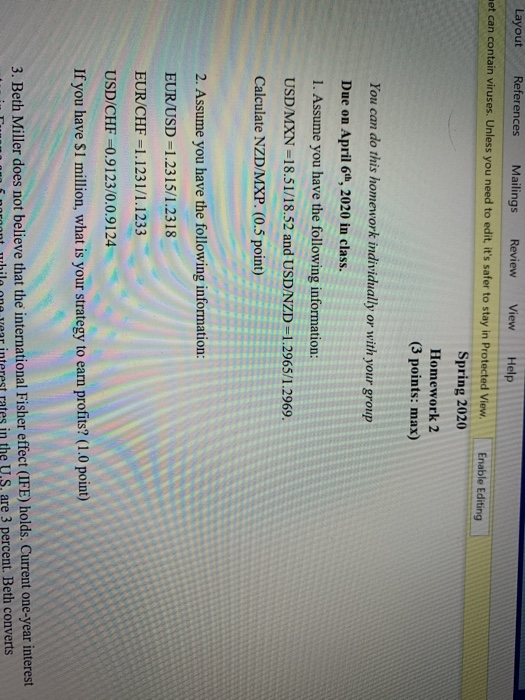

Enable Editing Layout References Mailings Review V iew Help met can contain viruses. Unless you need to edit, it's safer to stay in Protected View Spring 2020 Homework 2 (3 points: max) You can do this homework individually or with your group Due on April 6, 2020 in class. 1. Assume you have the following information: USD/MXN -18.51/18.52 and USD/NZD -1.2965/1.2969. Calculate NZD/MXP. (0.5 point) 2. Assume you have the following information: EUR/USD =1.2315/1.2318 EUR/CHF =1.1231/1.1233 USD/CHF =0.9123/0.0.9124 If you have $1 million, what is your strategy to earn profits? (1.0 point) 3. Beth Miller does not believe that the international Fisher effect (IFE) holds. Current one-year interest in u n norant while one year interest rates in the U.S. are 3 percent. Beth converts Enable Editing Layout References Mailings Review V iew Help met can contain viruses. Unless you need to edit, it's safer to stay in Protected View Spring 2020 Homework 2 (3 points: max) You can do this homework individually or with your group Due on April 6, 2020 in class. 1. Assume you have the following information: USD/MXN -18.51/18.52 and USD/NZD -1.2965/1.2969. Calculate NZD/MXP. (0.5 point) 2. Assume you have the following information: EUR/USD =1.2315/1.2318 EUR/CHF =1.1231/1.1233 USD/CHF =0.9123/0.0.9124 If you have $1 million, what is your strategy to earn profits? (1.0 point) 3. Beth Miller does not believe that the international Fisher effect (IFE) holds. Current one-year interest in u n norant while one year interest rates in the U.S. are 3 percent. Beth converts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts