Question: Can you help me with the part I got wrong? Dorothy acquired a 100% interest in two passive activities: Activity A in January 2015 and

Can you help me with the part I got wrong?

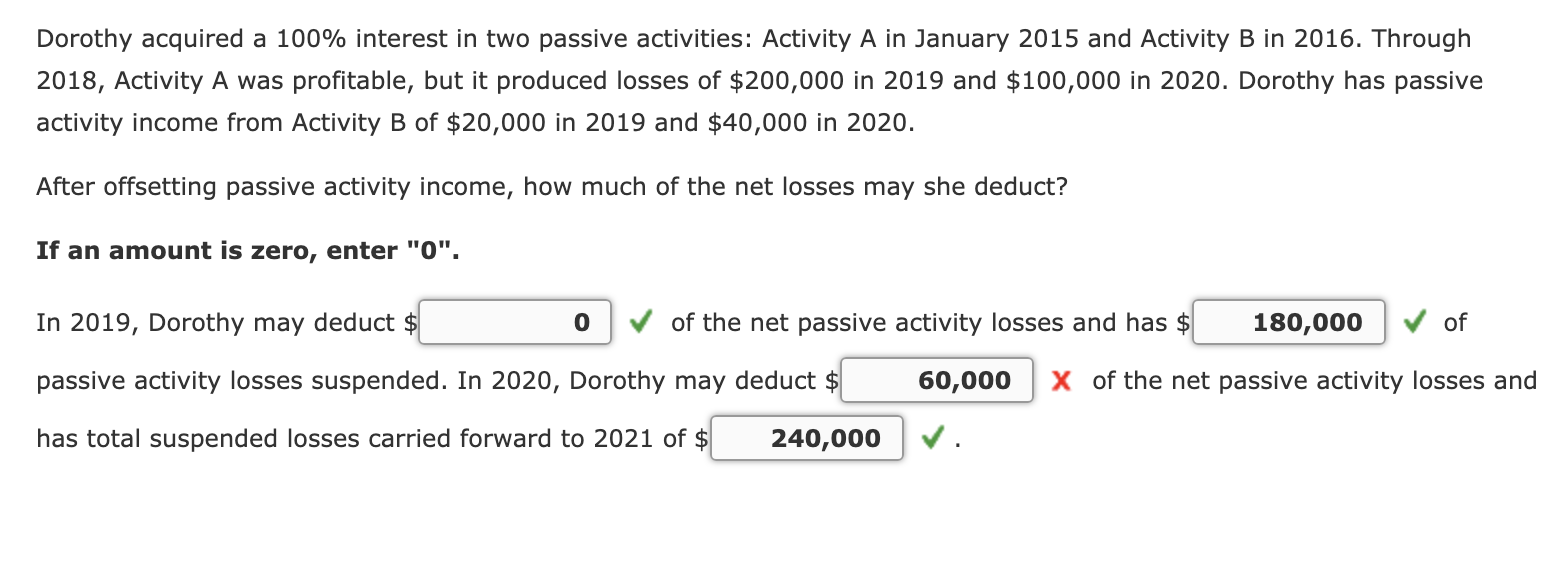

Dorothy acquired a 100% interest in two passive activities: Activity A in January 2015 and Activity B in 2016. Through 2018, Activity A was profitable, but it produced losses of $200,000 in 2019 and $100,000 in 2020. Dorothy has passive activity income from Activity B of $20,000 in 2019 and $40,000 in 2020. After offsetting passive activity income, how much of the net losses may she deduct? If an amount is zero, enter "O". In 2019, Dorothy may deduct $ 0 of the net passive activity losses and has $ 180,000 of passive activity losses suspended. In 2020, Dorothy may deduct $ 60,000 X of the net passive activity losses and has total suspended losses carried forward to 2021 of $ 240,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts