Question: Can you help me with these practice questions Problem 22. Like-Kind Exchange For each of the following like-kind exchanges of real estate, compute the taxpayer's

Can you help me with these practice questions

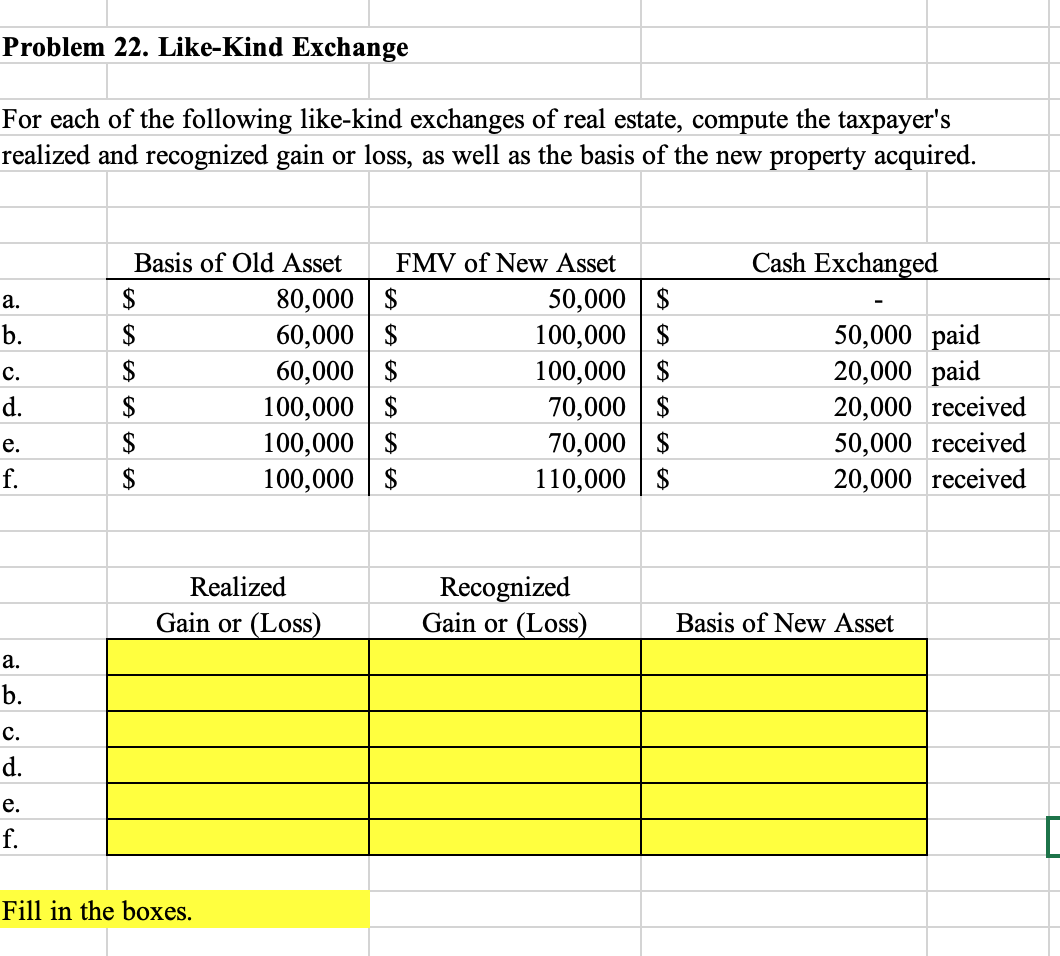

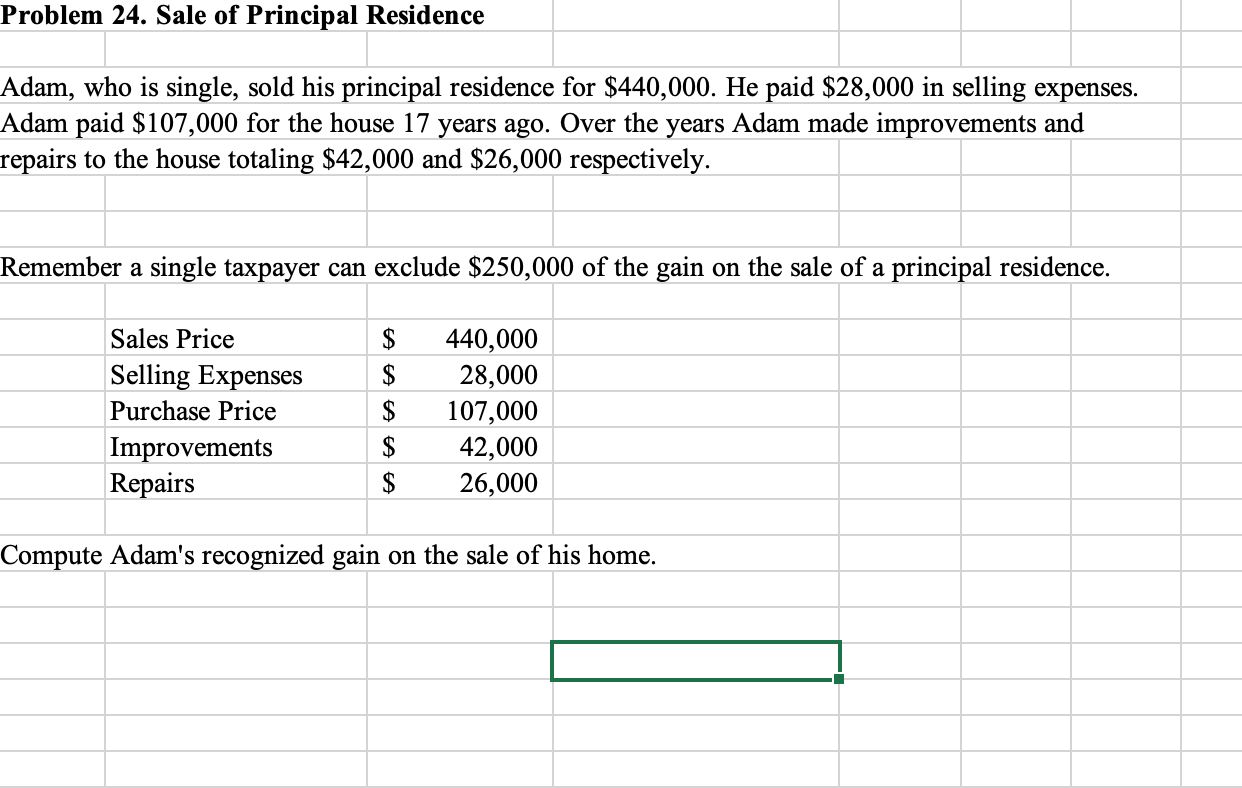

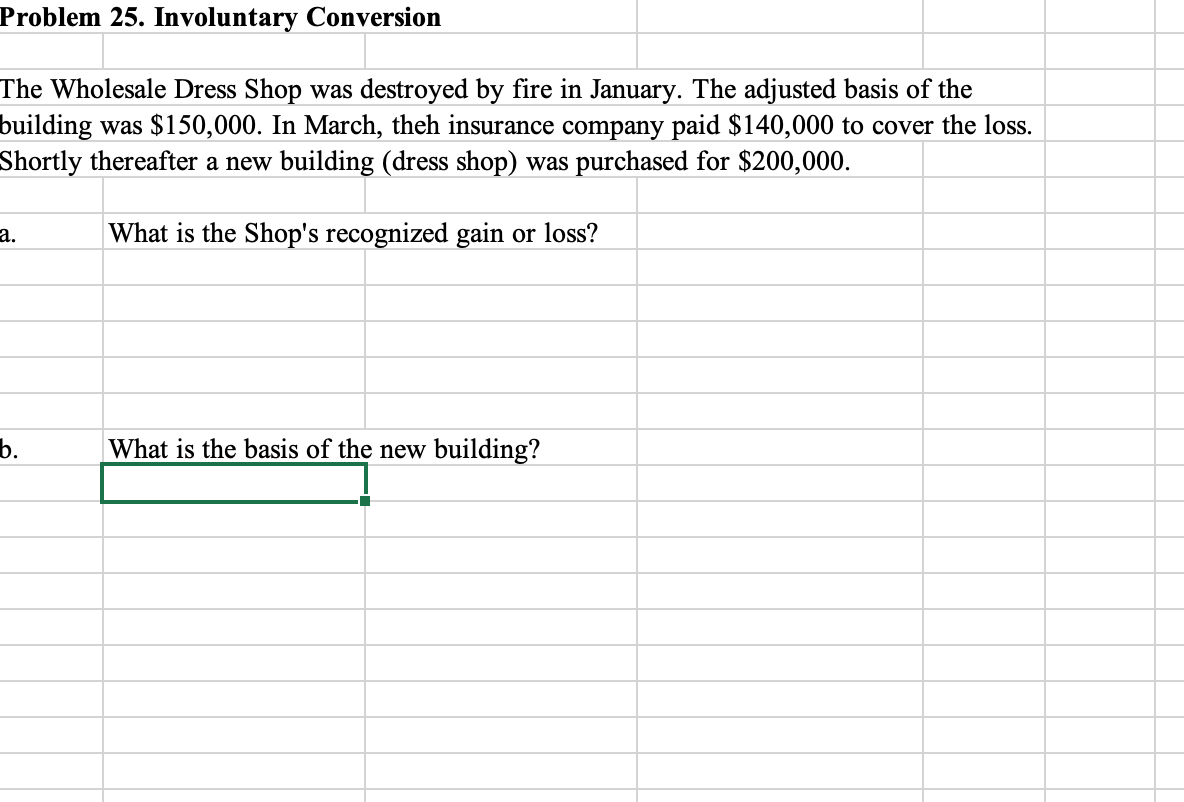

Problem 22. Like-Kind Exchange For each of the following like-kind exchanges of real estate, compute the taxpayer's realized and recognized gain or loss, as well as the basis of the new property acquired. Basis of Old Asset FMV of New Asset Cash Exchan ed a. $ 80,000 $ 50,000 $ - b. $ 60,000 $ 100,000 $ 50,000 paid c. 35 60,000 $ 100,000 $ 20,000 paid d. $ 100,000 $ 70,000 $ 20,000 received e. 35 100,000 $ 70,000 $ 50,000 received f. $ 100,000 $ 110,000 $ 20,000 received Realized Recognized Gain or Loss Gain or Loss Basis of New Asset a. b. c. d. e. f. Fill in the boxes. Problem 24. Sale of Principal Residence Adam, who is single, sold his principal residence for $440,000. He paid $28,000 in selling expenses. Adam paid $107,000 for the house 17 years ago. Over the years Adam made improvements and repairs to the house totaling $42,000 and $26,000 respectively. Remember a single taxpayer can exclude $250,000 of the gain on the sale of a principal residence. Sales Price $ 440,000 Selling Expenses $ 28,000 Purchase Price $ 107,000 Improvements $ 42,000 Repairs $ 26,000 Compute Adam's recognized gain on the sale of his home. :1 Problem 25. Involuntary Conversion The Wholesale Dress Shop was destroyed by fire in January. The adjusted basis of the building was $150,000. In March, theh insurance company paid $140,000 to cover the loss. Shortly thereafter a new building (dress shop) was purchased for $200,000. a. What is the Shop's recognized gain or loss? b. What is the basis of the new building? | :1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts