Question: can you help me with question 1(a) up until 1(e) and 2 (a) to (b) 1. Answer three parts of the following question. All questions

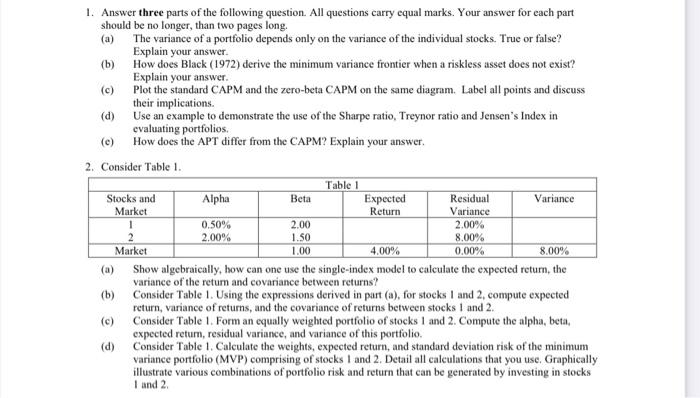

1. Answer three parts of the following question. All questions carry equal marks. Your answer for each part should be no longer, than two pages long. (a) The variance of a portfolio depends only on the variance of the individual stocks. True or false? Explain your answer. (b) How does Black (1972) derive the minimum variance frontier when a riskless asset does not exist? Explain your answer. (c) Plot the standard CAPM and the zero-beta CAPM on the same diagram. Label all points and discuss their implications. (d) Use an example to demonstrate the use of the Sharpe ratio, Treynor ratio and Jensen's Index in evaluating portfolios. (e) How does the APT differ from the CAPM? Explain your answer. 2. Consider Table 1. (a) Show algebraically, how can one use the single-index model to calculate the expected return, the variance of the retum and covariance between returns? (b) Consider Table 1. Using the expressions derived in part (a), for stocks I and 2, compute expected return, variance of returns, and the covariance of returns between stocks 1 and 2 . (c) Consider Table 1. Form an equally weighted portfolio of stocks 1 and 2. Compute the alpha, betai, expected return, residual variance, and variance of this portfolio. (d) Consider Table 1. Calculate the weights, expected return, and standard deviation risk of the minimum variance portfolio (MVP) comprising of stocks I and 2. Detail all calculations that you use. Graphically illustrate various combinations of portfolio risk and return that can be generated by investing in stocks 1 and 2 . 1. Answer three parts of the following question. All questions carry equal marks. Your answer for each part should be no longer, than two pages long. (a) The variance of a portfolio depends only on the variance of the individual stocks. True or false? Explain your answer. (b) How does Black (1972) derive the minimum variance frontier when a riskless asset does not exist? Explain your answer. (c) Plot the standard CAPM and the zero-beta CAPM on the same diagram. Label all points and discuss their implications. (d) Use an example to demonstrate the use of the Sharpe ratio, Treynor ratio and Jensen's Index in evaluating portfolios. (e) How does the APT differ from the CAPM? Explain your answer. 2. Consider Table 1. (a) Show algebraically, how can one use the single-index model to calculate the expected return, the variance of the retum and covariance between returns? (b) Consider Table 1. Using the expressions derived in part (a), for stocks I and 2, compute expected return, variance of returns, and the covariance of returns between stocks 1 and 2 . (c) Consider Table 1. Form an equally weighted portfolio of stocks 1 and 2. Compute the alpha, betai, expected return, residual variance, and variance of this portfolio. (d) Consider Table 1. Calculate the weights, expected return, and standard deviation risk of the minimum variance portfolio (MVP) comprising of stocks I and 2. Detail all calculations that you use. Graphically illustrate various combinations of portfolio risk and return that can be generated by investing in stocks 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts