Question: Can you help me with this problem, please? E20-BB {L04) (Application of the Corridor Approach) XTRA Inc. has begirming-oftheyear present values for its projected benet

Can you help me with this problem, please?

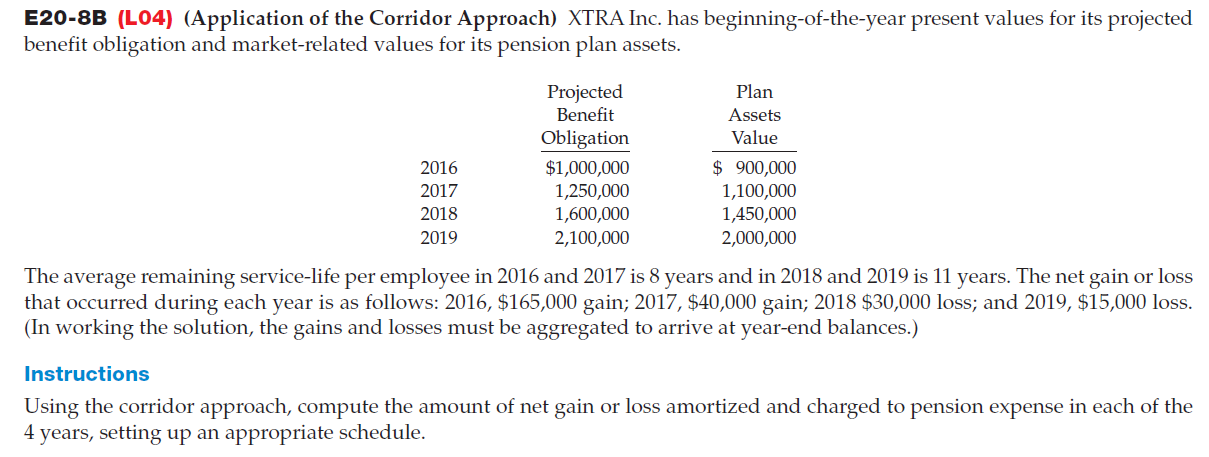

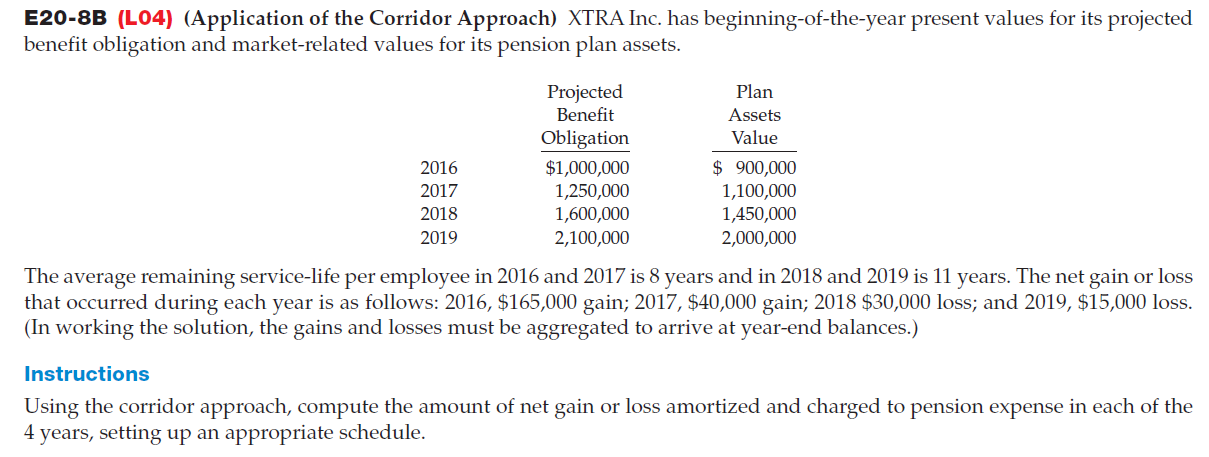

E20-BB {L04) (Application of the Corridor Approach) XTRA Inc. has begirming-oftheyear present values for its projected benet obligation and market-related values for its pension plan assets. Projected Plan Benet Assets Obligation Value 2016 $1,000,000 :3 900,000 2017 1,250,000 1,100,000 2018 1,600,000 1,450,000 2019 2,100,000 2,000,000 The average remaining service-life per employee in 2016 and 2017 is 8 years and in 2018 and 2019 is 11 years. The net gain or loss that occurred during each year is as follows: 2016, $165,000 gain; 2017, $40,000 gain; 2018 $30,000 loss,- and 2019, $15,000 loss. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.) Instructions Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the 4 years, setting up an appropriate schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts