Question: Can you help me with this? I need this answer for an exam and I can't do it, the second (5.72%) is correct, I need

Can you help me with this? I need this answer for an exam and I can't do it, the second (5.72%) is correct, I need the first one, if you can answer correctly of course I' ll put , the answer is not 180.36, 180.38, 176.36, 181, 176,23, I tried all of them and they're incorrect

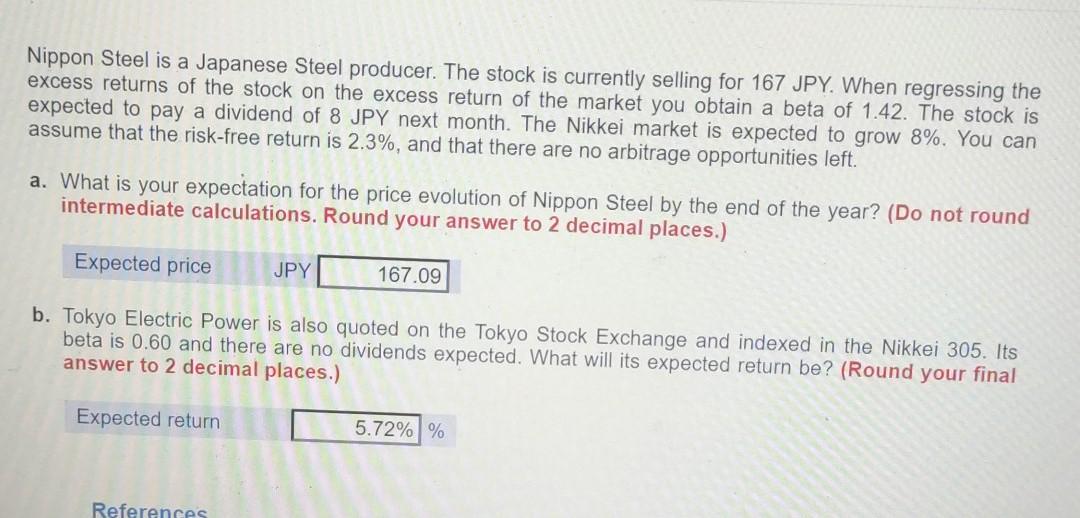

Nippon Steel is a Japanese Steel producer. The stock is currently selling for 167 JPY. When regressing the excess returns of the stock on the excess return of the market you obtain a beta of 1.42. The stock is expected to pay a dividend of 8 JPY next month. The Nikkei market is expected to grow 8%. You can assume that the risk-free return is 2.3%, and that there are no arbitrage opportunities left. a. What is your expectation for the price evolution of Nippon Steel by the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected price JPY 167.09 b. Tokyo Electric Power is also quoted on the Tokyo Stock Exchange and indexed in the Nikkei 305. Its beta is 0.60 and there are no dividends expected. What will its expected return be? (Round your final answer to 2 decimal places.) Expected return 5.72% % References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts