Question: Can you help? QUESTION 30 When a tax is placed on sellers, the actual incidence: O A falls solely on sellers. O B. is shared

Can you help?

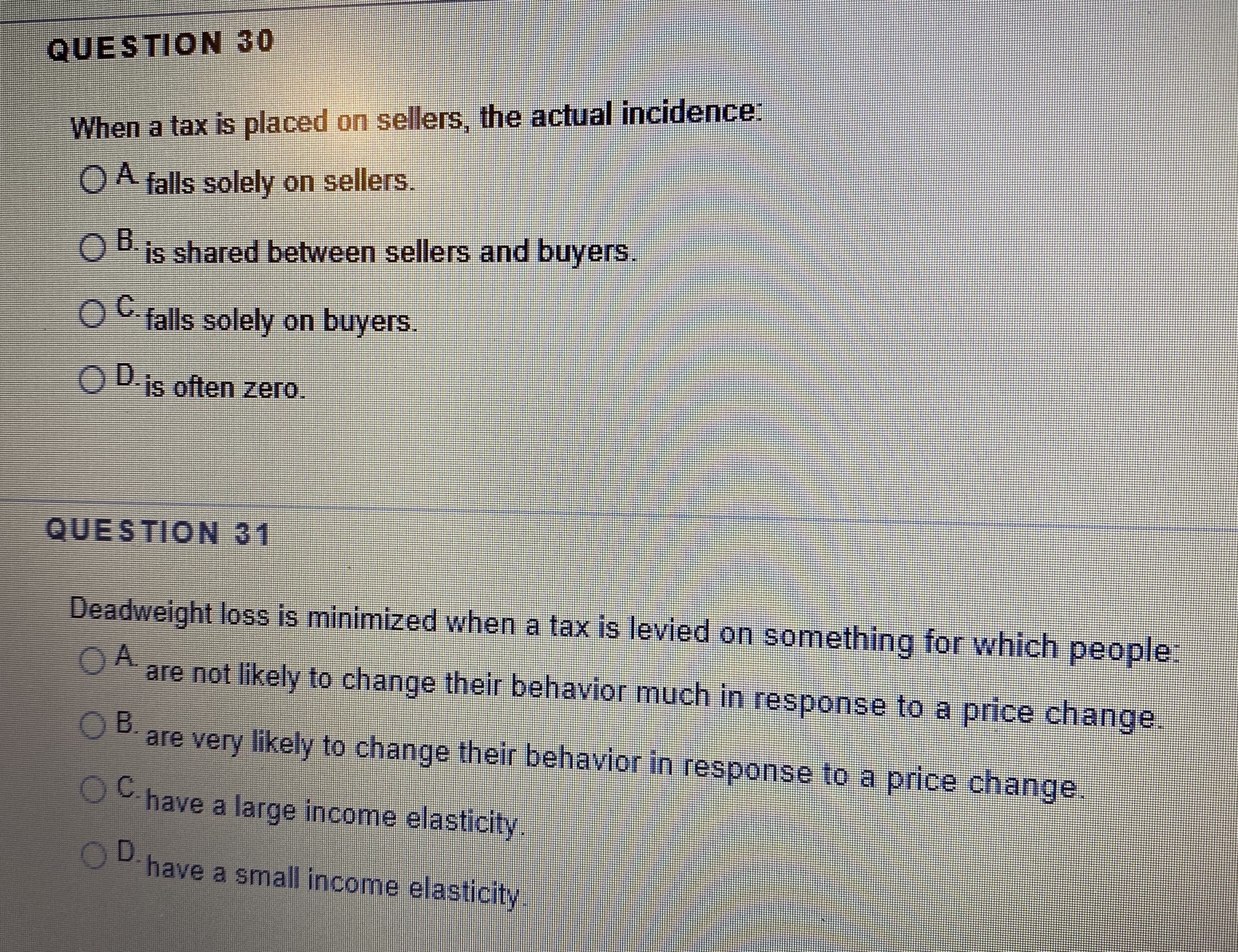

QUESTION 30 When a tax is placed on sellers, the actual incidence: O A falls solely on sellers. O B. is shared between sellers and buyers. O G falls solely on buyers. O D. is often zero. QUESTION 31 Deadweight loss is minimized when a tax is levied on something for which people: OF are not likely to change their behavior much in response to a price change O B. are very likely to change their behavior in response to a price change O C have a large income elasticity O D have a small income elasticity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts