Question: Can you help me with question 8 and 9 using CCH? Question S Let's assume you have a friend who is a blackjack dealer at

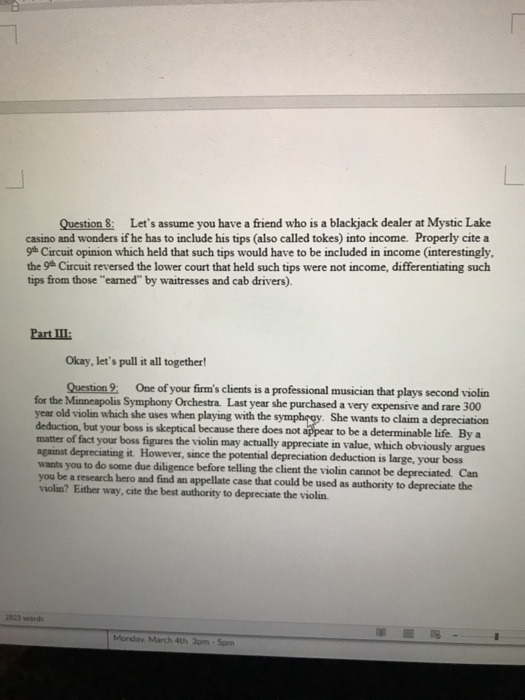

Question S Let's assume you have a friend who is a blackjack dealer at Mystic Lake casino and wonders if he has to include his tips (also called tokes) into income. Properly citea 9h Circuit opinion which held that such tips would have to be included in income (interestingly, the 9 Circuit reversed the lower court that held such tips were not income, differentiating such tips from those "earned" by waitresses and cab drivers). Part III Okay, let's pull it all together! for the Minneapolis Sympbony Orchestra Last year she purchased a very expensive and rare 300 year old violin which she uses when playing with the deduction, but your boss is skeptical because there does not appear to be a matter of fact your against depreciating it. However, since the potential depreciation wants you to do some due diligence before telling the client the violin cannot be depreciated. Can you be a research hero and find an appellate case that could be used as authority to violin? Either way, cite the best authority to depreciate the violin Question One of your firm's clients is a professional musician that plays second violin She wants to claim a depreciation boss figures the violin may actually appreciate in value, which obviously argues determinable life. By a deduction is large, your boss 823 words Monday, March 4th 3pm-5pm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts